|

Is SogoTrade a Scam? Is SogoTrade Safe, Legitimate, and Insured Firm in 2024?

|

Is SogoTrade a Scam?

If you’re thinking about opening an account with SogoTrade, you may have questions about its safety and reliability. Because it is a small brokerage firm, it is not very well known. We’ve done all the research for you on this broker, and here’s what we found:

History of SogoTrade

SogoTrade registered with the Securities and Exchange Commission in 1986. So it’s been around for more than three decades. That’s longer than many mainstream brokerage firms today, including Robinhood, M1 Finance, and E*Trade.

Memberships, Registrations, and Disclosures

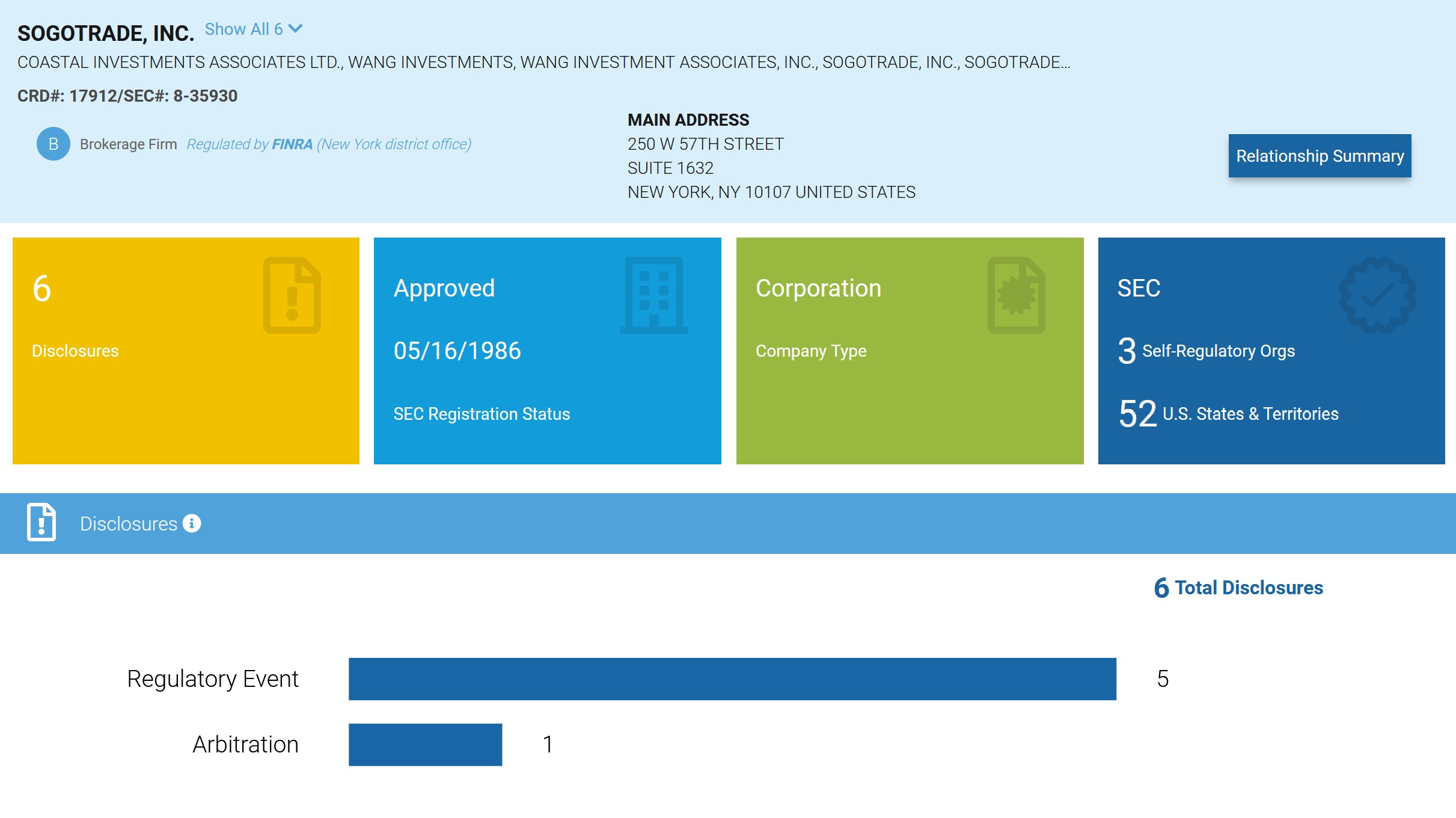

SogoTrade is a member of the SEC (as already mentioned) and also has a membership with FINRA, the brokerage industry’s self-regulatory organization. SogoTrade’s CRD number is 17912, and its SEC ID is 8-35930. The brokerage firm is also registered with the Nasdaq and the Chicago Board Options Exchange.

It does have two disclosures on its FINRA profile. One occurred in 2014, and involved an untimely report of a transaction. Without admitting any wrongdoing, SogoTrade paid a $10,000 fine. Another fine of the same amount was paid in 2012.

While two sanctions aren’t good, other brokerage firms have many more on their FINRA profiles. E*Trade, for example, has more than 200. Some of the fines are as high as $900,000. E*Trade also is a newer company; so Sogo looks pretty good here.

SogoTrade is registered to conduct securities business in all U.S. states plus Puerto Rico and the District of Columbia.

SogoTrade BBB Profile

SogoTrade has a profile at the Better Business Bureau, but there is insufficient information for BBB to provide a rating. Furthermore, Sogo is not accredited with BBB. This isn’t a bad sign; it may simply mean that the brokerage firm hasn’t sought accreditation from BBB. There are no customer complaints on SogoTrade’s profile, but there are also no reviews.

SogoTrade Competitors

Is SogoTrade Insured?

SogoTrade is a member of SIPC, which guarantees every account up to $500,000. Half of this level can be used to protect cash. While this is great, it’s important to remember that the guarantee only applies to number of shares, not share value. So, for example, if your 500 shares of GM stock decline to $0, SIPC wouldn’t bail you out. The 500 shares are guaranteed, but if they’re not worth anything, SIPC would do nothing.

Just in case $500,000 of coverage isn’t enough, SogoTrade has a supplemental policy through its clearing firm Apex Clearing. The policy insures up to $37.5 million per account with a $900,000 limit on cash. The total amount the insurance policy offers is $150 million. As with SIPC, this extra policy only protects the number of shares in an account. It does not protect against a decline in market value.

Is Sogotrade a Scam Judgment

It appears to us that SogoTrade is a legitimate firm operating in a legal fashion. There is no evidence to suspect that the broker-dealer is a scam. Combined with multiple insurance policies, the primary concern its customers should have is market risk.

If you’re interested in trying out the broker’s trading services, we recommend starting with a small balance (an account can be opened with as little as $100)

and test driving its software. Commissions are as low as $2.88 per trade (for high volume traders), which is better than $7.95 charged by TIAA but much higher

than $0 commission charged by

Charles Schwab. If you have an account with another broker, Sogo will reimburse any transfer fees the old broker charges, up to $100.

|