Overview of Citibank, Sofi and Cash App

Before you open your next investment account, you really need to check out Citi Self Invest, Cash App, and SoFi Invest.

Costs

Services

Assets and Accounts

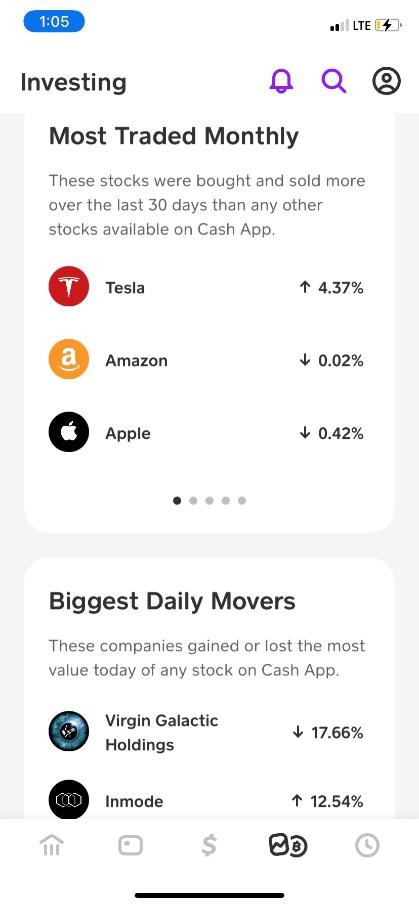

For self-managed accounts, SoFi Invest offers stocks, option contracts, ETFs, cryptocurrencies, and closed-end funds. Cash App has only stocks, exchange-traded funds, and one cryptocurrency (bitcoin). Citibank doesn’t offer any cryptos, although it does have mutual funds on top of ETFs and equities. None of the three firms permits short positions.

At Citi and SoFi, brokerage accounts are just the beginning of the financial journey. Investment-advisory accounts are available in robo programs, and it’s possible to bring on board human investment advisors, too. Cash App does not have an advisory program.

The largest number of tax vehicles for investing accounts will be found at SoFi Invest. There are joint, individual, and IRAs.

All three firms in this competition have banking tools that deliver a variety of enticing perks like debit cards. Only Cash App has a tax-filing service.

Winner: SoFi Invest

Websites

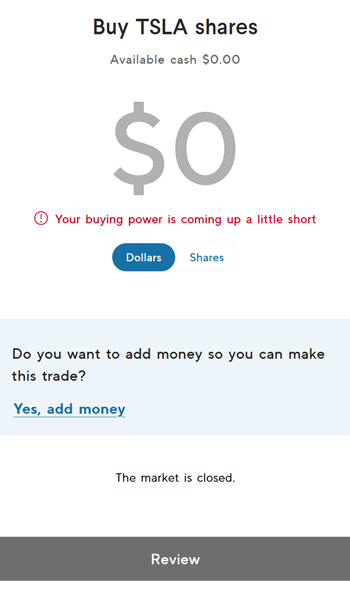

The Cash App site is very simple with no charting or trading tools. The site is used for cash management, which includes funds transfer on the site.

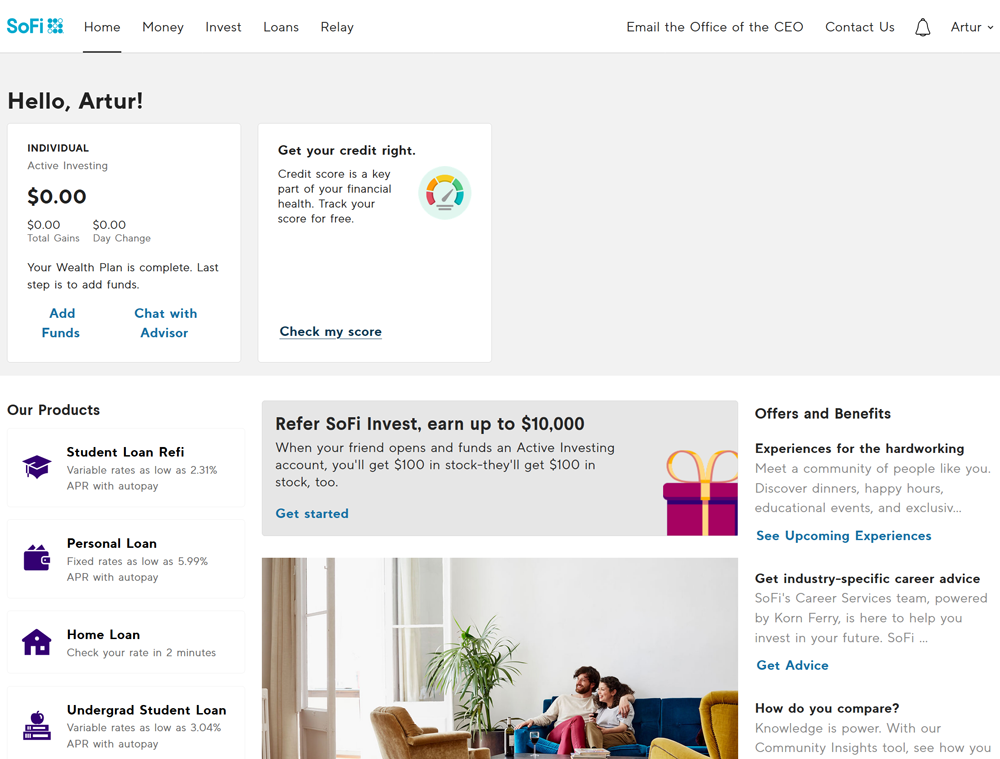

Over at SoFi Invest, the situation improves with actual trading. The broker’s order form has market and limit orders plus a special order type for recurring purchases. Then there’s options trading, which comes with chains for calls and puts. There are Greek values for every contract, although there are no spreads, and it’s not possible to create custom orders.

The SoFi Invest hub of the SoFi site has a watchlist and groups of assets like cryptocurrencies, dividend-paying stocks, and trending stocks. Profiles are pretty bare, though.

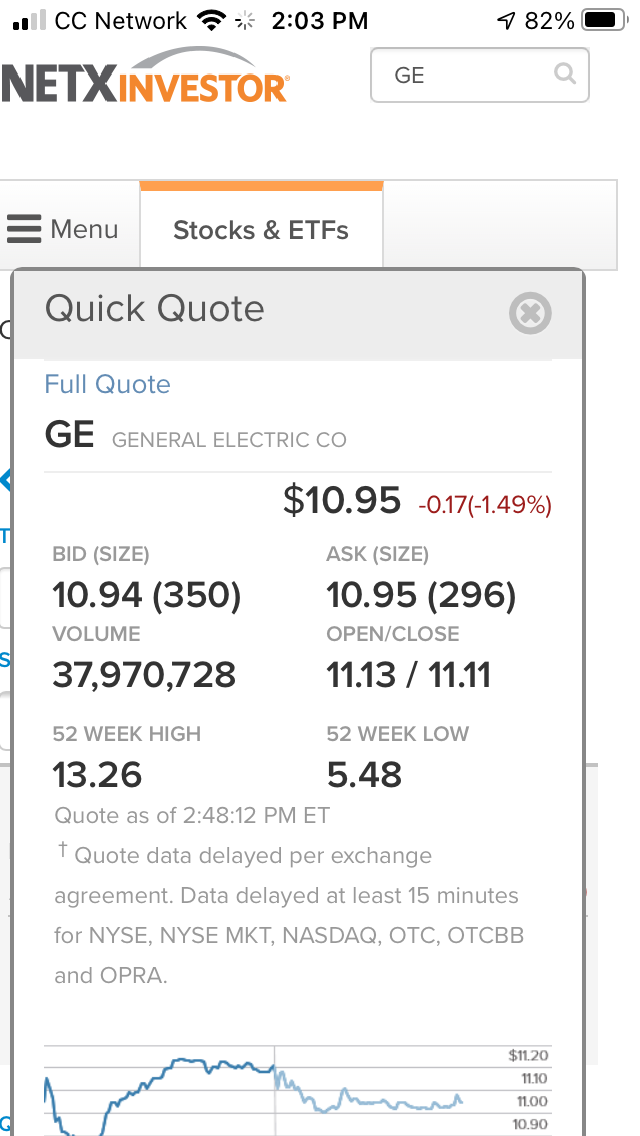

The Citi Self Invest site also has profiles with minimal information. We found trade stats like previous close and 52-week range. There are also news articles from Reuters. For actual trading, there is an order ticket with market, limit, stop, and stop-limit orders. Charts, however, are very elementary with zero tools and only 10 years of price data. SoFi Invest doesn’t even have that: just 5 years of price history.

Like SoFi Invest, Citi Self Invest has no stock screener. But it does have a simple fund screener. It can search by fund type (mutual or ETF) and fund category.

Winner: Tie between SoFi Invest and Citi Self Invest

Mobile Apps

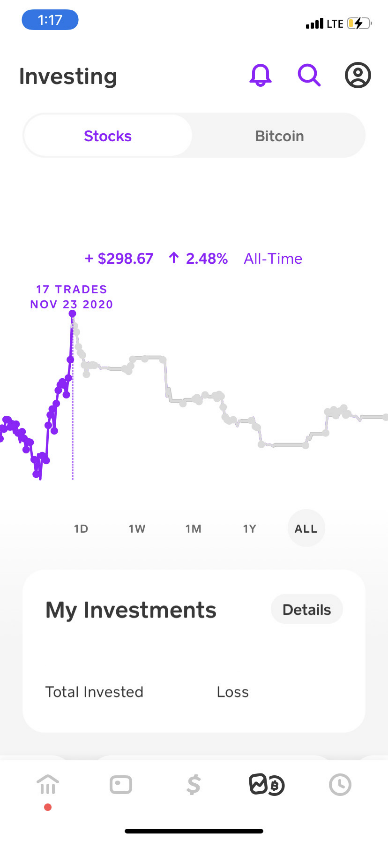

Although Cash App stumbled in the website category, it comes through for mobile users. This time, there are charts (although very simple) and order entry. There are three trade types on the broker’s order ticket: market, recurring, and custom. The custom order is similar to a stop order. Profiles have brief details, such as analyst opinions and earnings histories (and expected earnings).

The SoFi Invest app has the same order types that the company’s website has. Options trading has recently been added with the same chains we saw on the website. Some Greek values are missing, though. Just tap on a contract to trade it.

Next up is Citi Self Invest. Although there’s no stock screener, we did find collections of securities grouped into categories, like technology. Charting, order entry, and asset profiles are identical to what we found on the broker’s website.

Winner: SoFi Invest

Margin Service

Out of the three brokerage firms in this faceoff, the only one to offer margin trading is SoFi. The

company charges interest on a flat schedule, which means a balance of any size will cost

10% on an annual basis. SoFi Invest’s software displays initial and maintenance margin requirements for long positions on entered ticker symbols, which obviously is a helpful service. The company requires an account balance of $2k or more before a cash account can upgrade to margin.

Winner: SoFi Invest

Additional Services

Fully-paid securities lending program: Only at SoFi Invest.

DRIP service: Citi Self Invest and SoFi Invest both have auto dividend reinvesting.

Extended hours: SoFi Invest (and only SoFi Invest) has pre-market and after-hours trading.

Fractional shares: Available at all three firms.

Initial Public Offerings: SoFi Invest has a very thorough IPO service, and there are no account requirements to get in on the action.

IRA service: SoFi Invest customers can open Individual Retirement Accounts. There are 3 options: Roth, Traditional, and SEP.

Periodic mutual fund investing: Citi Self Invest customers can sign up for systematic mutual fund purchases.

Winner: SoFi Invest

Our Recommendations

Long-term investors & retirement savers: Because SoFi Invest has so many resources devoted to

personal finance, including insurance products, it is the easy pick here.

Beginners: An automated account with Citi or SoFi. Both firms have human financial advisors for

extra help.

Mutual funds: The only choice here is Citi Self Invest.

Active stock trading: SoFi Invest.

Small accounts: There is no account minimum at any firm for a brokerage account. On the robo

side of things, Citi Wealth Builder has a $5k starting requirement. SoFi Invest has a $1 minimum.

Ciri vs Cash App vs Sofi Summary

Although Cash App has the best name and Citi Self Invest is owned by one of the world’s best-known companies, SoFi Invest easily wins here.

|