Overview of Interactive Brokers and Cash App

Are you looking for a place to open an investment account? Cash App and Interactive Brokers both offer trading accounts, although they are very different in many ways.

Costs

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

IB

|

|

|

|

|

|

|

|

Cash App

|

|

|

|

|

|

|

Promotions

Interactive Brokers: Get up to $1,000 of IBKR Stock for FREE!

Cash App:

Use U2Q3HN referral link to get $10 cash bonus.

Accounts and Tradable Assets

Interactive Brokers has a long list of account structures that can be opened. These include both taxable and tax-deferred accounts. Joint accounts and trusts are two examples.

There are two modes available as well: robo and self-directed. The latter type has the largest selection of tradable assets. The cornucopia includes stocks, cryptocurrencies, bonds, mutual funds, warrants, options, forex, closed-end funds, futures, and foreign securities.

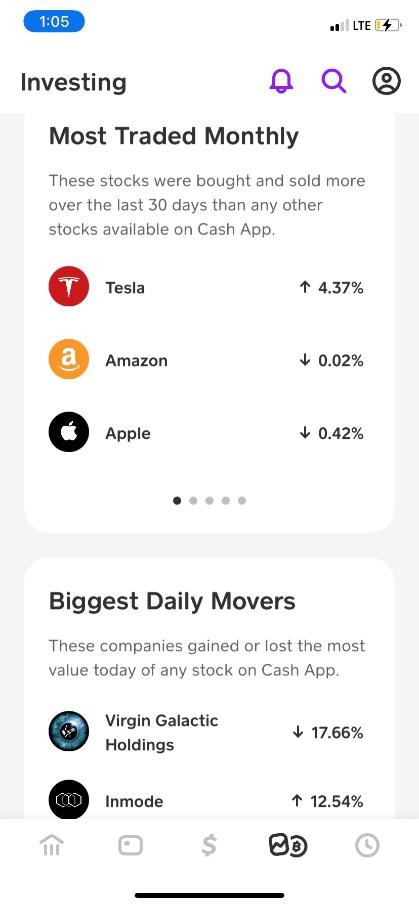

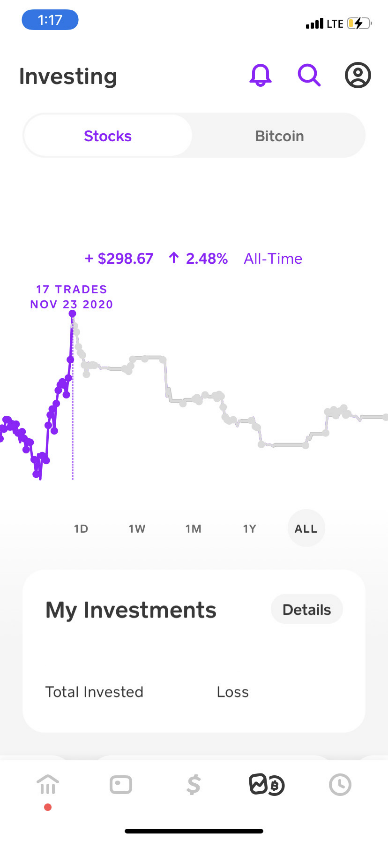

Cash App is an entirely different beast. Most of the investment vehicles available at Interactive Brokers will not be found. The company provides trading in a small list of stocks and ETFs. Only one cryptocurrency is available: bitcoin.

Cash App also has just one tax structure: the individual taxable account. It offers no robo accounts.

Winner: Interactive Brokers

Computer Software

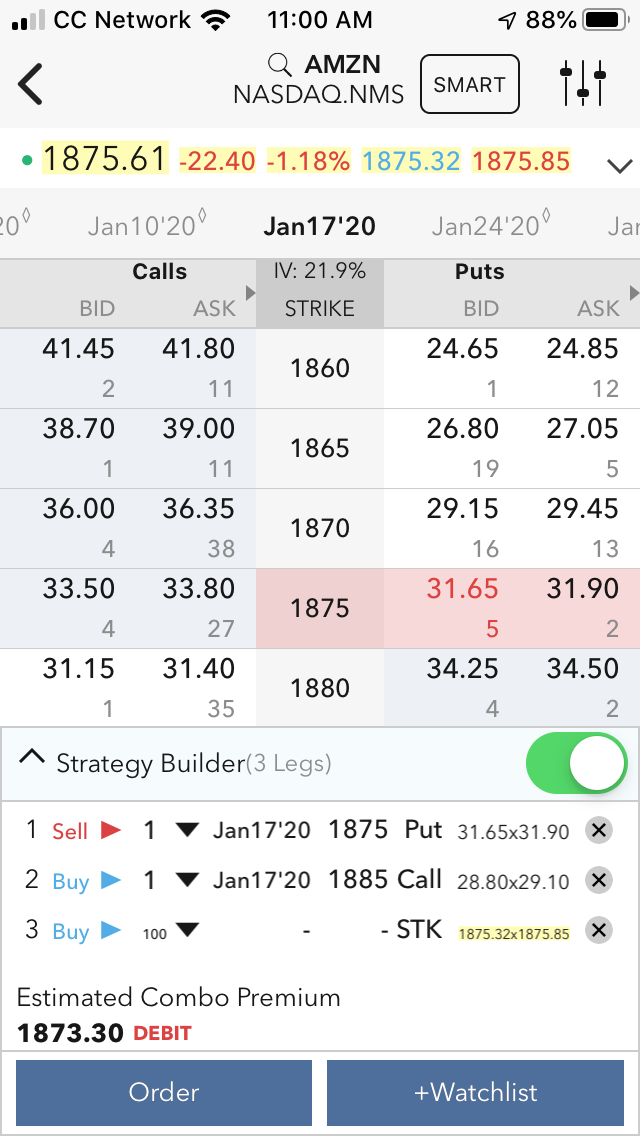

In addition to multiple tax structures, assets, and investment styles, Interactive Brokers also offers multiple trading platforms. Its website has a really good order ticket with several advanced trade types. Graphs are on a high level with a full-screen mode with many charting tools.

Then there is Trader Workstation, a desktop program. This software brings trading to an entirely different level. Direct-access routing is integrated with the trade ticket, and there are many option tools, like a probability lab.

Cash App has no desktop platform, and its website is quite simple. There are actually no trading or research tools at all.

Winner: Interactive Brokers

Mobile Platforms

Going from Trader Workstation to the IBKR mobile app is somewhat of a step down. Nevertheless, we did find several powerful trading tools on the mobile platform. For example, there is a wheel-order entry ticket that offers several pre-populated scrollable numbers to submit a trade quickly. The order ticket can only be used horizontally. There is also an Artificial Intelligence that can answer some, but not all, questions.

Cash App has no AI, although it does offer actual trading this time. The problem—or the advantage, depending on how you see it—is that the software is overly simple. There are just three order types, so advanced trading of any type is not possible. And charts have no tools and no horizontal mode. Graphs on the IBKR app, by comparison, have all sorts of gadgets and gizmos that create a pro-level feel.

Winner: Interactive Brokers

Margin Service

Cash and margin accounts are both available at Interactive Brokers. Margin trading is very enticing,

thanks to low interest rates. Currently, IBKR Lite customers pay a flat

7.83% across all debit

levels for U.S.-dollar-denominated accounts. IBKR Pro clients get lower rates, and other currencies

could be higher or lower.

Another great feature of IB is that it provides margin details on entered ticker symbols.

Information will be found on both Trader Workstation and the website. Data points include:

- Reg-T Initial Margin

- Portfolio Maintenance Margin

- Reg-T Maintenance Margin

Although Cash App does offer margin accounts, they paradoxically cannot be used to trade on margin.

Winner: Interactive Brokers

Additional Services

Automatic Mutual Fund Purchases: Neither broker-dealer offers this useful service.

Extended-hours Trading: Pre-market and after-hours trading are both possible with an IBKR account.

Fractional Shares: Securities and coins can be purchased in whole dollars at either brokerage firm in this comparison. At Cash App, it is the only option.

DRIP Service: Interactive Brokers offers auto dividend reinvesting for stocks. Cash App does not.

Initial Public Offerings: Not available at either brokerage house.

Banking Tools: Both firms offer debit cards. Cash App, not surprisingly, has more banking features, including customizable cards.

Stock Yield Enhancement Program: Traders at Interactive Brokers, but not at Cash App, can make money by lending out their holdings.

Tax Service: Only at Cash App.

Individual Retirement Accounts: Only at Interactive Brokers. There are three IRA types: Roth, Traditional, and SEP.

Winner: Interactive Brokers

Recommendations

Active Stock Trading and Day Trading: Definitely Interactive Brokers. There are many good day-trading tools, including maker-taker fees, technical indicators, Level II quotes, margin accounts, a short-locate widget, and bracket orders.

Mutual Fund Trading: Interactive Brokers is the only choice here.

Beginning Investors: A robo account with Interactive Advisors, an IBKR affiliate.

Small accounts: Self-directed accounts have no minimums. IBKR Lite and Cash App customers will receive no commissions on U.S.-listed stocks and ETFs. Interactive Advisors requires $100 to get started.

Retirement savers and long-term investors: An IRA with Interactive Brokers or Advisors would be a good way to start. The company offers target-date mutual funds in self-directed accounts.

Interactive Brokers vs Cash App Summary

Although we like some of its banking features, for actual trading, Cash App is no match for

Interactive Brokers.

|