Overview of Webull and Cash App

In the world of personal finance apps, there are seemingly hundreds of apps to choose from. Some of them excel at stocks and crypto investing while others are meant to be simple and user friendly. If you are considering Cash App or Webull as a personal finance app, continue reading to see which one will meet your needs best.

Ease of Use

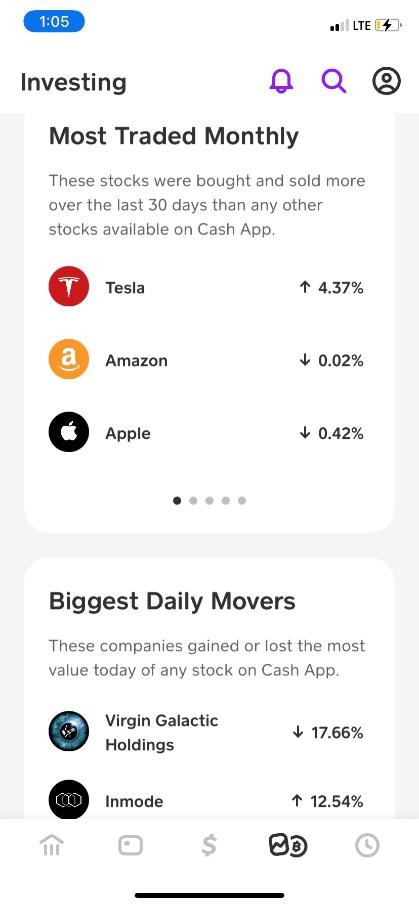

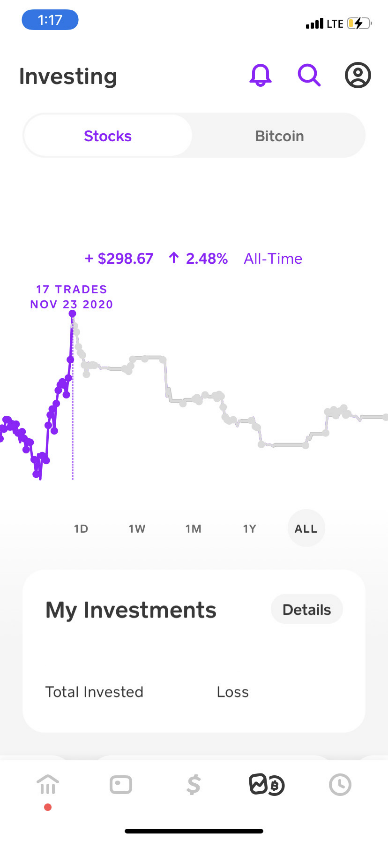

Cash App and Webull are two of the more popular apps for investing and managing money. When considering their ease of use, though, Cash App gets the nod. The app makes it easy to find and invest in a limited library of stocks and cryptocurrency. Basically, decide how much you want to invest in a stock and then you can purchase fractional shares for as little as $1.

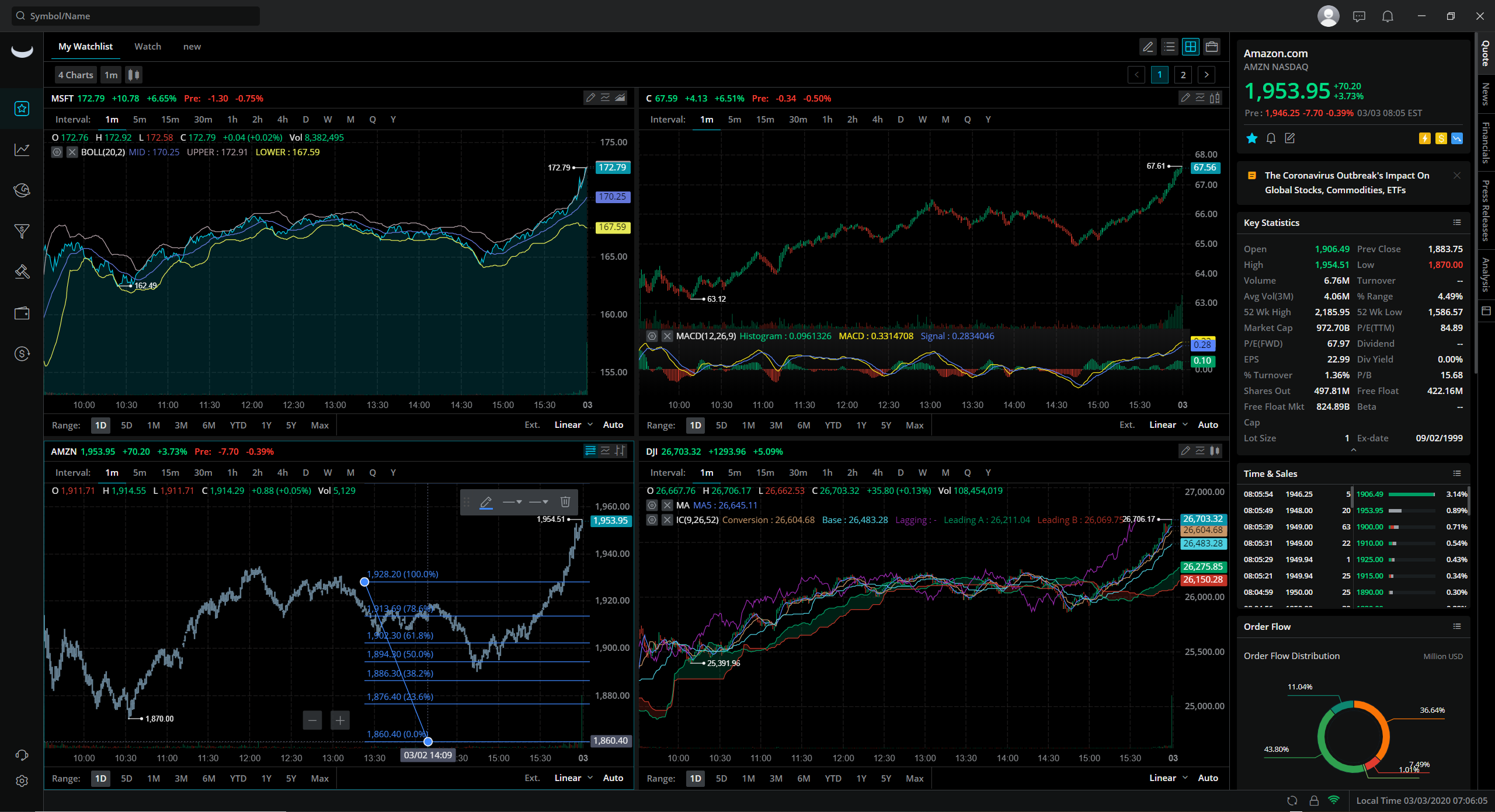

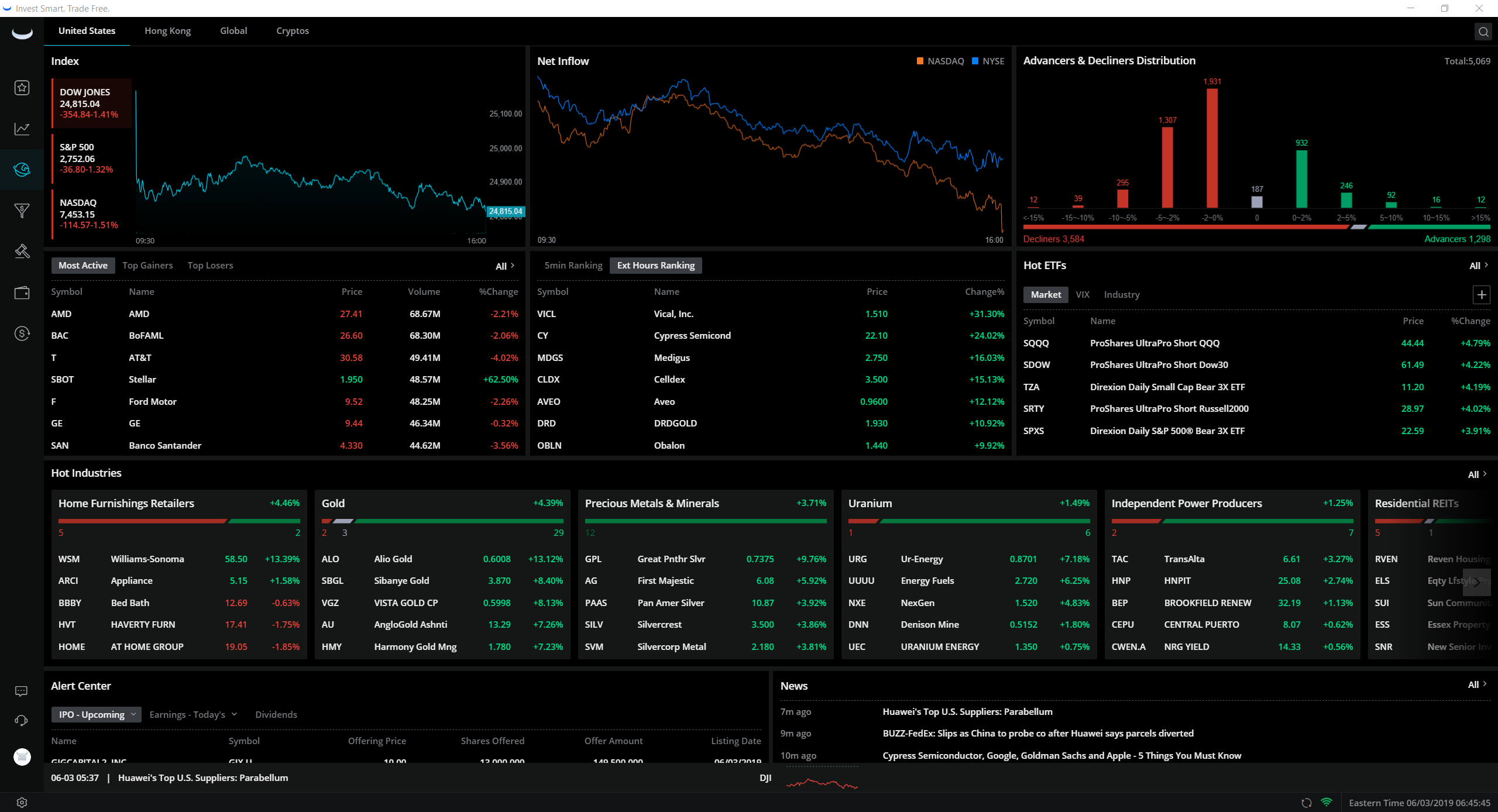

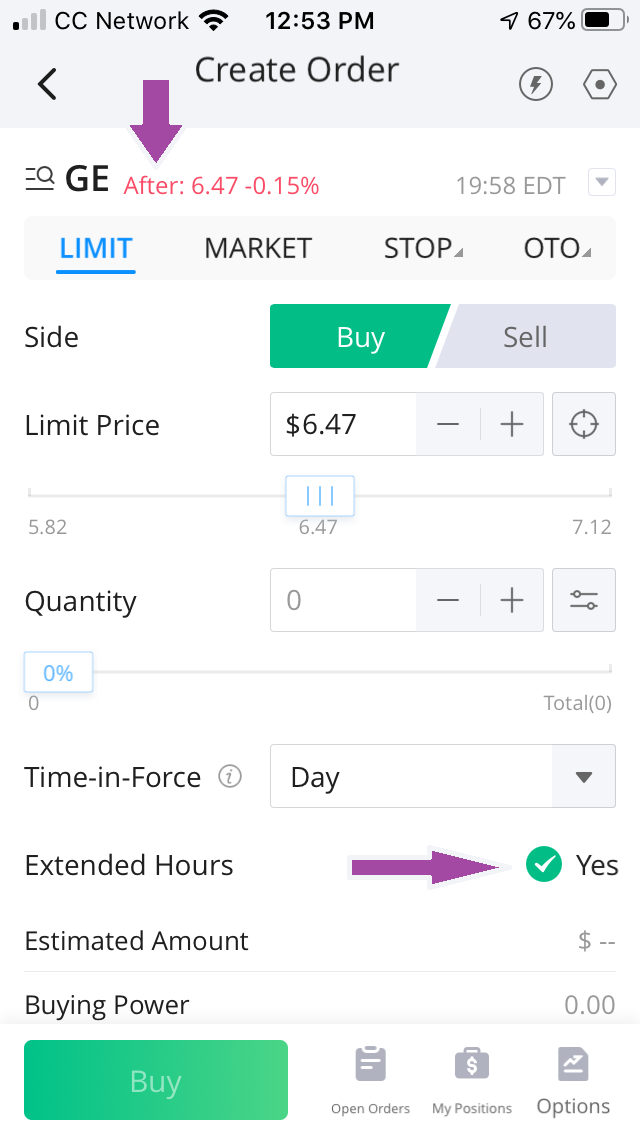

Webull appears more complex but has many more stocks, ETFs, options, and cryptocurrencies

available as well as more research.

Investment Vehicles

When considering investment vehicles, the nod definitely goes to Webull. Cash App offers you the ability to invest in a limited number of stocks as well as the ability to purchase Bitcoin. It can be really frustrating when you find a stock or ETF that you are super excited to invest in, search for it on Cash App, then find out it is not available for investment.

With Webull, you are able to invest in so many more vehicles. If you are wanting to invest in

crypto, there are over 40 digital currencies that you can research and invest in. In addition to

stocks and ETFs, you can also invest in options on Webull. It is obvious that Webull is intended

for users who want to become more advanced investors, compared to Cash App giving new investors an easy way to get started.

Fees and Commissions

In this category, it’s a draw. Both Webull and Cash App offer commission free stock trading. The

only slight downside to Webull is that they have a 1% spread on crypto transactions.

Promos

At the time of writing, Webull has a promotion

offering 75 free stocks when you open and fund an account with them. That gives them the nod in this category.

Cash App does not have a promotion for the investing side of the app.

Tools

Cash App, again, is more targeted at beginning investors. There is a part of the app called

“My First Stock” for people who want to learn more about what a stock and investing really means.

Other than that, you can do some cursory research of stocks, but you cannot really dig deep in your research.

Webull has a much more robust library of tools available for your research. Not only can you do more extensive research on individual investments, you can also create drag and drop widget boxes. In those widgets, you can use some predefined lists like “Hot ETFs” but also create your own defined watch lists and screeners. Another great tool offered by Webull is the opportunity to create a virtual portfolio to be able to practice trading without risk. Webull also offers a Net Order Imbalance Indicator (NOII). This tool gives you information about likely opening and closing prices to help minimize surprises. If you want to get serious about trading, Webull offers many more tools to help you optimize your investments.

Account Types

For Cash App, you are limited to a standard, self-directed, taxable brokerage account. No IRAs,

joint accounts, 401Ks, trusts, etc. Super simple but super easy to use.

Webull, however, offers you a pretty wide variety of accounts. For individual accounts, you can choose between a cash account or a margin account. You can also manage an IRA through Webull in traditional, Roth, or Rollover options.

Account Minimums and Requirements

To open an account on Cash App, you must be at least 18 years of age and a United States citizen. You must also provide some more personal information to verify identity and ensure tax notifications are being made. In order to purchase fractional shares on Cash App, you must invest a minimum of $1. There is no minimum account requirement.

In order to open a Webull account, you must be a United States citizen, at least 18 years of age, and have a U.S. residential address. To confirm all of this, Webull will require some documents to open an account. There is no account minimum for Webull unless you want a margin account.

Margin Requirements

To maintain a Webull margin account, you must have a account minimum of $2000. With that amount, you

can make 3 day trades in five business days. More than that and you will be labeled as a PDT (pattern day trader) and you will get unlimited day trades if you maintain a $25000 minimum.

For Cash App, every account is technically a margin account solely for the settling of funds in your account. If you engage as a PDT, you might have your account closed, suspended, or deactivated.

Promotions

Webull:

Get up to 75 free stocks when you deposit money at Webull!

Cash App:

Use U2Q3HN referral link to get $10 cash bonus.

Cash App Pros

- Easy to Use

- Provides some educational tools

- $1 minimum for investing

- You can gift stocks

- No account minimum

- No commission on trades

Cash App Cons

- Most beginning investors will outgrow the platform quickly

- Very limited for stocks, crypto, and account types available

- Really only available as a phone app (best not used on tablets or computers)

Webull Pros

- More account types available

- Few restrictions on stocks available to investors

- Lots of research tools for intermediate investors

- No commission on trades

Webull Cons

- Steeper learning curve for beginning investors

- Investors may be able to get in over their heads with options trading and the like before they are ready

Open Webull Account

Open Webull Account

Open Cash App Account

Open Cash App Account

|