Ally Invest Paper Trading

Ally Invest does not offer demo account (paper trading). For a 100% free paper

trading, open an account at

Charles Schwab.

Free Charles Schwab Paper Trading

Open Schwab Account

Ally Invest Overview

Ally Invest is considered one of the best investment companies for anyone with small account balance since there is no minimum account

deposit. That's right — you can open a brokerage account and keep it open with $0 down. The broker also has low pricing, which we will discuss in later sections.

Trading Tools

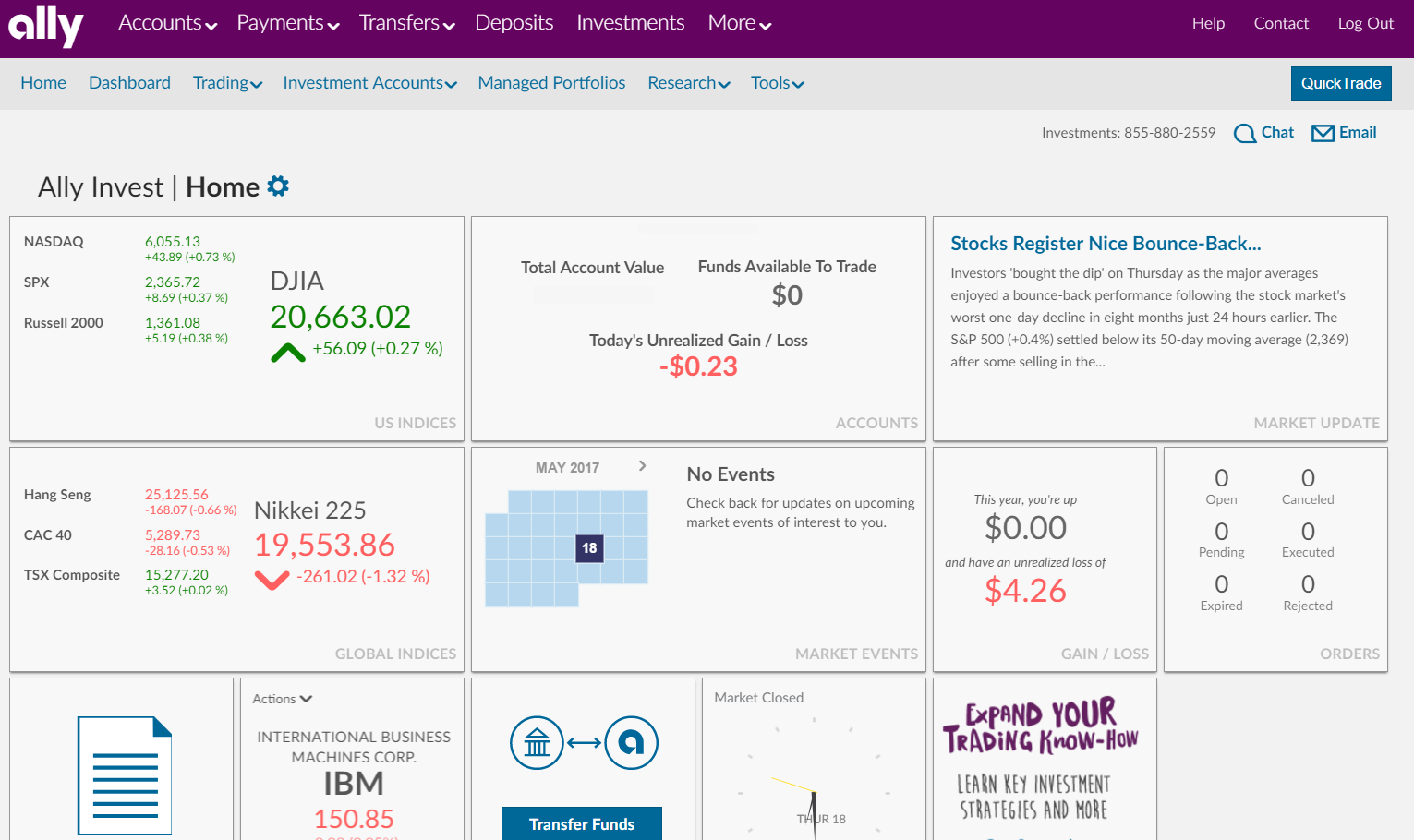

The firm has a browser-based trading system called Ally Invest LIVE. On this platform, users can follow market indices, look over a watch list, read market events,

and review account and position information. Other available features include option chains, a handy trade ticket, and funds transfer. The platform is somewhat

customizable and can be displayed in either white or black. Ally Invest LIVE has an account requirement of at least 1 trade per year or a balance of $2,500 or higher.

The platform has good charting capability. A stock's price action can be displayed anywhere between 1 day and 13 years. The time interval can be set from 1 minute

to monthly. Several good technical studies can be used. Some examples are Bollinger Bands, Aroon Oscillator, MACD, Coppock Curve, Stochastics, RSI, and Random Walk

Index. A stock's price history can also be compared to one or more other stocks. The style of the graph can be displayed as candlestick, bar, colored bar, line,

mountain, or hollow candle. A trade button is displayed in the upper-left corner of the chart. Clicking on it produces the firm's trading ticket on the right-hand

side of the chart. A graph can also be detached from the platform and displayed full screen. However, in this mode the trading ticket does not appear. If you click

on the trade button in the graph window, you'll have to go back to the platform where the trade ticket will be shown on the right-hand side.

Quotestream is another advanced platform from Ally Invest. It is available to customers who make at least 10 trades every month. It has an investment tracker,

multiple watch lists, a scrolling ticker, a most active list, and detailed quote information.

Mobile App

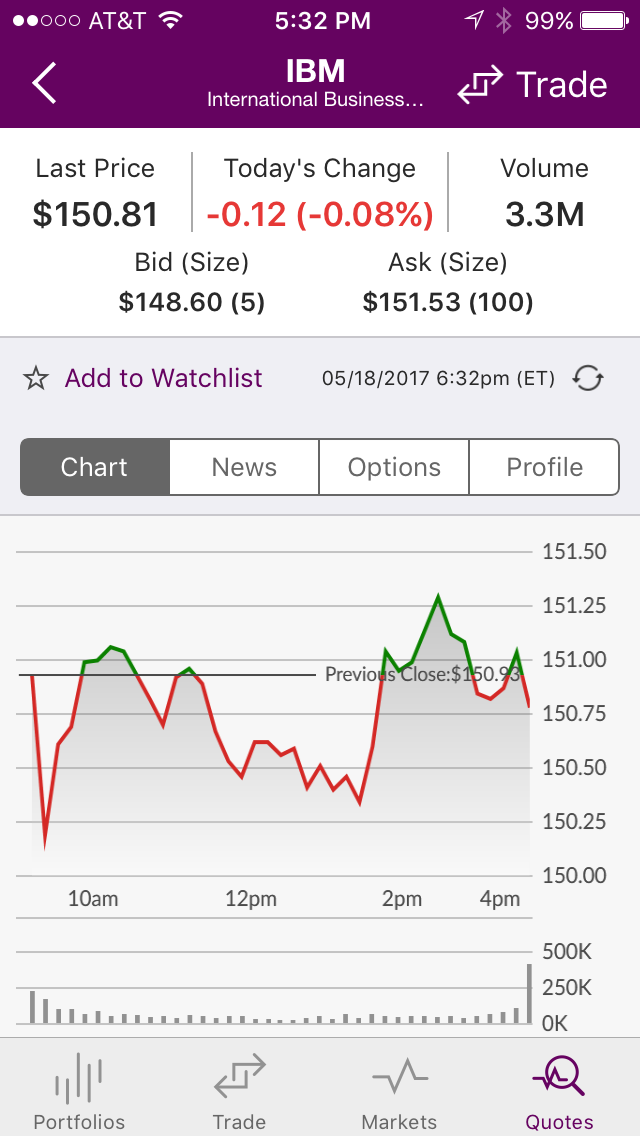

For investors on the go, Ally Invest offers mobile trading. The broker's app can be used on Apple, Android, and mobile web. In addition to market news, traders will

also find charting with a few technical studies available. The app also features a watch list, account and position data, an order status page, and option chains.

The day's market equity movers and global indices are displayed, too. Furthermore, a stock's profile page displays important fundamental analysis data, such as

dividend yield, shares outstanding, and the stock's 52-week trading range. The Android app currently has 4 out of 5 stars on the Google Play site.

Ally Invest hasn't left out other helpful features on its app. Customer service can be contacted by tapping on an e-mail or phone button. Streaming quotes can be

turned on or off. Account alerts can be sent to the mobile app, although users first must sign up for the service on the website. Mutual fund data is displayed

on the app, although unfortunately trades for mutual funds must be placed on the website.

Mutual Funds and ETFs

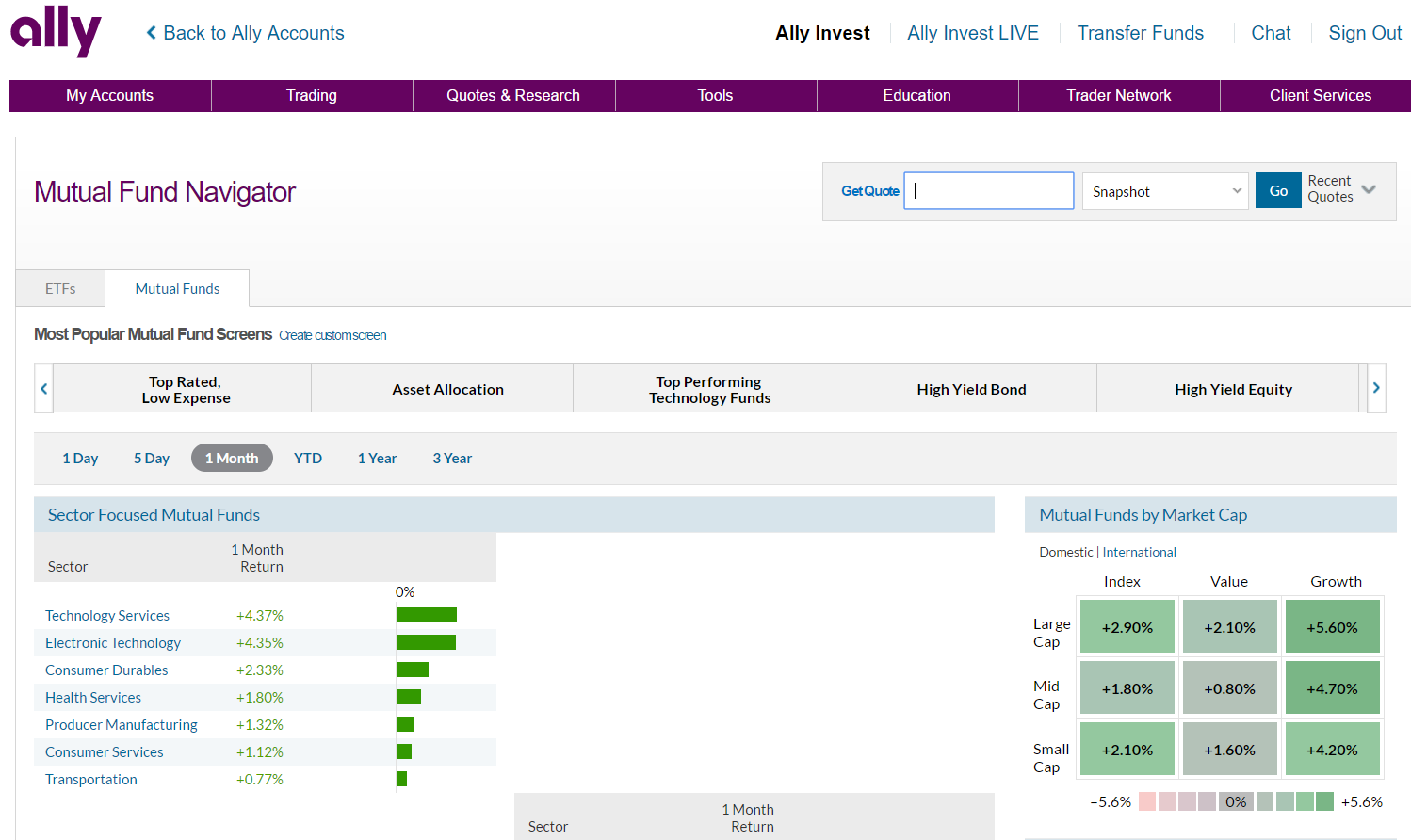

The broker offers 8,532 mutual funds. Load funds have no transaction fee. Mutual funds without loads are $0 on both the sell and buy sides.

The broker has very good research tools for mutual funds. Ratings from Lipper are displayed for ranked funds. The broker's website also shows top-performing Lipper-rated funds. Users can search through various categories of funds, such as China region or technology services. A mutual fund screener scans the broker's list of mutual funds based on several available criteria. For example, users can select YTD return, load type, beta v. S&P 500, 3-year total return, fund category, and Lipper ratings.

Similar tools are available for ETF traders. Investors can search through the year's top and bottom performers for both domestic and international exchange-traded funds. Predefined screens are available for various characteristics, such as commodities and high-yield bond. All ETFs are available through Ally Invest commission-free.

Research and Education

There are good educational and research tools on the Ally Invest website for all security types. For instance, the broker offers several educational videos on a variety of investment topics. General market ideas are also available in written format. For example, there is information on U.S. housing starts and natural gas inventories, articles from Seeking Alpha, and market news. The global market isn't left out either. Information on exchange rates and foreign indices is displayed on the broker's site.

Helpful information on each security type can be accessed on the website's education section. These resources can be sorted by rookie, veteran, and all-star experience levels. One article introduces technical analysis, while another discusses ETF strategies.

Yields for various fixed-income investments are displayed on the Ally Invest bond section. Different bond ratings and maturities can be selected, which produces a different yield chart. A bond table displays yields for a variety of debt types and bond ratings.

Effective screeners for all security types are on the Ally Invest website. These helpful tools can scan through thousands of investment possibilities based on criteria such as market cap, load type, asset class, inception date, total return, economic sector, P/E ratio, and many more. Orders can be placed from a screener's results.

A unique feature that Ally Invest has is its trader network. Here, investors can connect with each other and share investment ideas. The broker has an active forum where Ally Invest customers post their recent trades and ask customer service for help with various issues. An Ally Invest staff member always answers these questions. An active blog has posts covering a wide variety of financial news and issues.

A stock's profile page includes many helpful features. An S&P Capital IQ report is available. Reports from other analysts are not available; however, a tally of buy, hold, and sell recommendations from many reports is displayed. For some stocks, there are over 20 votes. An options summary shows open interest and put and call volume for the underlying stock. Market news relating to the particular stock is available, along with information on what company insiders are doing with their stock.

Many financial metrics are shown for a stock under investigation. These include such important measurements as book value, debt-to-equity, earnings per share, return on assets, and quick ratio. These values are compared to the company's industry, which gives the investor a good idea of how the stock is performing relative to its peers.

Cash Management Features

A securities account with Ally Invest can have checks and a debit card added.

Customer Service

Ally Invest customer service reps can be contacted by e-mail, snail mail, phone, fax, or on-line chat. Phone and chat service is available 7am-10pm ET, 7 days a week.

E-mails receive a 2-hour response time during regular business hours. The firm promises a 24-hour response time on Saturday and Sunday. An Ally Invest

forex team has its own contact information to help currency traders.

Comparison

Ally Invest's $0 commission is lower than the vast majority of on-line brokers.

Its charge for option contracts, $0.50, is also lower than most other firms' commissions.

ZacksTrade has a $3.00 trading commission for stocks and ETFs, and a $0.50 charge for option contracts. However, Ally Invest has better research and educational

materials on its website.

Ally Invest Paper Trading Summary

Ally Invest is one of the best on-line discount brokers for small investors in business today. Although it does have some weaknesses

in a few areas, the broker is a hard-to-beat value.

|