How to Move a TradeZero Account to Schwab

If you’re not satisfied with the experience you’re getting at TradeZero, with just a little work, you could be trading at Schwab instead. Both broker-dealers participate in the Automated Customer Account Transfer Service (ACATS), which means it’s super easy to move an account from one firm to the other electronically.

Transfer from TradeZero to Schwab

There are a few tasks that need to be completed before the assets from the TradeZero account show up at Schwab. With this simple guide, you can do it:

First Step: Because holdings are transferred and not the actual account itself, the first

task is to open a new brokerage account at Schwab so it can receive the assets. We do emphasize “brokerage” because a bank account won’t work here. An existing brokerage account will work if it has the same name on it as the TradeZero account and is of the same type account type (such as joint or individual).

Besides a self-directed account, it’s also possible to transfer assets into an advisory account at Schwab, including a robo account. However, an automated account can only accept a transfer of cash, so this option would modify some of the transfer work below.

Second Step: After the Schwab account is open and ready to accept a transfer of assets, it must be set up correctly. Typically, there are two tasks in this step: adding options and margin privileges. If either will be coming over from TradeZero, the appropriate privilege must first be added to the Schwab account. Be sure to add the correct options level, too.

Third Step: The same step must be completed at TradeZero, meaning it must be adequately prepared for the upcoming migration. This step may be a little more involved than the second step. Any holdings that Schwab won’t accept must be properly handled. Options that expire in under a week, for example, should not be moved. Schwab also won’t accept positions of cryptocurrencies. Although Schwab does offer trading in OTC stocks, some positions may not be transferrable. It’s best to check with Schwab before attempting to move any over-the-counter securities to verify that specific positions can be transferred in.

Any holding that can’t be moved in should be liquidated, moved into a second TradeZero account, or left behind in a partial transfer. If you’re going into a robo account at Schwab, everything in the TradeZero account will need to be sold off.

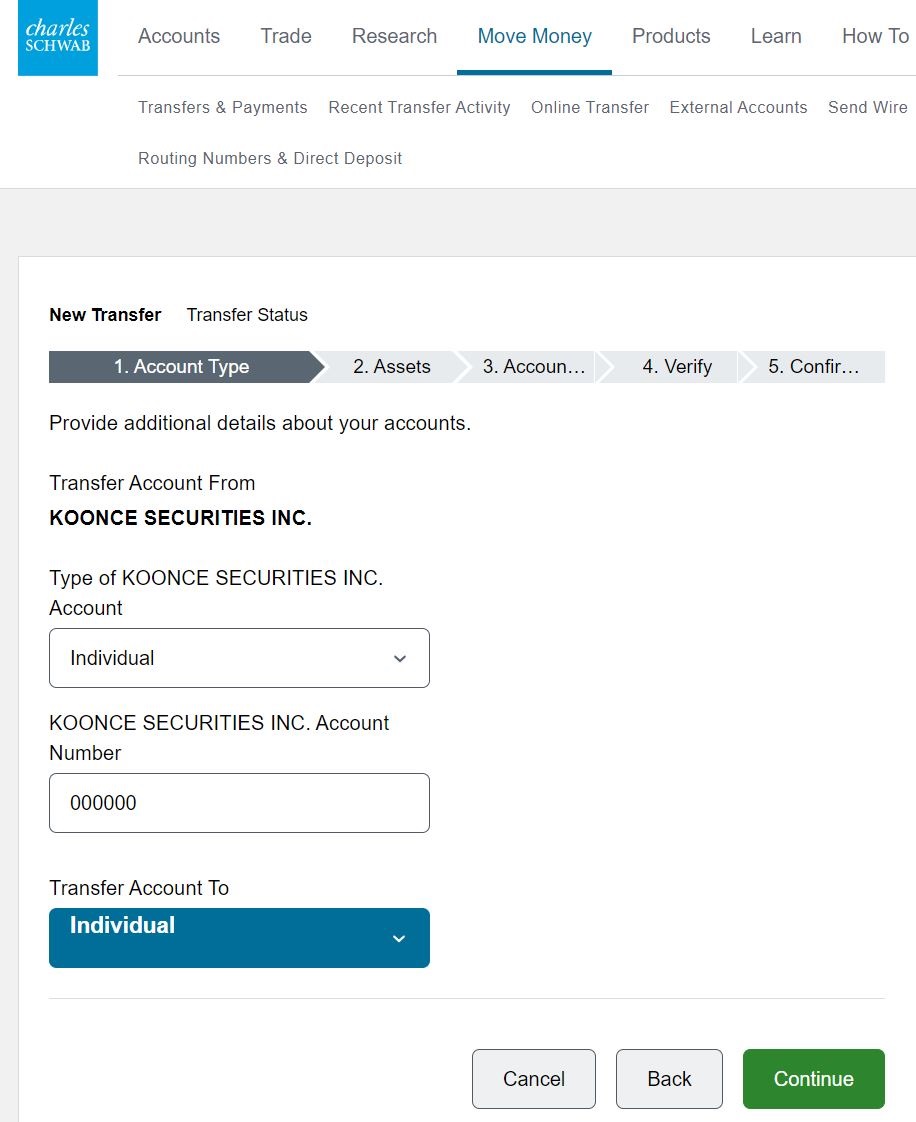

Fourth Step: Now is the time for the actual ACATS request. This should be submitted with the incoming, and not the outgoing, brokerage firm. That is Schwab in this situation. Schwab’s website, but not its mobile app, has a digital ACATS request form, and this is where our journey begins.

To find the ACATS form, click on the tab in the top of the website labeled ‘Move Money.’ In the drop-down menu that appears, select the ‘Transfer Account’ link. The front page of the ACATS form will appear. The first field that needs to be filled in is the outgoing brokerage firm. More precisely, the name that should go here is the clearing firm of the outgoing brokerage house. TradeZero uses Koonce Securities. Type in Koonce Securities and select the link for it that appears. You’ll need to go through and fill in other details, including the account at Schwab to accept the transfer (remember, the account types must match).

Schwab’s ACATS form permits either a full or partial transfer. For the latter type, up to 70 positions can be specified. Any cash balance in the TradeZero account can be moved, and Schwab’s transfer form allows for the entire cash balance to be moved or only part of it.

Once everything has been filled in, go ahead and submit the transfer request. Schwab will notify TradeZero, and the two brokerage firms will take over.

Fifth Step: Monitor the status of the request. Under the ‘Move Money’ tab, Schwab has a ‘Recent Transfer Activity’ link. Click on this to get a list of submitted transfer requests. They will be here for 90 days.

Open Charles Schwab Account

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

Cost of Migrating

TradeZero charges $125 for an outgoing full or partial ACATS transfer. Schwab does not publish an ACATS fee refund, although it never hurts to ask. Schwab does have a current refer-a-friend special. It’s good for up to $1,000. To get any prize, the transfer amount must be at least $25,000, and in all cases, the new Schwab account must be opened through the refer-a-friend link.

How Long Does an ACATS Transfer Take?

Schwab claims a processing time of roughly 1 to 3 weeks for an ACATS transfer, although in our experience, most transfers are completed in less than 2 weeks. Our estimate assumes there are no mistakes made in the digital paperwork.

|