Transfer SoFi Account to E*TRADE in 2024

Transfer Your SoFi Invest Account to E*Trade

If you have a brokerage account at SoFi but want to move to E*Trade, you might wonder what transfer methods are available to you. There are two ways to transfer a SoFi Invest account to E*Trade, each with pros and cons.

Read about the methods below to learn which is best for your situation.

Available Transfer Methods

When transferring your SoFi account to E*Trade, you can either handle the details yourself or use the Automated Customer Account Transfer Service (ACATS) to make the move.

ACATS Transfers

One way to move your SoFi account to E*Trade is to use an ACATS transfer.

Here’s how to do it.

The first step is to ensure that you have an open and funded E*Trade account. This is necessary because the ACATS transfer request must be initiated from your E*Trade account.

When opening an account with E*Trade, ensure it is the same type as your SoFi Invest account. SoFi offers a limited range of investment and retirement accounts, and ACATS only works with accounts that are set up similarly and have comparable features.

E*Trade's ACATS Transfer Tool

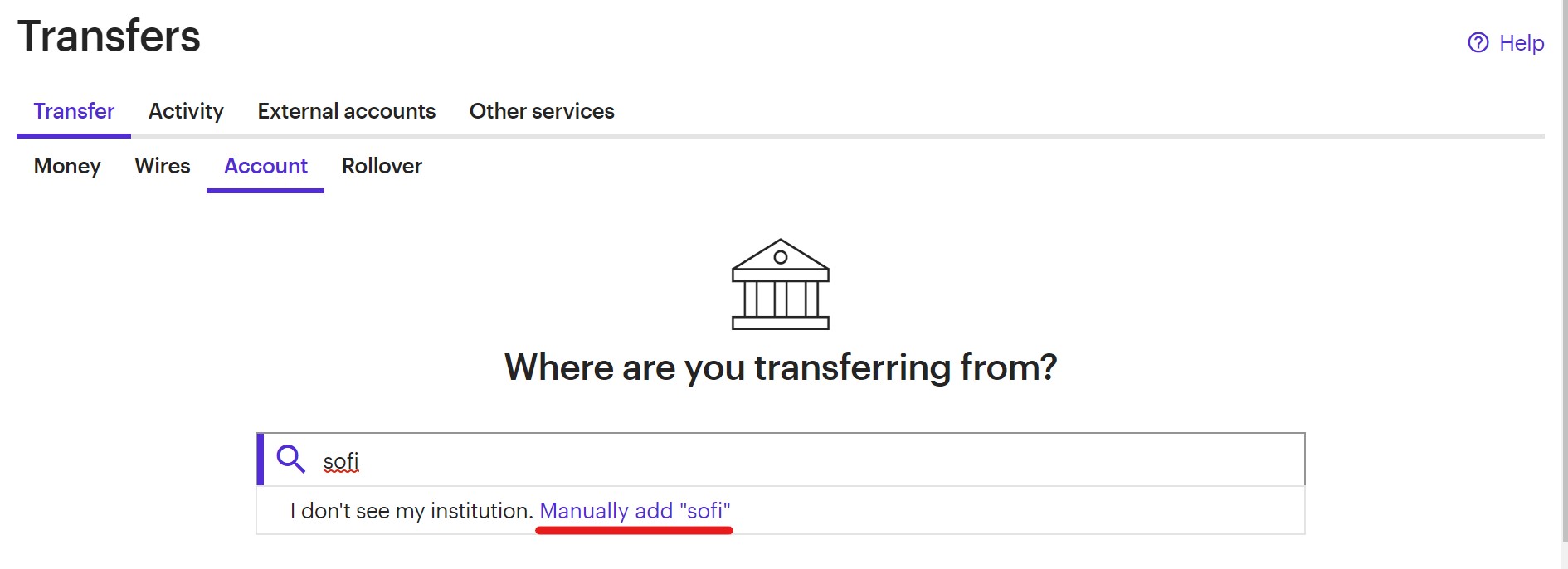

To access E*Trade’s ACATS Transfer Tool, login to your E*Trade account and click on the dollar sign icon near the search bar in the top-right corner of the website. From there, go to the 'Transfer Money' tab, then select 'Transfers' and 'Account.'

E*Trade's ACATS broker selection page includes a search tool and links to some popular brokers. However, in this case, SoFi is not included in the list of links, nor does it appear in the search results. To transfer your account to SoFi, you must download an ACATS transfer request form, fill it out, and upload it to the E*Trade document hub.

Requesting an ACATS Transfer

SoFi is one of many brokers that uses Apex Clearing to manage the backend processes of the brokerage. One of its tasks is account management, so transfer requests are made to Apex Clearing Corp, not SoFi.

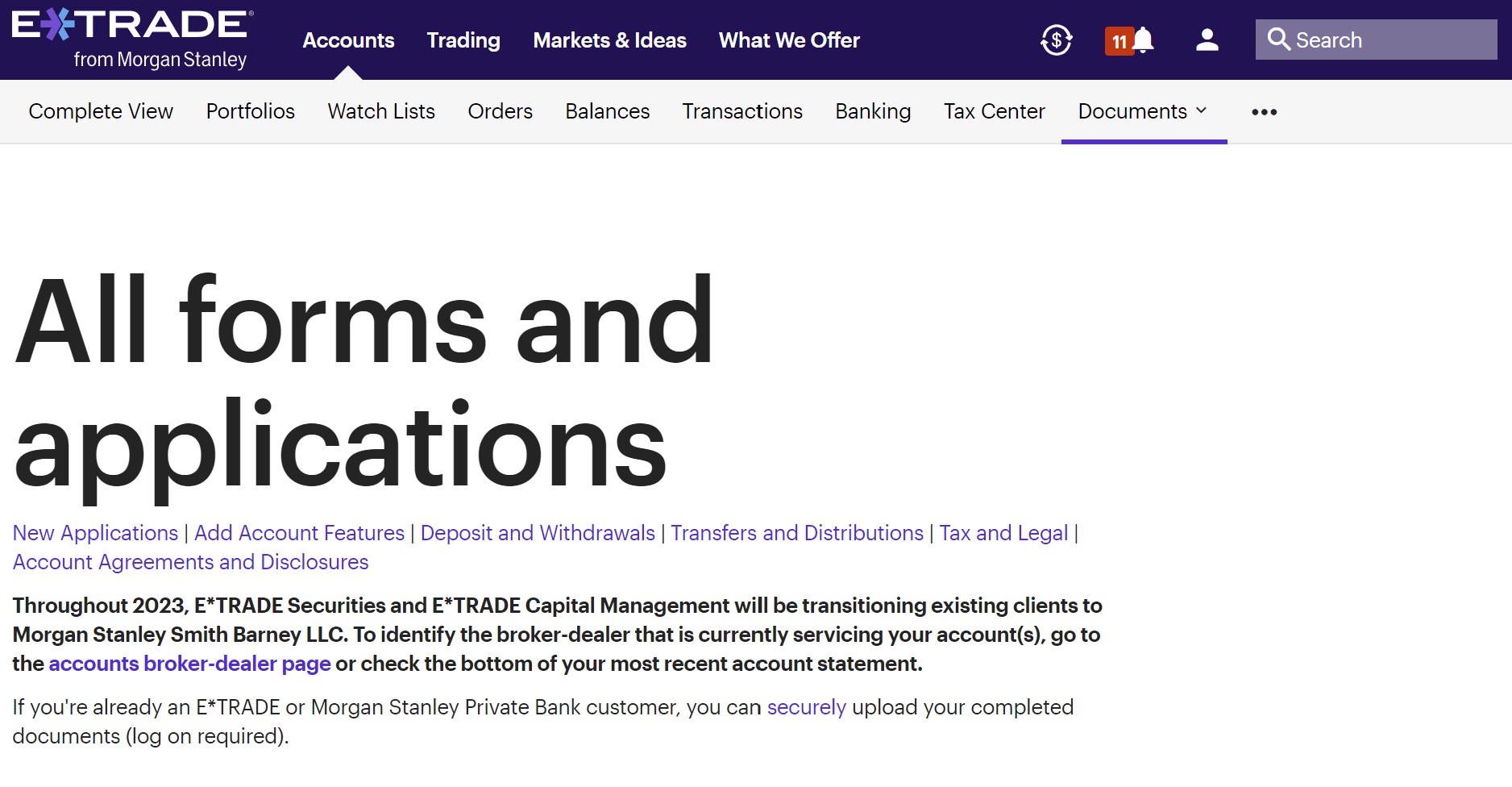

To access the ACATS request form, go to All Forms and Applications and scroll down to the ‘Transfers and Distributions’ section. Locate ‘Transfer an Account to E*Trade Securities.’ Note that the online option is not available in SoFi’s case.

Download and print the form, and carefully follow the instructions to avoid any issues with the transfer. You will provide several pieces of information on the form, including the clearing firm name (Apex Clearing Corp), broker clearing number (0158), SoFi account number, and the physical address of Apex Clearing (350 N St Paul Street, Suite 1300, Dallas, TX 75201). You will also indicate the type of transfer you want to initiate, collect signatures, and attach any requested documents.

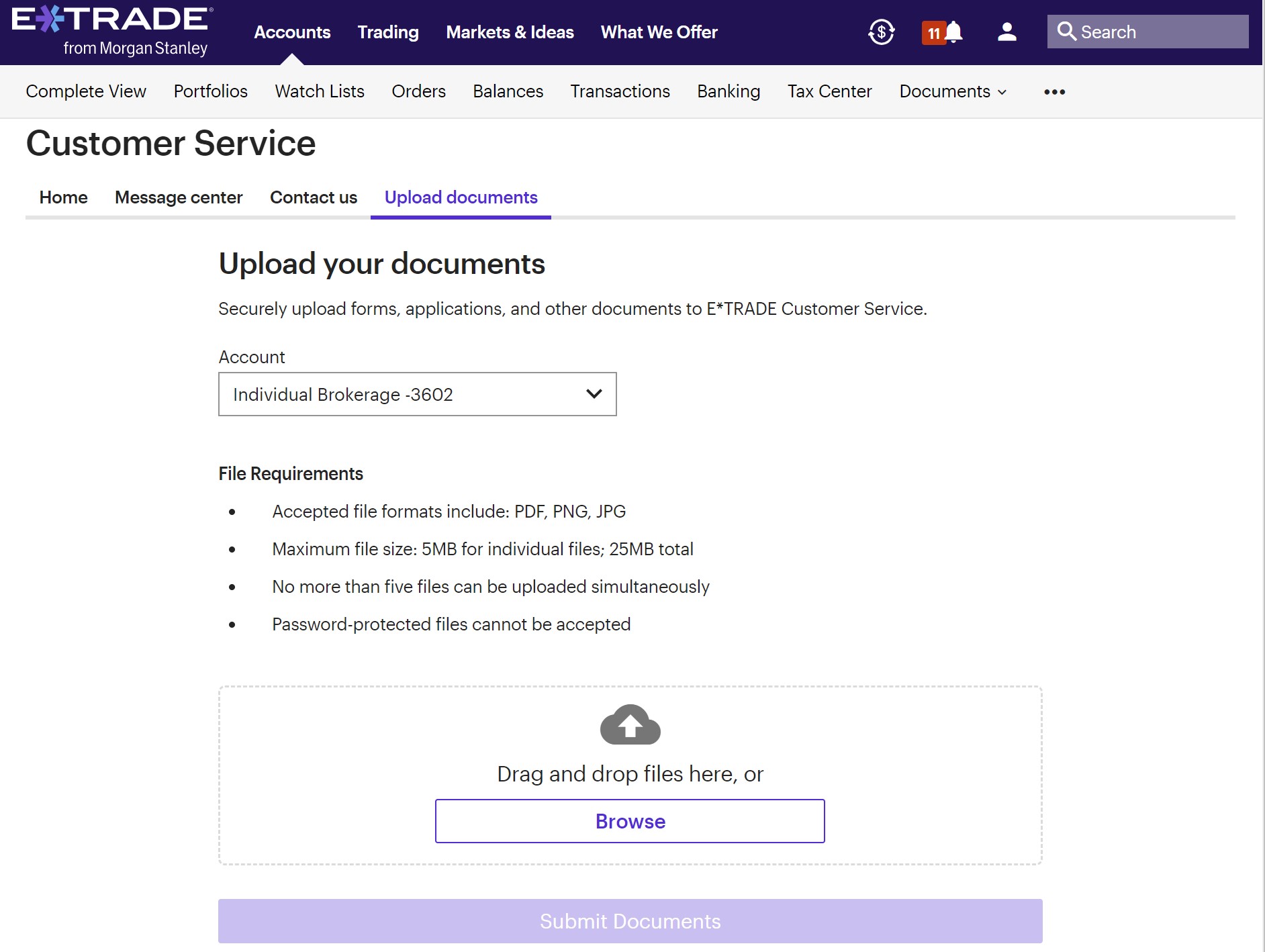

When you are ready, the final step is to upload the application to E*Trade’s document center.

E*Trade Promotion

Get up to $600 cash bonus at E*Trade.

Open Etrade Account

ACATS Requirements and Reminders

ACATS transfers are a convenient and straightforward way to transfer funds, but it's important to understand the process to avoid failed transfers. Here are a few things to keep in mind:

ACATS transfers can be used for partial or full transfers. If you do a full account transfer, your SoFi brokerage account will be closed during the process.

The destination account should be the same type as your SoFi account.

Both accounts must be registered under the same name.

SoFi charges a $75 fee for ACATS transfers, regardless of whether you do a partial or full account transfer.

Note that cryptocurrencies cannot be transferred using ACATS.

Manual Account Transfer Process

Since the process of setting up an ACATS transfer can be complicated, we will explain how to move your account to E*Trade manually.

The first step is to liquidate the assets in your SoFi account, bringing it to a cash-only state. Settlement typically takes at one day (T+1), except for cryptocurrency sales, which settle in one day.

If you have recently made deposits or received bonus payouts, those amounts will also have a settlement period. Newly deposited money cannot be removed for five days, and bonus funds may have a waiting period of up to two months.

To confirm that your account balance has fully settled, check the "Withdrawable Cash" label in your account settings. You're good to go if the figure matches your actual account balance.

Once everything is ready, withdraw your money to an outside bank. Then, fund your new account with funds from your bank.

Alternatives

Which Account Transfer Method is Best?

Deciding the best way to move your SoFi Invest account to E*Trade will depend on several factors. Here are the top considerations most investors have:

Reasons to avoid ACATS:

E*Trade makes requesting an ACATS transfer from SoFi a bit complicated. The need to download, fill, and submit actual paperwork makes the process more difficult than it should be.

SoFi charges $75 for each ACATS transfer request.

Reasons to avoid manual account migration

Although it is easier, manually moving your account will result in a capital gains tax bill (this may be more of an issue for larger, more complex accounts).

Total portfolio liquidation means you lose your trade history and position cost basis. You will have to rebuild your positions from scratch.

Due to transaction times, settlement periods, and regulatory holds on some funds, manual transfers can take considerably longer than ACATS transfers.

|