Transfer Betterment to E*TRADE in 2024

Transfer Accounts Between E*Trade and Betterment

In some situations, it’s easy to move an investment account between E*Trade and Betterment. In others, more leg work is required due to policies at Betterment. Here are the details:

Transfer from Betterment to E*Trade

First Step: Although this may be self-evident,

opening an E*Trade account is a requirement.

It really is the first thing you should do just in case it takes a few days for the account to fully

open and be ready to receive a transfer.

Make sure you open an investing account and not a bank account. Only a securities account can be used in an ACAT transfer, which is what we’re going to do here.

The account type, such as trust or IRA, must match the one you have at Betterment. The names on the two accounts must match as well. An old E*Trade account can be used if it meets these two criteria.

The E*Trade account could be either an automated or self-managed account. If it’s a robo account, the ETFs from Betterment may be sold off by E*Trade’s computer program. This event may have tax implications, depending on the tax structure of the account, so be sure to visit with a licensed CPA for more information. A self-directed account will be able to receive whole ETF shares without any problems.

Second Step: With the E*Trade account opening, the Betterment account needs prepping. Assets in crypto, 401(k), and cash accounts cannot be moved out of Betterment in an ACAT transfer. Therefore, only individual, joint, IRA, and trust accounts should be used. Open orders need to be closed out and unsettled trades should be allowed to settle before requesting a transfer.

Third Step: Now the E*Trade account should be set up correctly. Because Betterment doesn’t offer margin or options trading, there’s really not much to do here.

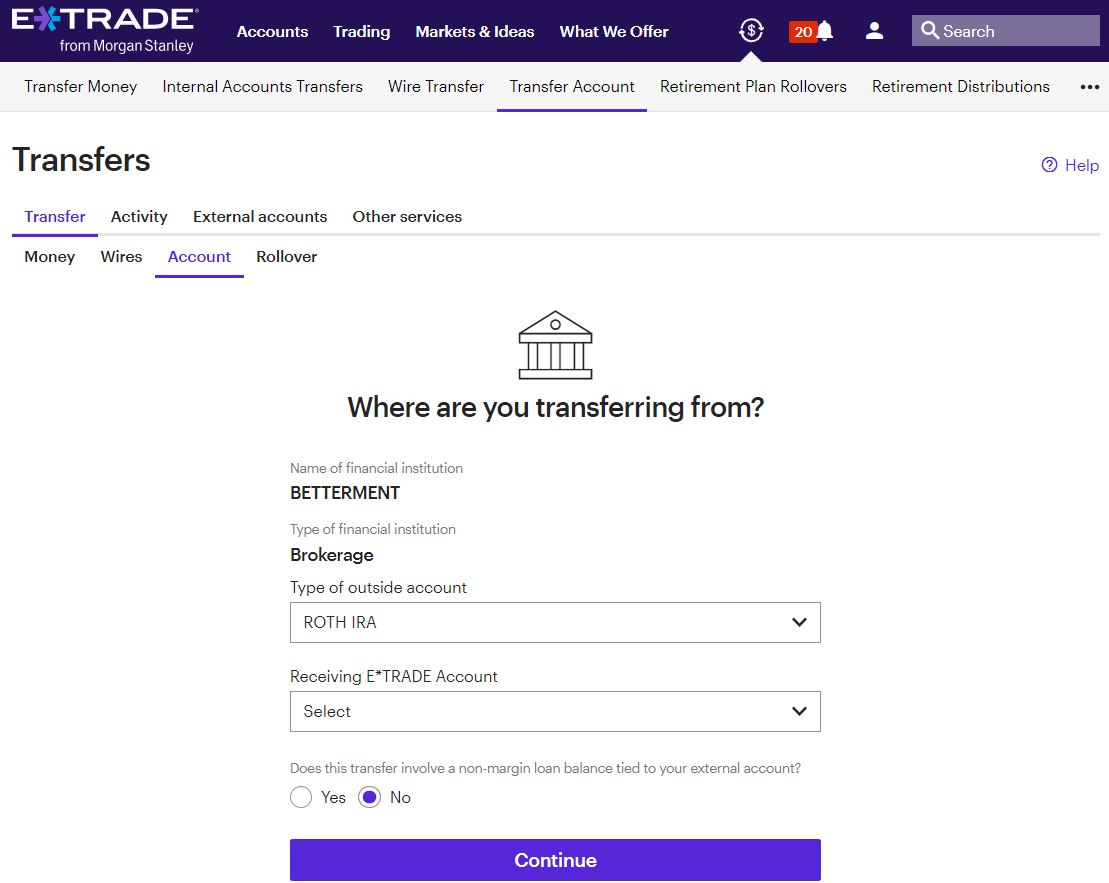

Fourth Step: Request the ACAT transfer. This should be done with the receiving firm, which is E*Trade in this case. A transfer request can be made on either the website or mobile app. On the former platform, hover over the Transfer link at the top of the site and select the link to transfer an account. On the next page, you’ll need to enter Betterment as the outgoing investment firm. Fill in the other requested details and submit the transfer.

E*Trade Promotion

At E*TRADE, get $0 trades + 65₵ per options contract.

Open Etrade Account

Transfer from E*Trade to Betterment

Going in the other direction will follow a similar path.

First Step: The correct account type with the correct name needs to be opened at Betterment.

Second Step: The E*Trade account needs to be set up properly. Many assets can’t be transferred into Betterment for the sheer fact that Betterment is a robo-only firm. Stocks, mutual funds, bonds, futures contracts, and options must all be sold off. Most ETFs won’t be accepted, either. Betterment uses primarily Vanguard and iShares funds.

One workaround here is to perform a partial transfer, which Betterment will accept.

Third Step: The Betterment account should be prepared, although once again, there’s not much to do in this case. A margin balance can’t be transferred into Betterment.

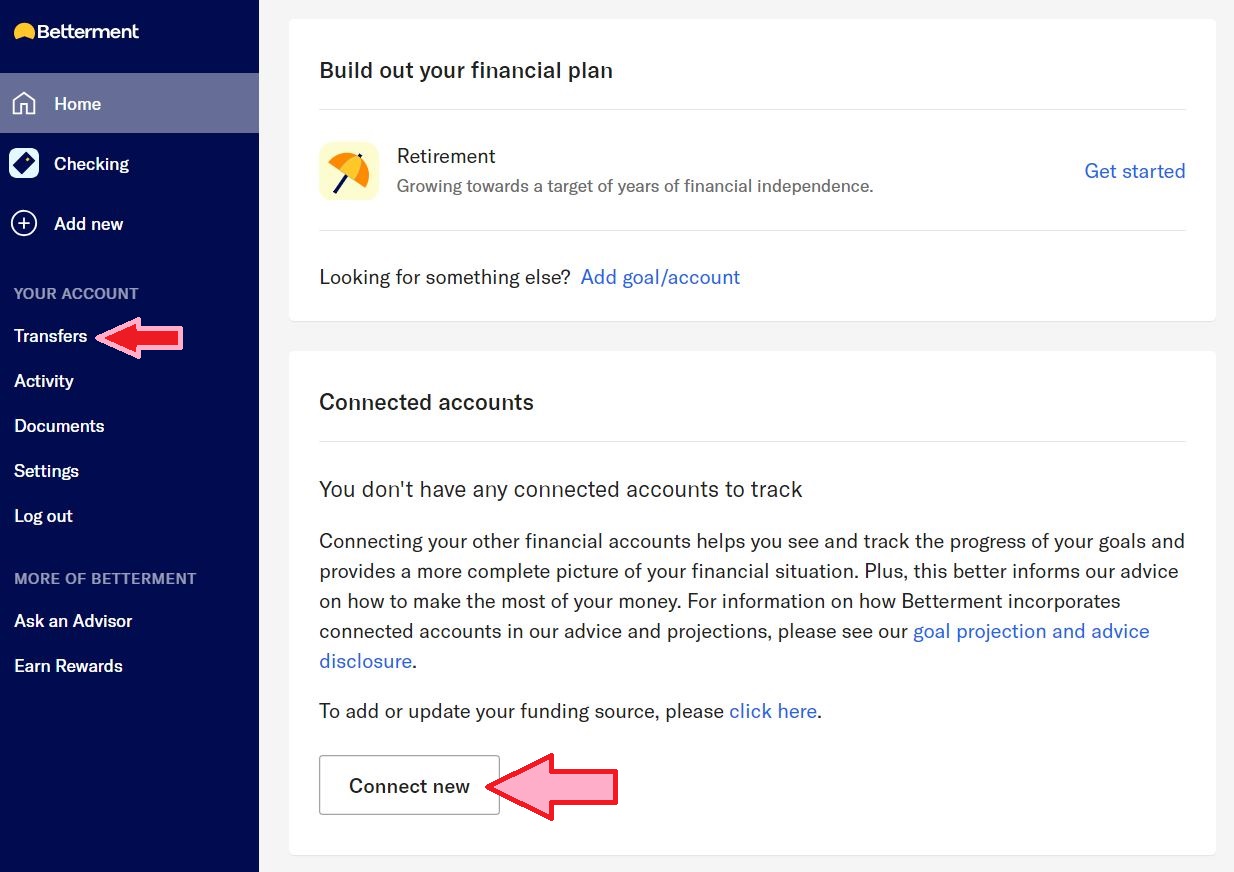

Fourth Step: Betterment requires the E*Trade account to be connected to the Betterment login. To do this, log into the Betterment site and scroll down to the button to connect an account. Here, you’ll add the account you have with E*Trade. You can do this with login credentials or with details on the account. Just follow the on-screen prompts.

Fifth Step: Now is the time to submit the ACAT request. To do this, click on the Transfers link that appears on the left-hand column on the Betterment site. On the next page, click on the link to initiate a new transfer (you can also select transfer or rollover in the drop-down menu at the top of the site). In either case, follow the on-screen prompts to submit the request.

Note that Betterment does not permit online account transfers into an Inherited IRA, trust, or joint account. To perform a transfer into one of these you’ll need to email Betterment at transfers@betterment.com and supply details on the E*Trade account.

Cost

Betterment charges nothing for transfers. E*Trade has a $75 outgoing ACAT fee for a full transfer. It charges $25 for a partial outgoing transfer if the value of the account drops below $5,000.

How Long Does a Transfer Take?

Expect a week and a half, assuming all paperwork is filled out correctly, for whole shares of securities to arrive in the receiving account from the time the request is made. Fractional shares of ETFs or stocks will arrive as cash probably a few days later.

|