Is Stash Offered in Europe

Stash is not available in European countries (France, Poland, Germany, UK, Italy, Spain, Austria, Sweden, and others).

Open Stash Account

Open Stash Account

Alternative to Stash in Europe

For European investors, we recommend opening an account with these American brokers:

ZacksTrade Website

Open ZacksTrade Account

Overview of Acorns, Stash, and Firstrade

While Acorns and Stash are better known among Millennial investors, Firstrade is a more traditional brokerage firm that offers services that neither Stash nor Acorns provides. Could those Millennials be at the wrong brokerage firm? Let’s have a look.

Broker Cost

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Firstrade

|

$0

|

$0

|

$0

|

$0

|

$0

|

|

Acorns

|

na

|

na

|

na

|

$3, $5, or $9 per month

|

$3, $5, or $9 per month

|

|

Stash

|

$0

|

na

|

na

|

$3 or $9 per month

|

$3 or $9 per month

|

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

Firstrade

|

|

|

|

|

|

|

|

Acorns

|

|

|

|

|

|

|

|

Stash

|

|

|

|

|

|

|

Promotions

Firstrade: Get up to $250 ACAT rebate and $0 commission trades.

Acorns:

Get Acorns absolutely free and a $20 bonus.

Stash:

$20 in free stock when you open a new account.

Investment Vehicles

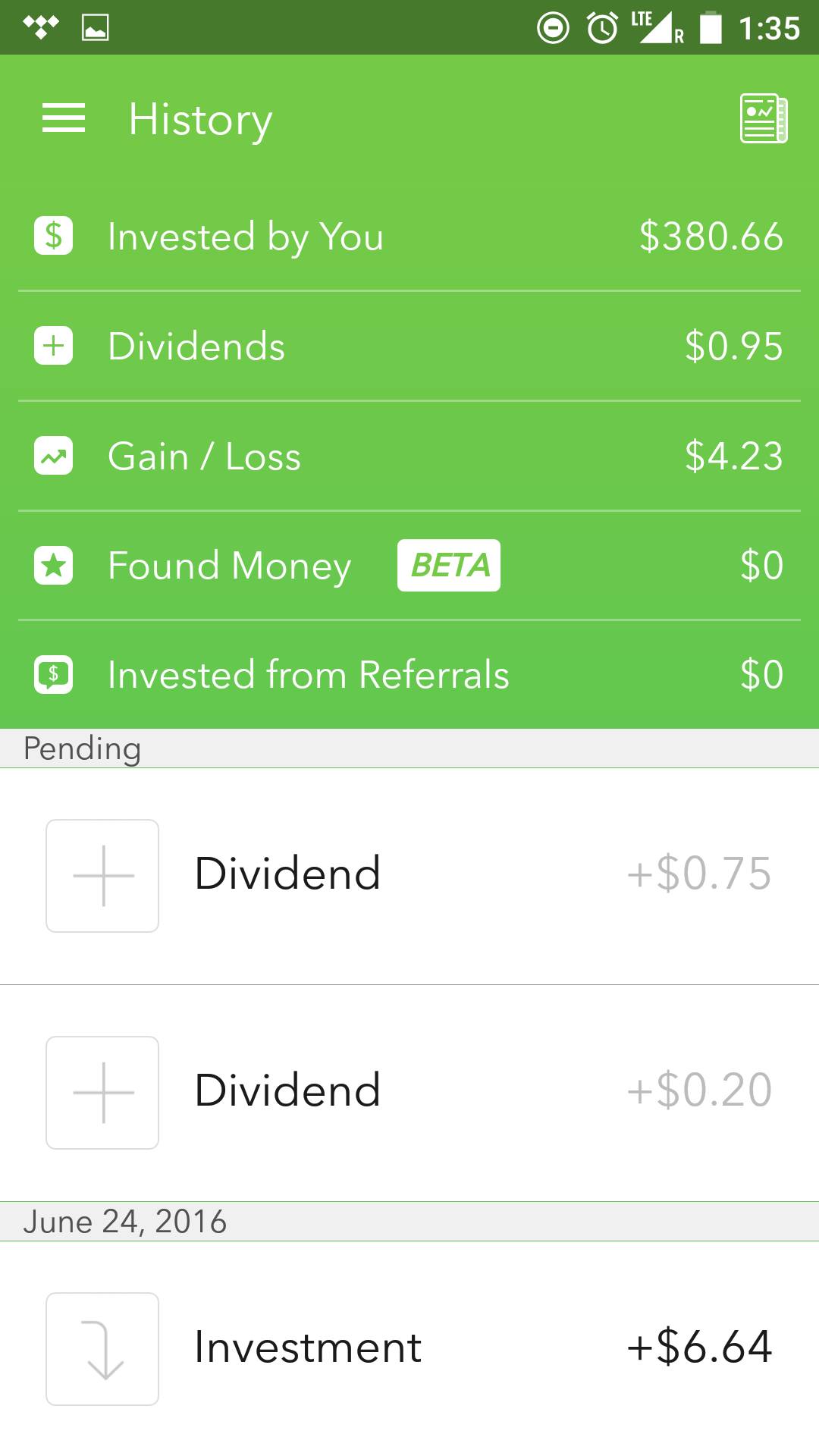

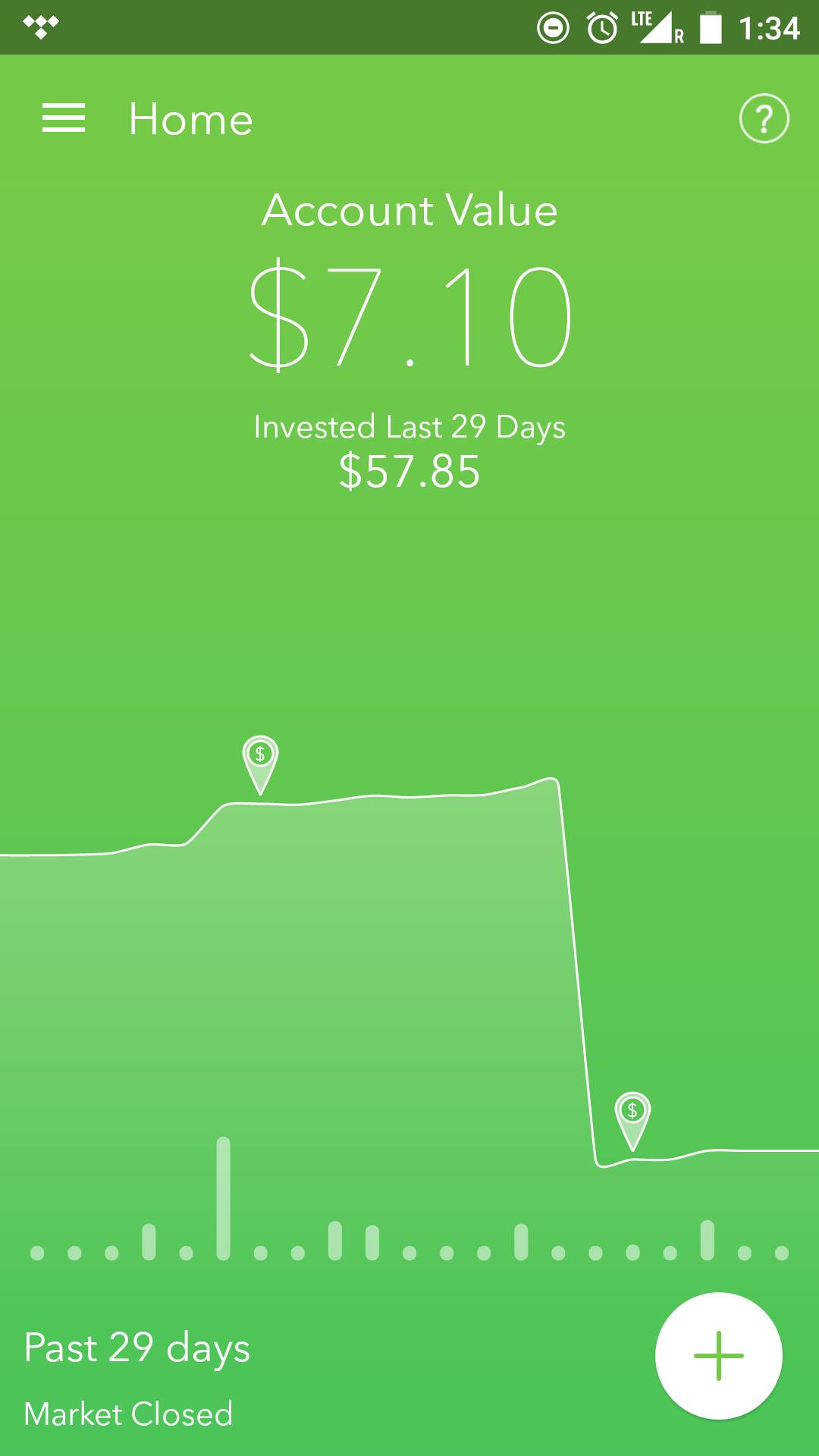

Stash customers can trade a limited selection of exchange-traded funds and stocks. While this is all Stash offers, Acorns offers even less: just twelve ETFs.

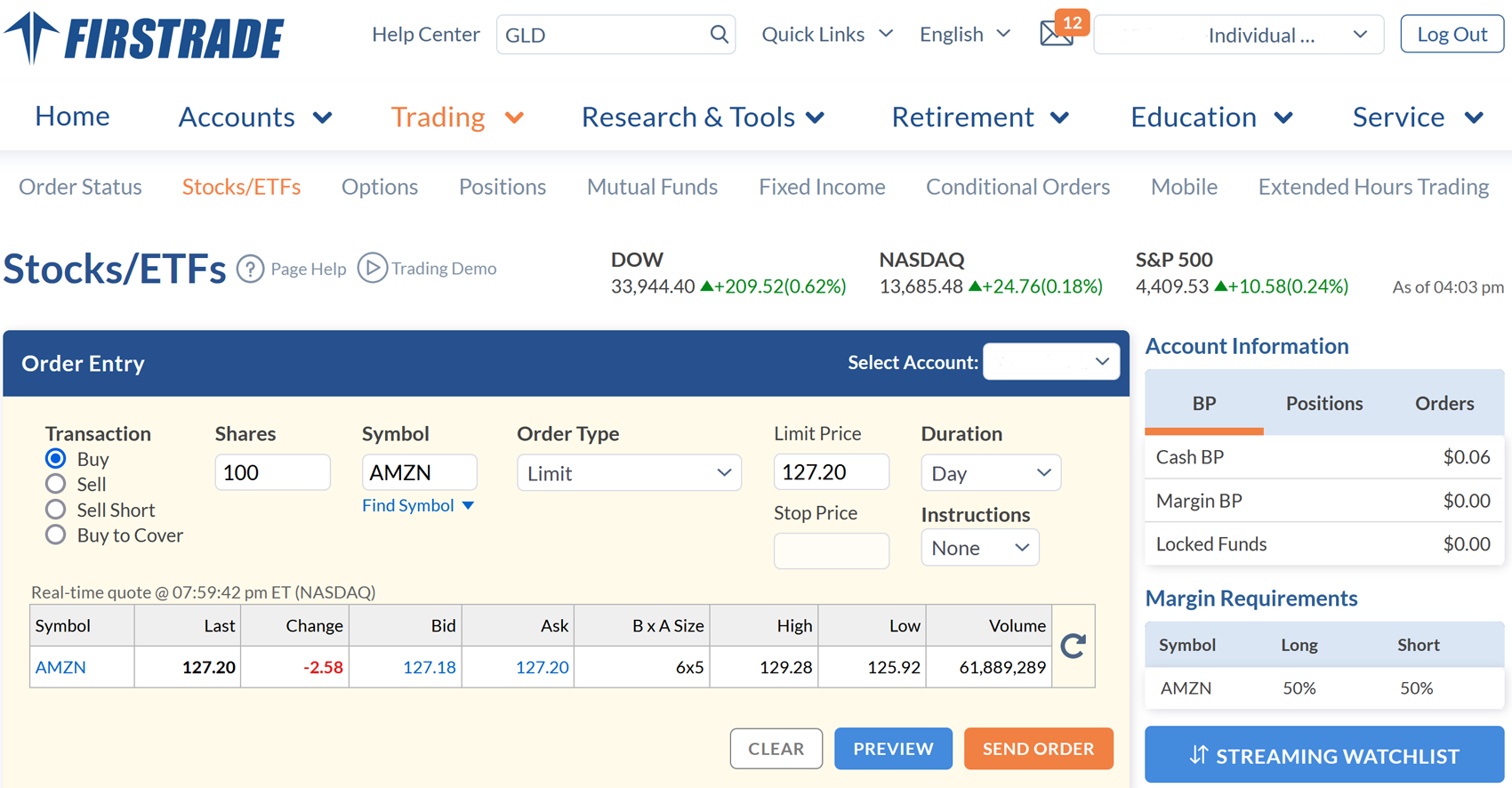

Firstrade clients can buy and sell:

- Stocks (the entire U.S. marketplace, including penny stocks and over-the-counter instruments)

- Exchange-traded funds (again, the entire U.S. space)

- Closed-end funds

- Options

- Bonds and other fixed-income assets

- Mutual funds (thousands of them)

There is also an IPO center on Firstrade’s website.

Winner: Firstrade

Investment Methods

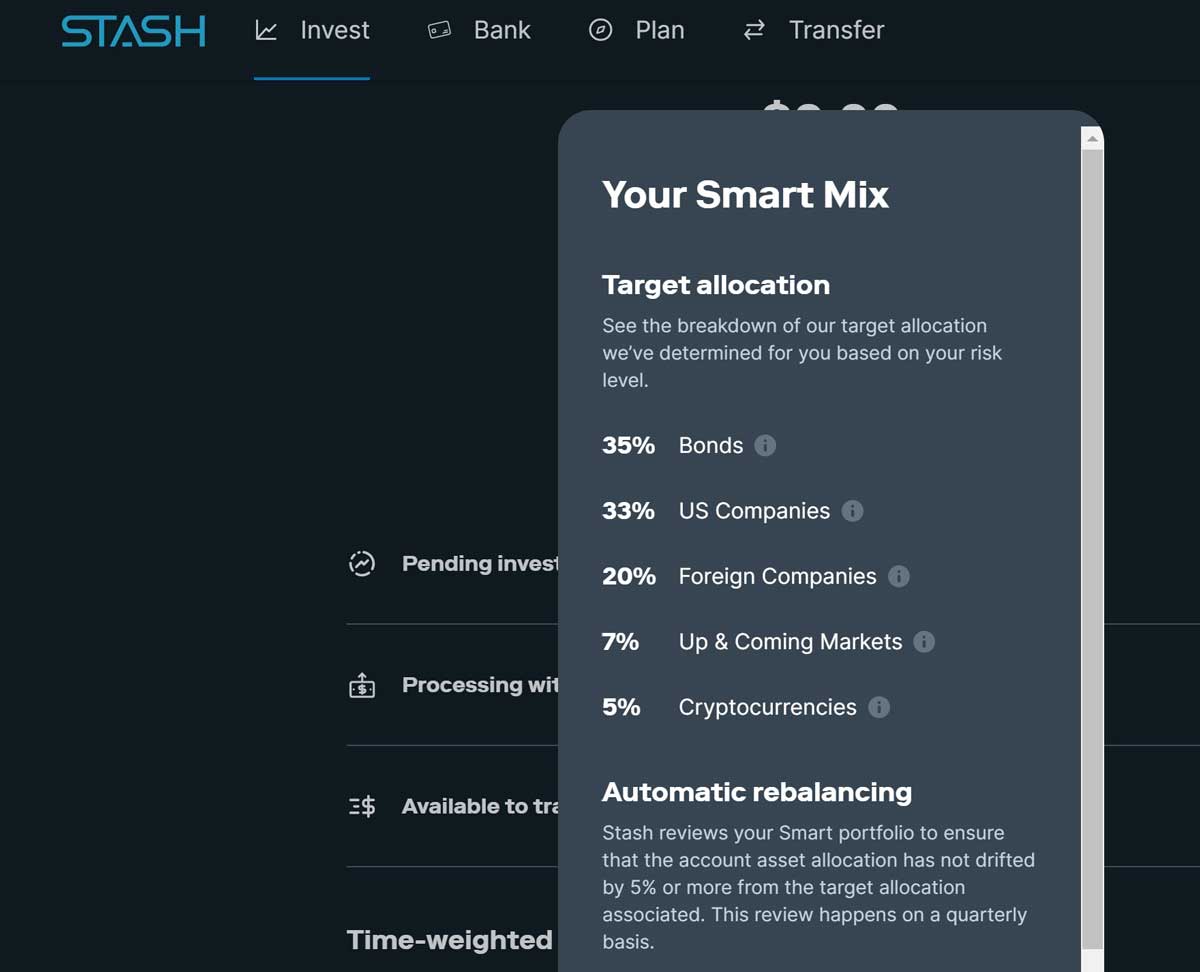

Acorns offers robo accounts. It does not provide any self-directed accounts. The company’s software is responsible for all trading decisions. The brokerage firm also offers a round-up service and a bonus investment program for shopping at certain retailers.

Stash offers self-directed accounts only. Therefore, there’s no robo service. The brokerage house has a round-up service like its rival. Instead of a bonus investment program, it offers a stock-back service that rewards fractional shares of stocks to its customers when they shop at eligible retailers.

As a traditional broker, Firstrade offers self-directed, no-frills accounts. It does not have a stock-back, round-up, or bonus investment program. The advantage of Firstrade here is that it doesn’t charge a monthly fee. Acorns and Stash do. Acorns’ most expensive plan is $5, while Stash is as high as $9.

Winner: Toss up

Desktop Software

Because Acorns doesn’t have any self-directed trading, the broker doesn’t offer much in terms of trading tools. The company’s website has user-friendly account management tools, and that’s about it.

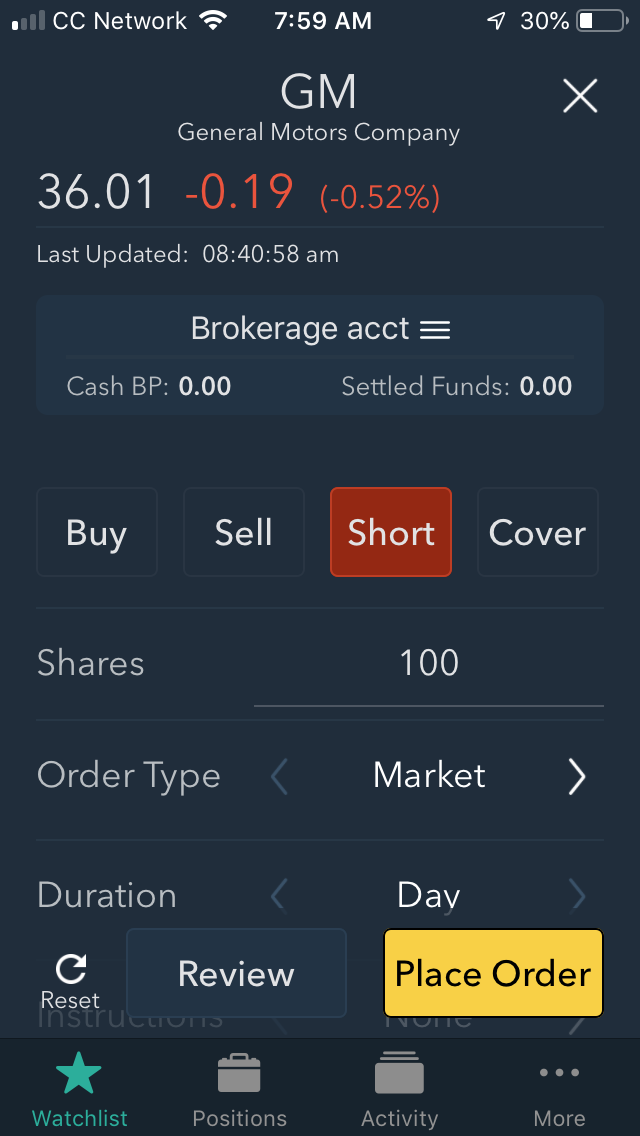

Stash’s site has an order ticket that can be used to submit trades. It’s easy to set up periodic investments on the site as well.

At Firstrade, things improve dramatically. The broker’s website has a permanent trade ticket that sits at the bottom of the screen. With this widget, we were able to successfully submit orders for equities, ETFs, closed-end funds, and option contracts. There are many custom features, including order types and time-in-force choices.

Because Firstrade uses Morningstar’s software, there is good charting on Firstrade’s site. On top of a graph, it’s possible to use technical indicators and comparisons. And we really like the broker’s stock and fund screeners, which are much better than anything Stash or Acorns provides.

Winner: Firstrade

Mobile Apps

All three broker-dealers in this examination have mobile apps. Both Stash and Acorns have simple apps that mimic their websites. This means they are user friendly but only offer minimal tools.

The Firstrade app offers charting in both vertical and horizontal modes. In horizontal mode, we were able to change the graph style, add some technical studies, specify logarithmic or linear scale, and specify percent change on the vertical axis rather than price.

Firstrade’s order ticket offers multiple trade types and duration choices. One final highlight is the ability to trade option contracts (mutual funds have to be traded on the website).

Winner: Firstrade

Cash Management Tools

Besides investing, all three brokers offer banking tools; although they do differ significantly.

Firstrade customers who have at least $25,000 in assets can add checks and a Visa debit card to an existing securities account. There is no fee for doing so.

Neither Stash nor Acorns offers checkwriting. They do offer Visa debit cards. Acorns’ has tungsten and UV glass in it. Unfortunately, the card isn’t available on the $1 per-month plan. For the debit card, Acorns charges $3 per month. In return, though, Acorns reimburses all ATM fees incurred with the card.

Firstrade doesn’t offer this great perk. Stash offers fee-free withdrawals only at Allpoint ATMs. Its Visa card is available at just $1 per month, though. For $9 per month, Stash has a metal card.

Winner: Draw

Miscellaneous Services

Dividend reinvestment program: Free DRIP service is available at all 3 brokerage firms.

IRAs: Same story here, although Stash and Acorns charge higher monthly fees than Firstrade, who has fee-free IRAs.

Automatic mutual fund investing: Firstrade offers this service at no charge.

Winner: Firstrade

Our Recommendations

Beginners: Stash or Acorns.

Retirement savers and long-term investors: Firstrade.

ETF and stock trading: Definitely Firstrade.

Small accounts: Firstrade.

Round-up investing: Although Stash and Acorns promote their round-up services, we think saving the change and making one transfer per month (at no cost) into a Firstrade account via ACH makes more sense. Instead of paying a monthly fee to save, just learn to save on your own for free.

Promotions

Firstrade: Get up to $250 ACAT rebate and $0 commission trades.

Acorns:

Get Acorns absolutely free and a $20 bonus.

Stash:

$20 in free stock when you open a new account.

Firstrade vs Stash and Acorns Summary

Although Stash and Acorns could be good choices for the most untutored of investors, Firstrade has

many advantages that are difficult to ignore.

Open Firstrade Account

Open Acorns Account

Open Stash Account

Updated on 1/4/2024.

|