Can You Buy REITs at JP Morgan Chase?

With a brokerage account at J.P. Morgan Investing, it’s possible to invest in Real Estate Investment Trusts (REITs) and REIT funds. The broker-dealer charges nothing to trade REIT securities, so a great value can be achieved here.

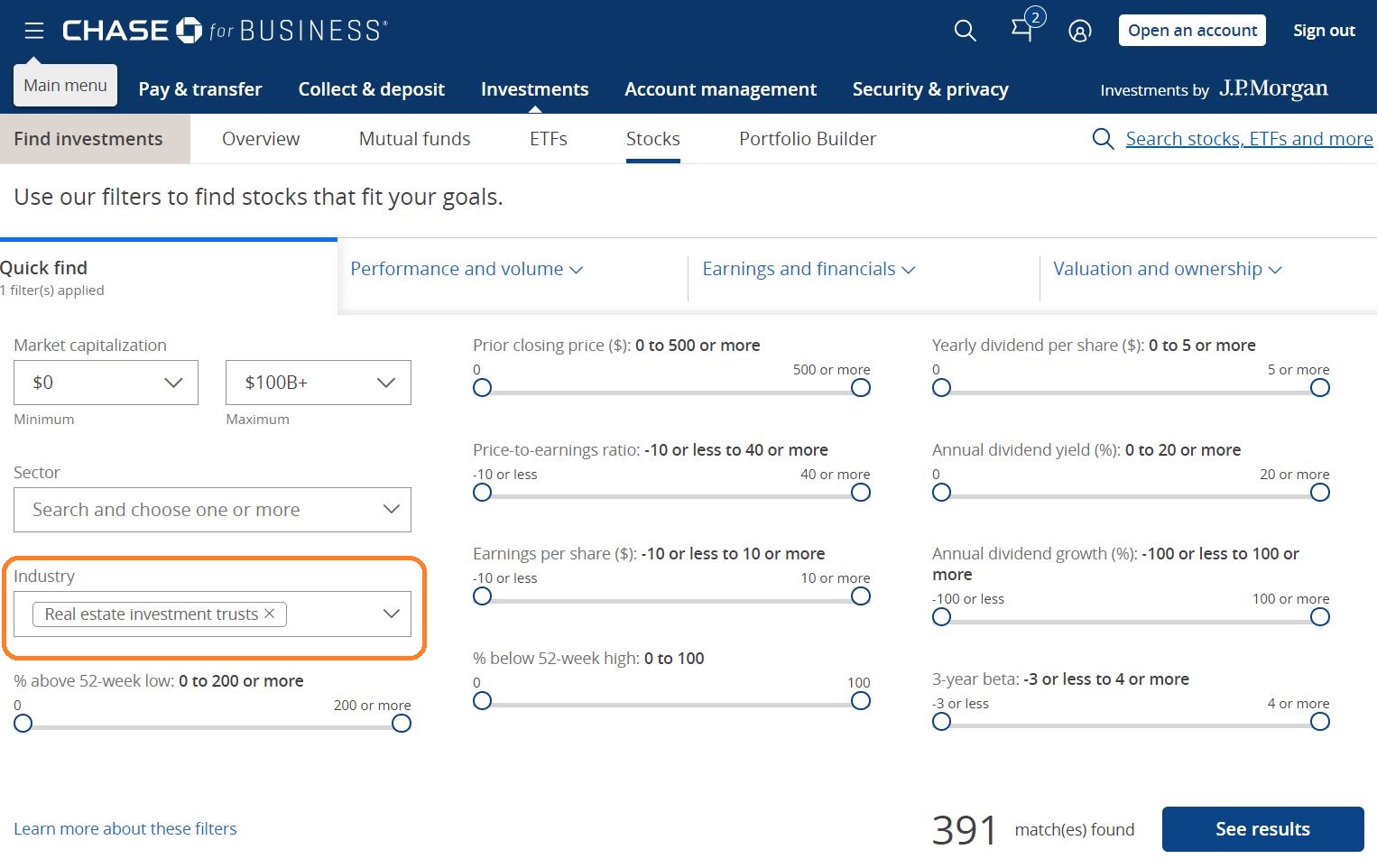

A good place to begin on the J.P. Morgan Investing website is on the Research page, which is accessible through the Investment tab that appears in the top menu. The Research hub has links for various screeners, such as ETF, mutual fund, and stock. Open the stock screener and specify Real Estate Investment Trusts in the drop-down menu for Industry. When we did exactly this, we received 391 REITs available for trading. It’s possible to filter these results by a wide range of criteria, including:

- Prior closing price

- % below 52-week high

- Market cap

- Outstanding shares

- And many more...

After filtering, one result we found was Arbor Realty Trust, Inc. This REIT trades on the New York Stock Exchange with ticker symbol ABR. It has a market cap of over $3 billion with average daily trading volume of roughly 4.5 million shares.

J.P. Morgan Equity Research follows Arbor Realty, and the latest stock report is on Arbor’s profile. The report shows a price target of $15 and a current price of $16.57.

JP Morgan Chase Promotion

Open Chase Account

J.P. Morgan Self-Directed Investing does not permit short positions, so only purchase orders can be used on the entry side for REITs and other equities. The broker’s trade ticket has several order types; an order for a REIT should be placed like any other stock order.

The same trade ticket on the website or mobile app can be used for exchange-traded funds. It’s easy to find ETFs that invest in REITs. Simply go back to the page with the security screeners and select the search engine for ETFs this time instead of for stocks. In the drop-down window for the fund category, select Real Estate. During our investigation, we found 38 REIT ETFs.

One example we found in the search results is the Fidelity MSCI Real Estate Index ETF with ticker symbol FREL. The fund’s profile at J.P. Morgan Investing shows a Morningstar rating of 3 stars and a dividend yield of 3.76%. ETFs can be traded just as stocks or individual REITs.

Besides REIT exchange-traded funds, J.P. Morgan Self-Directed Investing also has REIT mutual funds, and it’s super easy to find them. Simply open the mutual-fund screener and specify Real Estate as the fund category. When we did this, we received 25 funds. None of them have any loads or transaction fees, and very one of them has Morningstar ratings on the J.P. Morgan Investing site. These range from 2 stars to 5 stars.

An example of a fund we found is the Baron Real Estate Income Fund with ticker symbol BRIFX. The fund has 5 stars on a five-year basis and 4 stars overall.

JP Morgan Chase Promotion

Open Chase Account

|