Transfer Robinhood to Firstrade Or Vice Versa (2024)

How to Transfer a Robinhood Account to Firstrade

If you’ve tried Robinhood, but want to give Firstrade’s $0 commission schedule a try, it’s pretty easy to do. Just follow the easy steps in this article, and you’ll be ready to go with your new account.

Step 1: Look Over Firstrade’s Pricing Schedule

Before transferring your account to Firstrade, you want to make sure you’re aware of Firstrade’s

fees and commissions. Trades of stocks, options, ETF’s, closed-end funds, and mutual funds are

completely free. Accounts also have no fees.

Firstrade Promotion

Get up to $250 ACAT rebate and $0 commission trades.

Open Firstrade Account

Step 2: Open a Firstrade Account

If everything on the broker’s commission schedule looks acceptable to you, the first step in moving from Robinhood is to open a

Firstrade account. This is a fairly straightforward process. Simply click on their promotion offer - Get up to $250 ACAT rebate and $0 commission trades.

- and follow the online instructions.

Step 3: Submit an Account Transfer Request

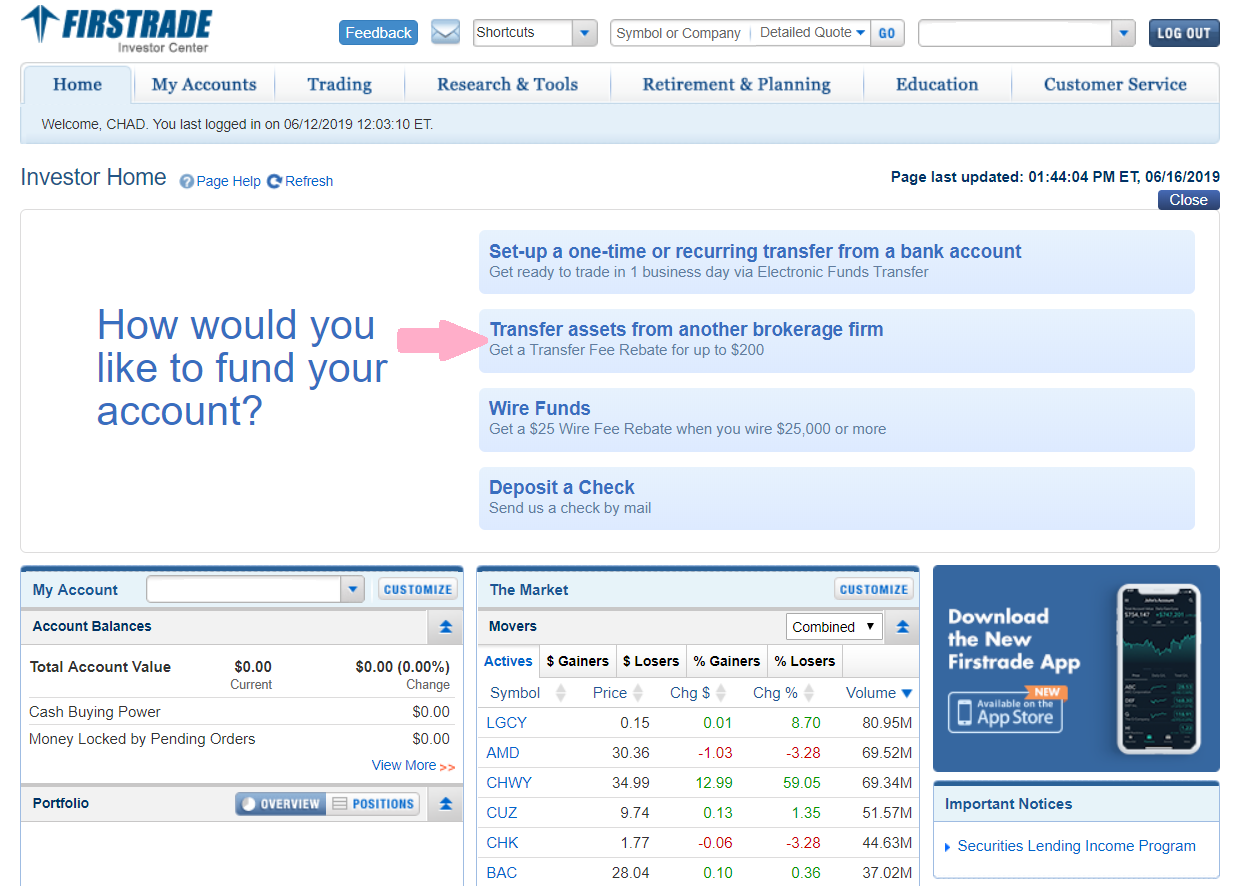

After your Firstrade account has been open for at least one business day, it’s time to submit an ACAT request to move your Robinhood account into your Firstrade account. When you login to your new Firstrade account, click on the “Home” tab in the top menu. On the next page, you should see a top menu with several methods to fund your new account. One of them will say, “Transfer assets from another brokerage firm.” Click on this.

The next page will display a simple form you’ll need to fill out. Under “Firm Name” you can start typing Robinhood, and the website will automatically populate “Robinhood Financial, LLC” in the drop-down menu. Select this. You’ll also need your Robinhood account number to complete the form.

It’s possible to do a partial transfer where some securities are left at Robinhood and others are moved to Firstrade. To take this route, you’ll need to download Firstrade’s pdf transfer form, fill it out, and send it back to Firstrade.

You can do this via several methods. The most convenient is probably to upload it through your online account. There is an upload link on the account transfer page. You can also find the upload link under the “Customer Service” tab. Be sure to click on “Form Center” and then “Upload Form.”

Keep in mind that cryptocurrencies cannot be moved; so if you have any digital currencies at

Robinhood, you’ll want to liquidate those positions.

Step 4: Wait for Your Robinhood Securities to Move

The transfer process could take three to four business days to finish. It’s best not to trade during this period. Doing so could delay the process. Once the transfer is complete, your Robinhood account will be automatically closed if you requested a full transfer.

Step 5: Wait for Your Transfer Fee Rebate

Robinhood charges $100 for its side of the transfer. Fortunately, Firstrade doesn’t charge anything

for its ACAT service. In fact, it actually

refunds the old broker’s fee for full transfers. Obviously, if you want the rebate, you’ll need to perform a full transfer.

Firstrade Promotion

Get up to $250 ACAT rebate and $0 commission trades.

Open Firstrade Account

Transfer from Firstrade to Robinhood

If you want to transfer from Firstrade to Robinhood, the process is very similar, but there are some broker-specific differences to keep in mind.

The first thing to know is that you need to initiate your transfer request from a Robinhood account.

If you don’t already have an account at Robinhood, you can open one here: Free stock up to $200 and 1% IRA match when you open an account.

Here are the steps to transfer a Firstrade brokerage account into Robinhood:

Requesting an ACATS Transfer

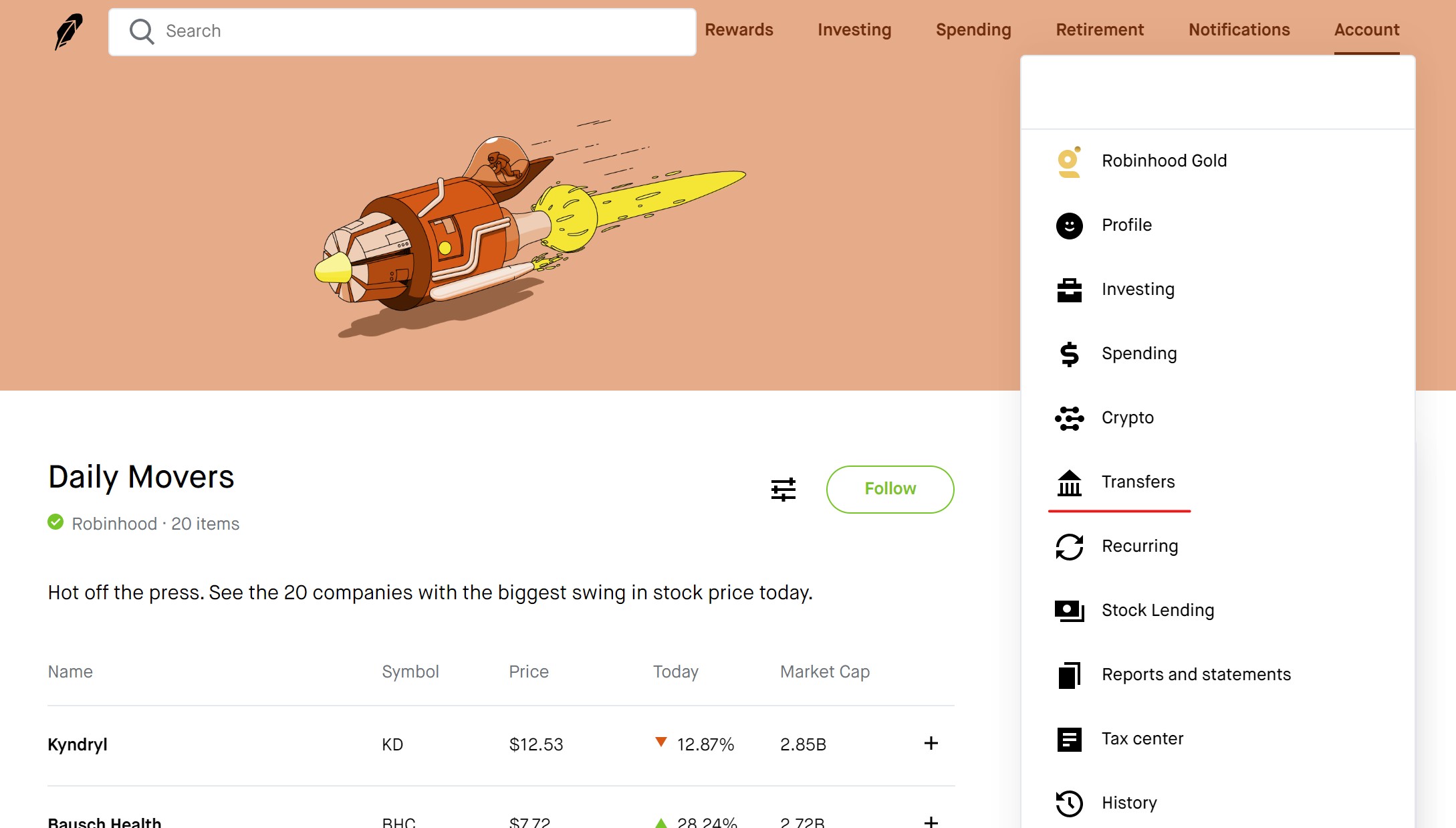

To start the account transfer process, navigate to the ‘Transfers’ menu (under ‘Settings’) from your Robinhood account (available on the app and browser-based platforms). Once there, select ‘Transfer accounts in’ to initiate the ACATS transfer.

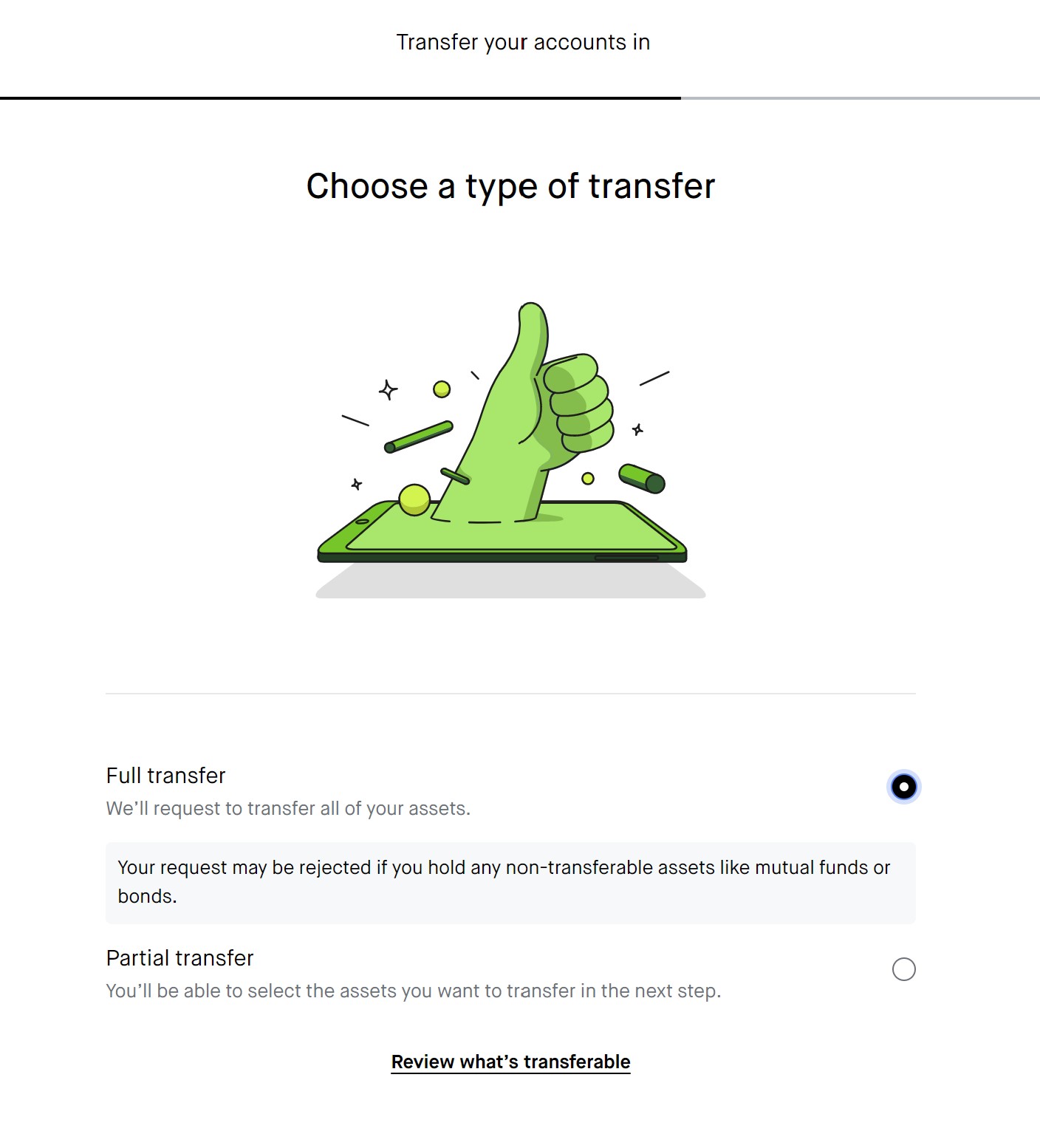

Note that two types of account transfers are available at Robinhood: full and partial. Full account transfers move all your assets and close the originating account, while partial transfers only move the assets you select.

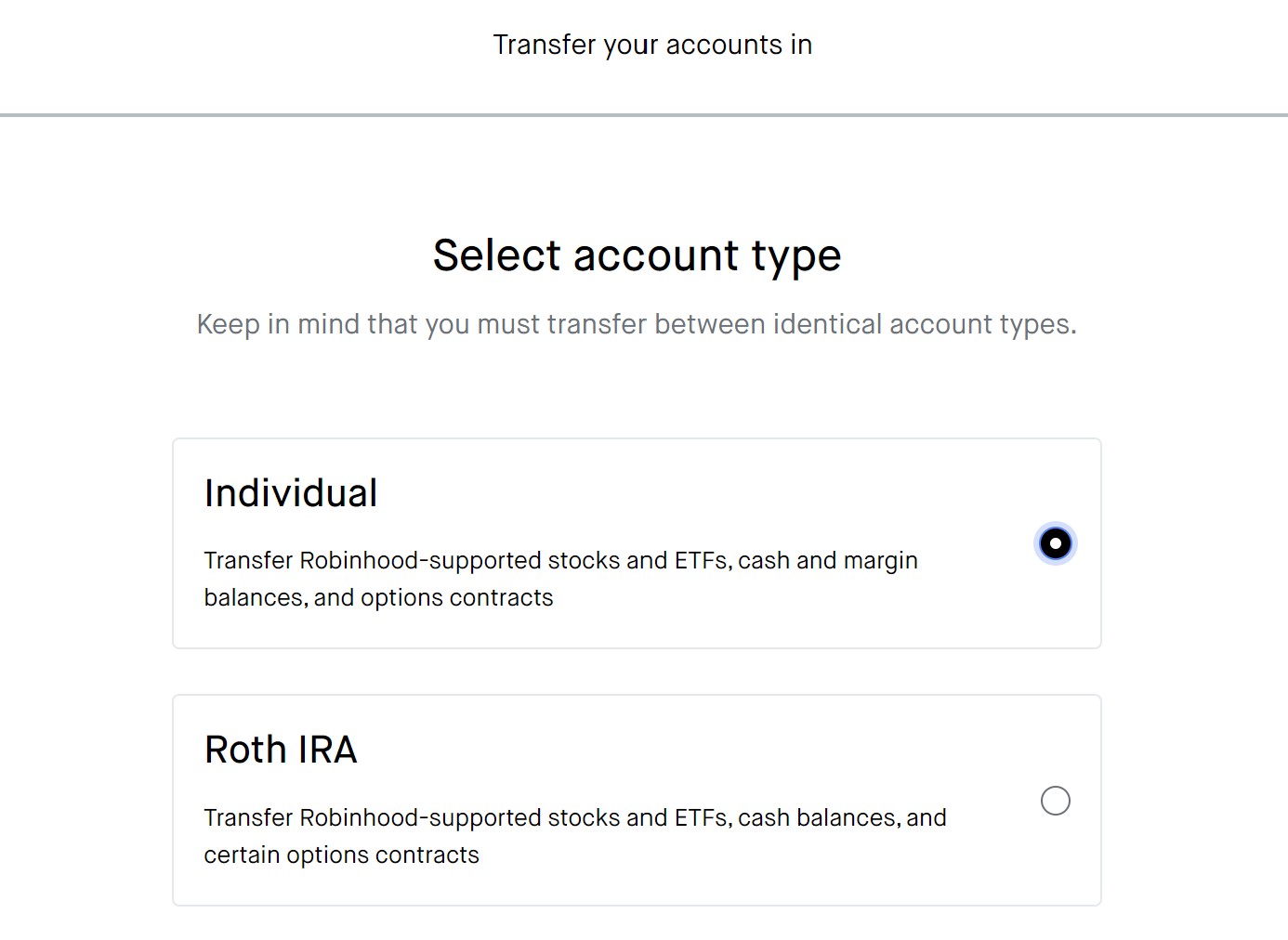

The first step is to tell Robinhood what kind of account you are moving. Robinhood only supports standard brokerage accounts and two types of IRAs.

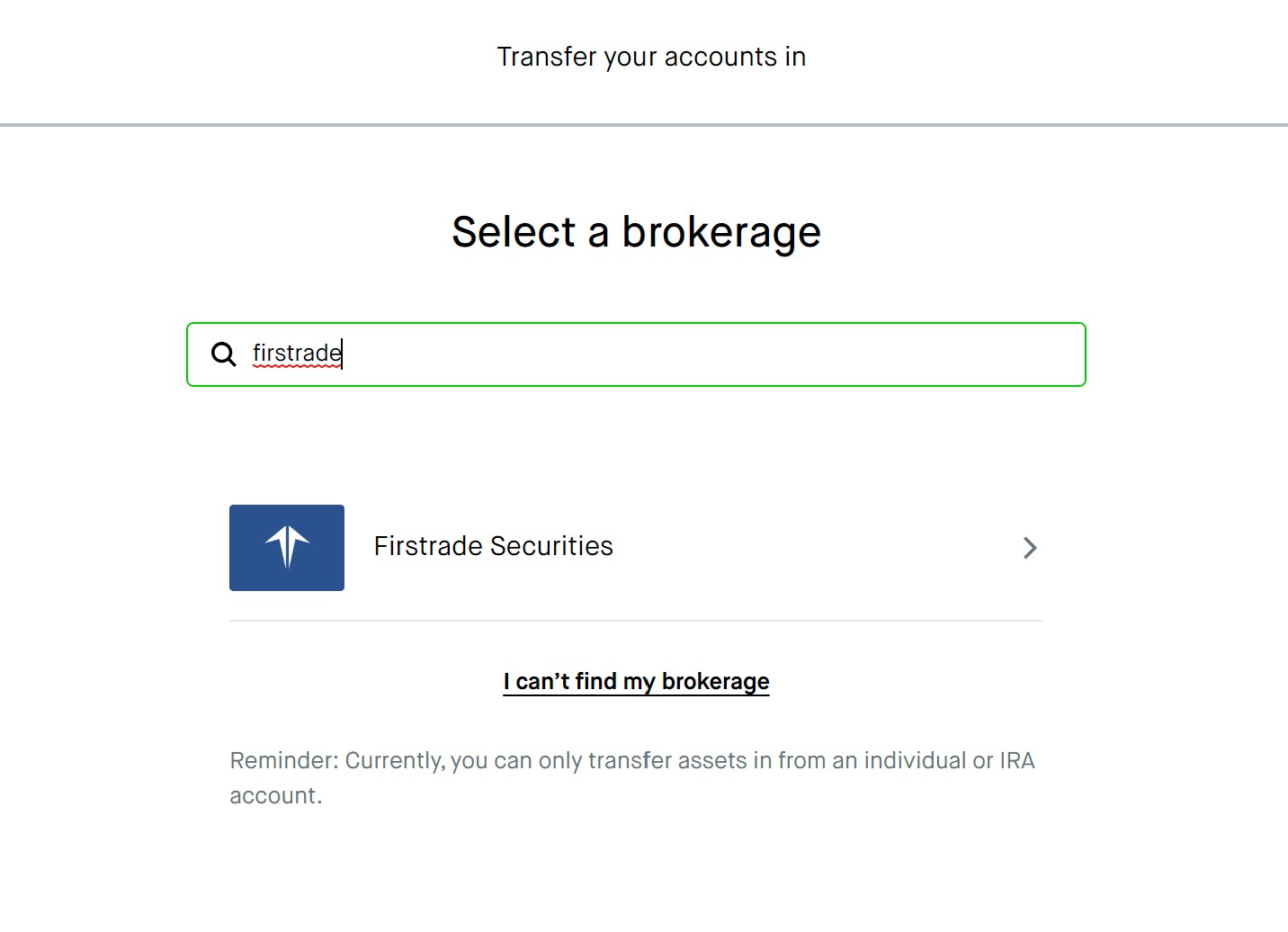

Next, you must enter your account and personal details to connect the two brokerage accounts. Robinhood collects your Firstrade account number and some other details to validate the transfer request with the other broker. You select your broker from the list and then add your ‘other’ broker’s account number when prompted.

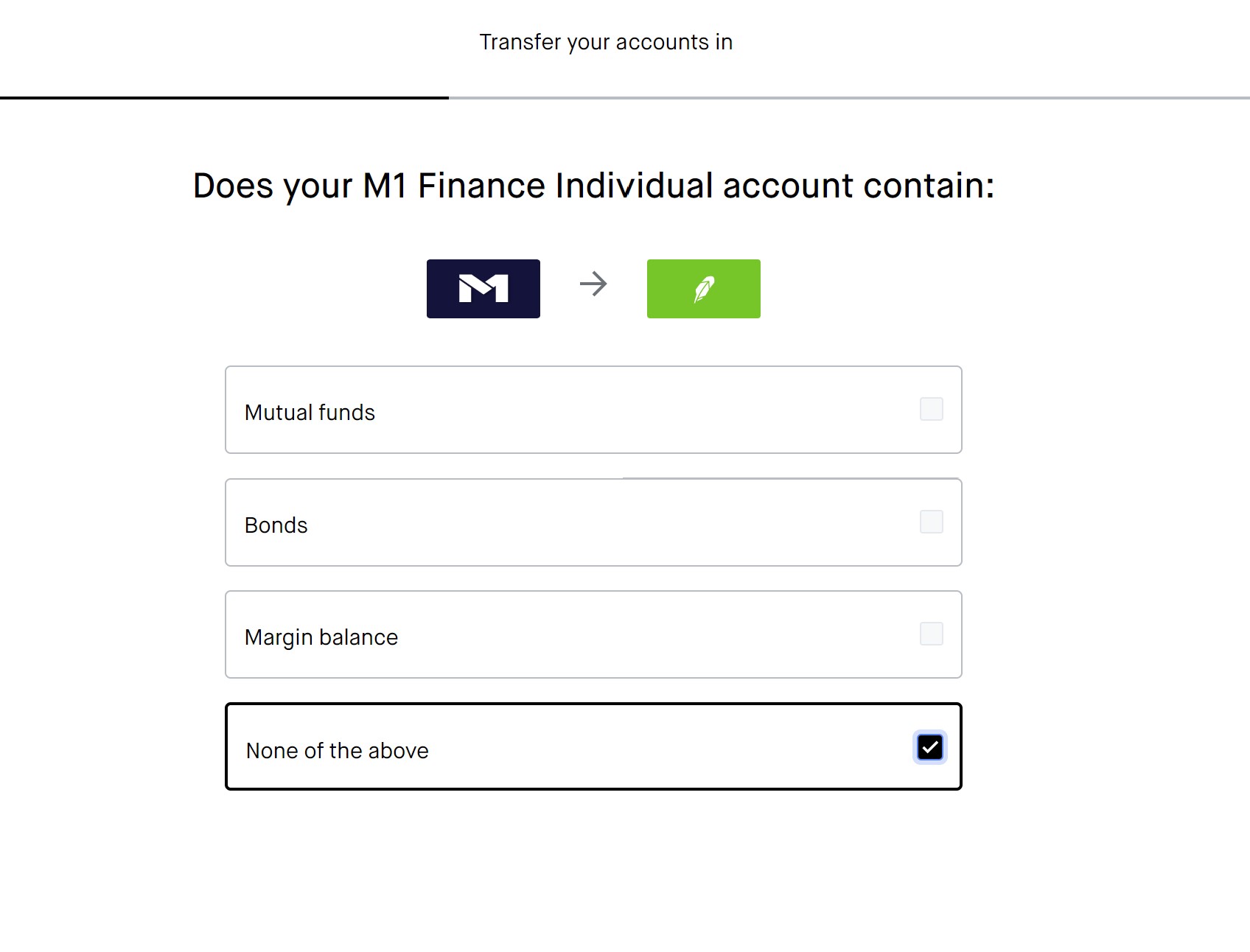

Then, you’ll need to ensure that your securities in Firstrade are transferable.

If you choose any securities that Robinhood does not support, like bonds, CDs, or mutual funds, you can only do a partial transfer. Otherwise, you can select either transfer type: full or partial.

The final steps in the transfer process are to select the transfer type (full or partial), review your request details, and submit your transfer request.

Account Transfer Timeline

Transferring your Firstrade account to Robinhood takes about a week, with the possibility of taking longer in the event of complications.

To expedite the transfer process, you should make sure that your Firstrade account is set up correctly by waiting for transactions to settle fully, liquidating non-supported securities, and resolving any outstanding debts with Firstrade.

Free Robinhood Account

Open Robinhood Account

Transfer Fees

Robinhood does not charge any fees for incoming account transfers.

Moreover, the broker will reimburse the fees charged by Firstrade up to $75. This is a significant benefit because Firstrade charges $75 for full account transfers and $55 for partial transfers.

However, it should be noted that the transfer amount must be at least $7,500 to be eligible for reimbursement.

Eligible Account Types

Regarding eligible account types, it’s good to know that Robinhood's list of account types is a bit short compared to many other brokers (including Firstrade). That means only accounts that match Robinhood's can be transferred. Robinhood only accepts individual cash or margin brokerage accounts, traditional IRAs, and Roth IRAs.

Other account types, such as custodial, joint, business, or trust accounts, cannot be transferred to Robinhood.

Eligible Securities

Not all securities can be transferred when moving your Firstrade account to Robinhood. Robinhood accepts stocks, ETFs, options contracts (with more than seven days before expiration), cash, and margin balances (if enabled in Robinhood).

Assets that are not supported include fractional shares, cryptocurrencies, options expiring within 7 days, unsupported options strategies, mutual funds, bonds, futures, annuities, and other unidentified assets (like OTC Pink sheets and foreign stocks). Make sure to sell any unsupported assets before initiating the transfer.

Promotions

Robinhood offers a free stock valued between $5 and $200 and an ACATS transfer reimbursement:

Free stock up to $200 and 1% IRA match when you open an account.

Robinhood Pros

Moving your account from Firstrade to Robinhood provides various advantages, such as reduced fees and commission rates, a mobile app and user-friendly trading platform, direct access to cryptocurrency markets, IRAs with a 1% match on deposits, and a specialized crypto wallet for Ethereum-based tokens. Generally, Robinhood delivers a more economical and user-friendly trading experience than Firstrade.

|