|

JP Morgan Chase vs Cash App (2024)

Cash App vs JP Morgan Chase—which is better in 2024? Compare investing accounts,

online trading fees, stock broker extended hours, and differences.

|

Overview of J.P. Morgan Investing and Cash App

Before you open an account with Cash App or J.P. Morgan Investing, be sure to take a look at our research. It will reveal who succeeds and who fails in important areas.

Costs

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

Chase

|

|

|

|

|

|

|

|

Cash App

|

|

|

|

|

|

|

Up First Is Tradable Assets

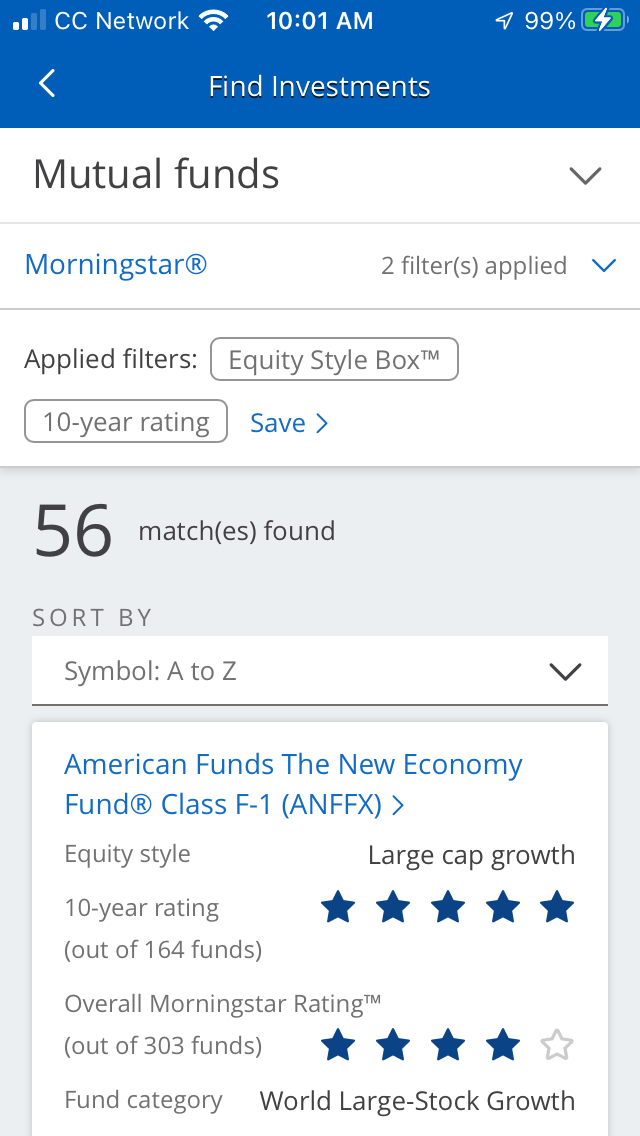

J.P. Morgan Self-Directed Investing provides access to a moderate range of financial products. It includes:

- Mutual funds

- Exchange-traded funds

- Closed-end funds

- Options

- Bonds and other fixed-income vehicles

- Equities

Cash App subtracts bonds, mutual and closed-end funds, and options from the list. In their place, the brokerage firm adds one cryptocurrency (bitcoin).

J.P. Morgan Investing wins the opening category.

Next Is Mobile Apps

J.P. Morgan Investing uses the Chase Bank app. A single login is able to access both securities and deposit accounts. On the brokerage side of things, we found several useful tools, including a trade ticket with 4 order types and 5 duration choices. Mutual funds and options have their own trading tickets. Charting is possible only in vertical format, although there are several tools, like technical studies.

Because J.P. Morgan Investing uses the Chase Bank app, there are many cash management tools in the app, including mobile check deposit, adverts for free credit scores, and cash bonuses for using a Chase credit card at a participating retailer.

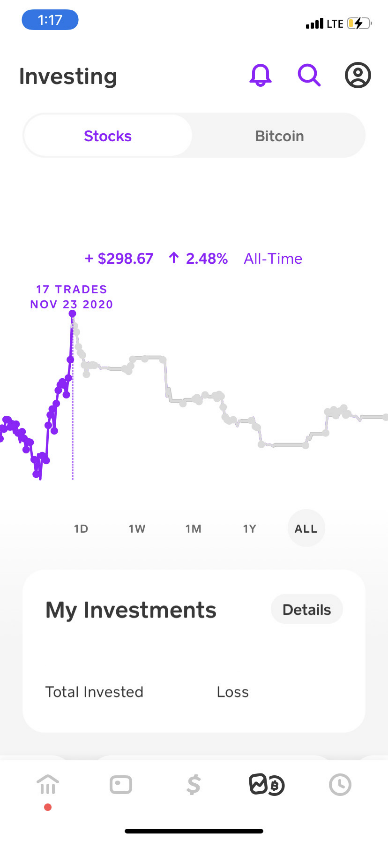

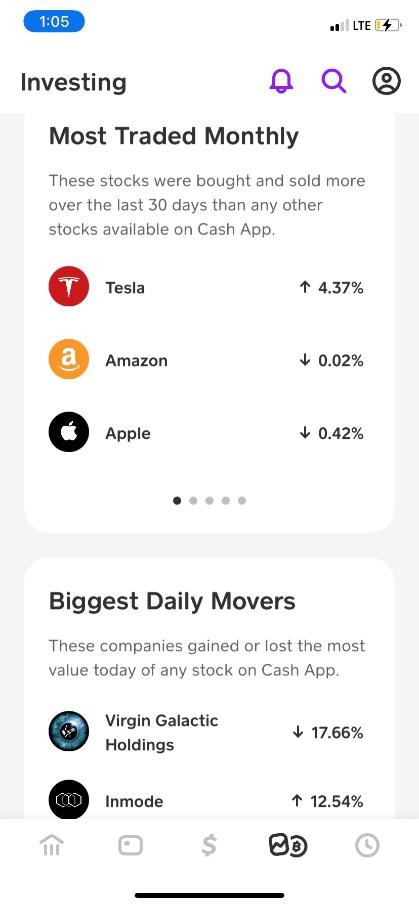

Cash App has a user-friendly app, and it, too, has several cash management tools. Like the J.P. Morgan Investing app, there are bonuses for shopping with linked businesses. We did not find a mobile check deposit widget, however.

For actual trading, there are 3 order types and 2 duration choices. The app has categories of stocks like Energy and Food & Drink. Tapping on one generates a list of possible investments.

Charting on the Cash App mobile platform is pretty much pointless as there are no tools of any kind.

J.P. Morgan Investing captures the victory here.

Promotions

J.P. Morgan:

Get $0 stock commissions at J.P. Morgan.

Cash App:

Use U2Q3HN referral link to get $10 cash bonus.

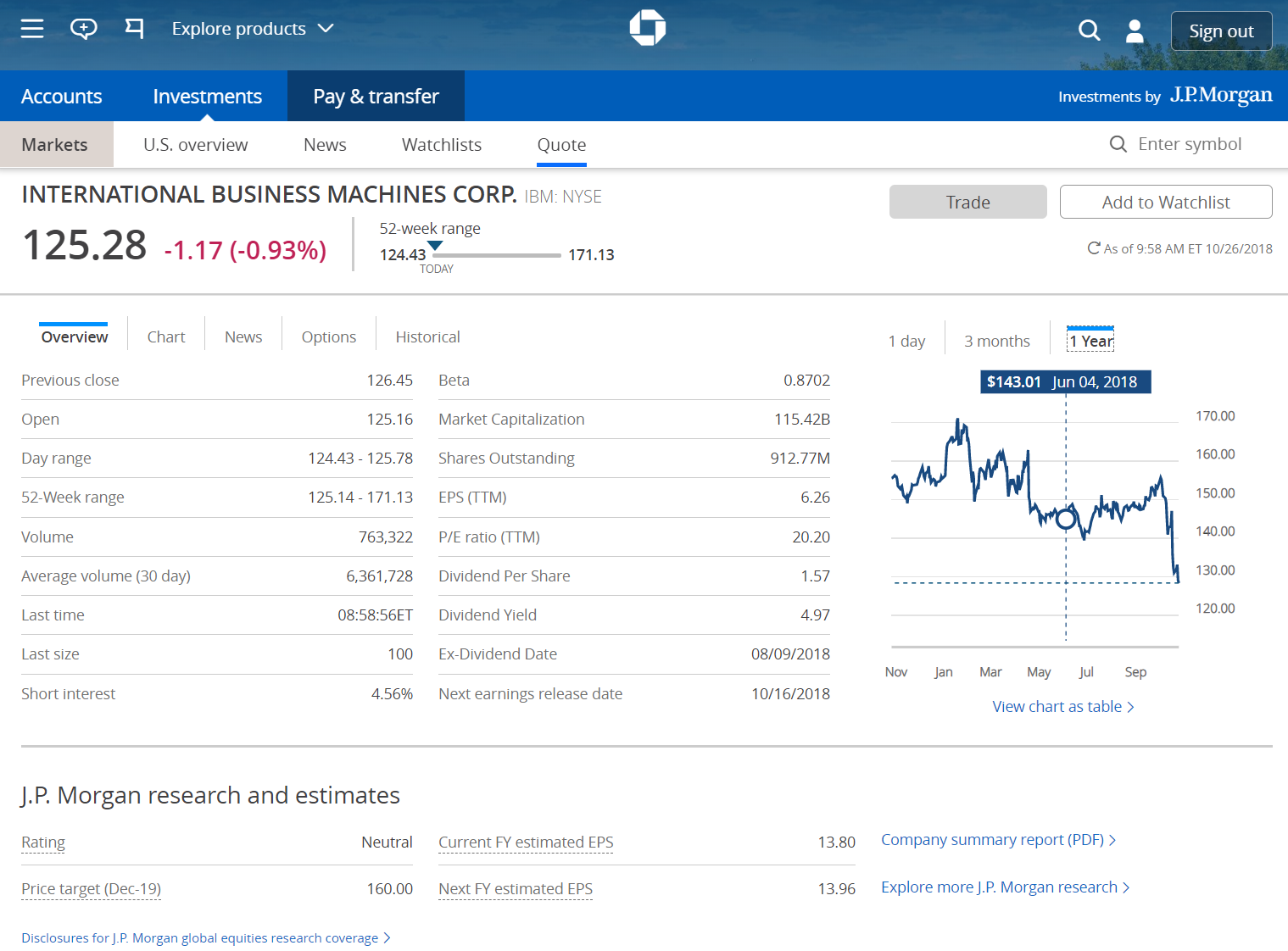

Now, It’s Website Trading

The situation for Cash App becomes much worse in the realm of website trading. Its website actually has no trading or charting tools at all. Instead, the site is used for account management, including cash features.

Over on the J.P. Morgan Investing website, we found resources for both trading and account management. Charts can’t be displayed the full width of the PC monitor, but they do have the following features:

- 7 plot styles

- Drawing tools

- Indicators

- 30 years of price history

The order ticket on the website is the same one we found on the mobile app. Asset profiles are also the same with the following features:

- Watchlist button

- Analyst trade recommendations

- Stock reports

- News articles

- Estimates for future earnings

- Dividend history

- List of funds that hold a stock

J.P. Morgan Investing has one more tool that Cash App doesn’t: an actual security screener that can search by many criteria.

J.P. Morgan Investing easily takes the third category.

The Fourth Category Is Margin Accounts

At Cash App, every account is a limited-margin account. This means technically every account is a margin account, but Cash App does not permit the use of margin for the purchase of securities.

At J.P. Morgan Investing, every account is a cash account. There is no margin service of any kind, which obviously limits options trading quite a bit. Only calls and puts can be traded. Stocks cannot be shorted.

Cash App has a slight edge in this category because its margin service will facilitate the settlement of funds.

The Last Category Is Extra Services

IPO Offerings: It’s not possible to trade an Initial Public Offering at either firm.

Banking Resources: Both companies have departments that deliver lots of cash management tools.

Extended-hours Trading: Neither brokerage firm offers pre-market or after-hours trading in securities.

Systematic Mutual Fund Purchases: Investors at J.P. Morgan Investing can set up ongoing purchases of mutual fund shares.

Auto Dividend Reinvesting: Available at J.P. Morgan Investing.

Fractional-share Trading: Cash App has it.

Tax Filing: Cash App has software to file state and federal taxes. J.P. Morgan Investing does not.

IRA Service: J.P. Morgan Investing (in both self-directed and investment-advisory modes) has Individual Retirement Accounts (with a $75 termination fee).

J.P. Morgan Investing wins this one, too.

Finally, Our Recommendations

Beginning Traders: An account with J.P. Morgan Automated Investing would be a good way to start.

Retirement Planning & Long-Term Investing: J.P. Morgan Investing has lifecycle mutual funds and a

Portfolio Builder tool that is able to make investment recommendations.

Small Accounts: J.P. Morgan Automated Investing requires $500 to get going. Neither company has any ongoing fees or minimums for self-directed taxable accounts. We suggest Cash App for self-directed trading due to its $1 minimum investment amount.

Mutual Fund Trading: Only possible with J.P. Morgan Self-Directed Investing.

Stock and ETF Trading: J.P. Morgan Investing has better software and more securities.

Chase vs Cash App Summary

Although Cash App is the modern brokerage firm in this survey, J.P. Morgan Investing is the winner.

|

Open Account

|

Open Account

|