|

Bank of America Money Market IRA Review

Bank of America Money Market IRA review and rates for 2024. BOFA MMA Roth & traditional IRA accounts pros, cons, fees, and promotions.

|

Bank of America Money Market IRA Overview

Investors are increasingly wary of the traditional stock portfolio in their retirement accounts. Volatility is extreme, and keeping cash in equities is increasingly risky, especially for those close to retirement. Even those with a long path to retiring may be sitting on cash to capture the upside when the market does eventually bottom out. But, for both, cash as a position is also a poor decision as inflation eats away at its value daily. For those in either situation or other risk-averse investors, Bank of America offers money market options for the IRA.

What is a Money Market IRA?

A money market IRA is a type of savings IRA, which in turn is a subset of the three primary IRAs most investors use in retirement planning: Roth, Traditional, and Rollover. Any of these three IRAs can be used as savings IRAs.

A savings IRA has the same structural advantages as a standard, equities-heavy IRA but carries additional features that reduce risk:

Tax Advantages

Since a savings and money market IRA is just a subset of an IRA, it enjoys the same tax advantages as other IRA accounts. You’ll need to check with your tax planner to determine your specific situation, but most can enjoy tax-free withdrawals in Roth IRAs and other advantages in a Traditional account.

(Almost) Risk-Free

Since a savings and money market IRA uses commercial banking products rather than speculative investments like stocks and options, the money in a savings IRA is FDIC-insured. This means that the federal government protects or guarantees cash up to a certain amount (usually $250,000) if the bank collapses or cannot return its customers’ money.

Bank of America Benefits

As with any other Bank of America IRA, you won’t pay annual or custodial fees on the account.

Bank of America Money Market IRA

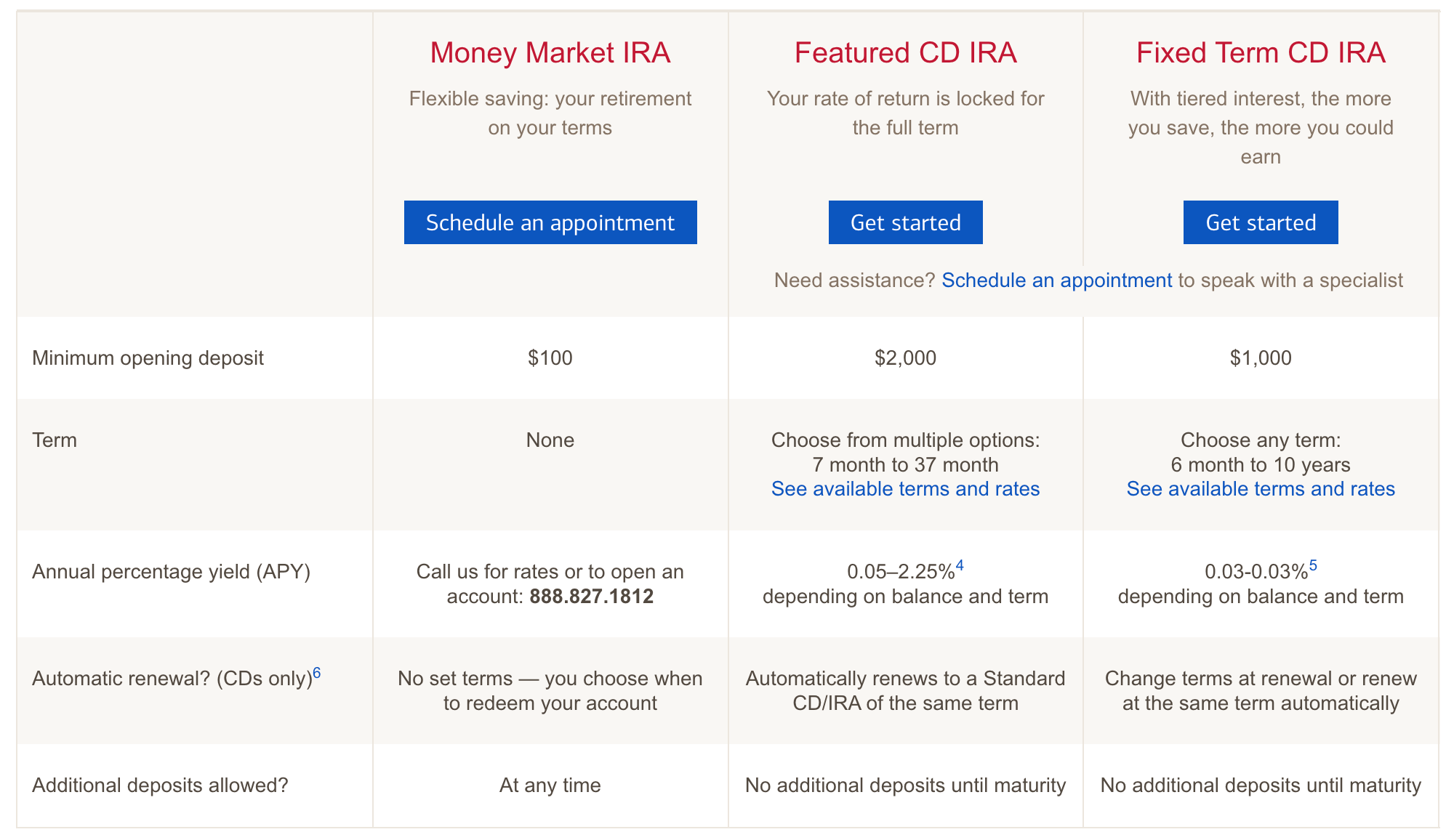

Bank of America’s money market IRA offers the most flexibility for other savings IRAs, which typically center around certificates of deposit (CDs).

The money market’s primary benefit over the CD is flexibility. A CD locks your cash in for a set period, so you can’t use it to take advantage of stock opportunities or withdraw during retirement.

CDs also have higher purchase costs than the $100 minimum opening amount for a money market IRA. It is best for new investors looking to start and grow a retirement account.

And, whatever amount you invest in a CD, you’re stuck with that until the CD matures. With a money market IRA, you can add more cash any time you want with no additional investment minimum.

The yield on the money market IRA does vary, although, in today’s environment, they’re higher than

before as the Federal Reserve continues to increase interest rates. You’ll have to call for the

current rate, as it does fluctuate, but when we called Bank of America’s customer service line, the

rate fluctuated between 0.05% and 0.07%. This represents an opportunity to grow your cash reserves

while waiting to withdraw or take advantage of stocks on sale.

Bank of America's money market IRA rates are extremely low. To compare,

Robinhood offers

5% APY on free cash balances with the

Robinhood Gold package that costs only $5 per month.

Top Alternatives

Bank of America Money Market IRA Conclusion

Yes, you can capture more significant gains over a long period by investing in stocks within an IRA.

But, for those who shy away from risk, today’s extreme volatility is turning eyes towards lower-risk

investments like Bank of America’s money market IRA.

This savings IRA is nearly riskless with FDIC insurance, offers greater flexibility than other fixed-income investments like CDs or bonds, and is great for any investor level, whether a new account creator, investor waiting for an opportunity to jump back into the market, or a retiree actively withdrawing from the account but wanting to earn a little extra yield.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

|