Ally Invest Day Trading Rules in 2024

Ally Invest day trading rules, active trader platform, margin account requirements, buying power

limits, and SEC/FINRA restrictions. Can you day trade on Ally Invest (ROTH) IRA?

Pattern Day Trading at Ally Invest

If you do not have $25,000 in your account at Ally Invest but still wish to day trade, we will show you how. You can in fact day trade as much as you desire by legally avoiding this rule.

How Many Day Trades Does Ally Invest Allow?

If you are in the United States, account holders must have a minimum of $25,000 in their account that they wish to day-trade with, unless they qualify for an exemption. This is not a rule made up by Ally Invest; in fact, it is a policy that is industry wide and is in place from financial regulators, not the companies themselves. Because Ally Invest is required to implement this rule, Ally Invest customers who wish to day trade will need to follow this regulation.

The definition of a pattern-day-trading account is simple:

- The account must place 4 or more round-trip day trades of stocks, options, ETFs, or other securities in a single trading week (or other 5-business-day duration).

- The account must be a qualified margin account.

- The total number of day trades must amount to at least 6% of the account’s total trades overall.

If your account does not meet all three of these attributes, it is not a pattern-day-trading (PDT) account, and therefore you do not have to deposit $25,000.

General Strategy

The PDT rule is often viewed as a nuisance by most traders, but there are several loopholes that exist to get around it. In fact, it is totally legal to structure your trading to avoid meeting the strict definitions of pattern day trader. If you structure your trades in a manner so as not to meet the qualifications, Ally Invest will not make you deposit $25,000 in your account.

Ways to Bypass the PDT Rule

The first method to avoid meeting the attributes of a pattern day trader is to

open a cash account as opposed to a margin account. Recognize that to be defined as a PDT, you need to have a margin account, so if you only have a cash account, you will not meet the definition.

Be aware that if you do decide to go this route and place all your trades using a cash account,

you will not be able to trade with unsettled funds, and it typically takes two business days after the trade date for your funds to settle. If you were to sell a stock on Thursday, your funds would not be available to trade with again until Monday of the following week.

Another method to get around the PDT regulation is to only make 3 or fewer trades each week.

Since the regulation defines PDT as 4 or more trades and resets every 5 business days, you would be able to freely trade 3 times without triggering the regulation.

Finally, you could also get around the PDT regulation by maintaining the number of day trades you

perform to less than 6% of all your trading activity in the account. This would likely require you to do a lot of standard trading, so it is unlikely that this will be a viable option for most traders.

Day Trading on Ally Invest

For day trading, Ally Invest may not be the most popular of brokerage firms. But it does offer some basic tools and a decent commission schedule. Let’s check it out.

Ally Day Trading Platforms

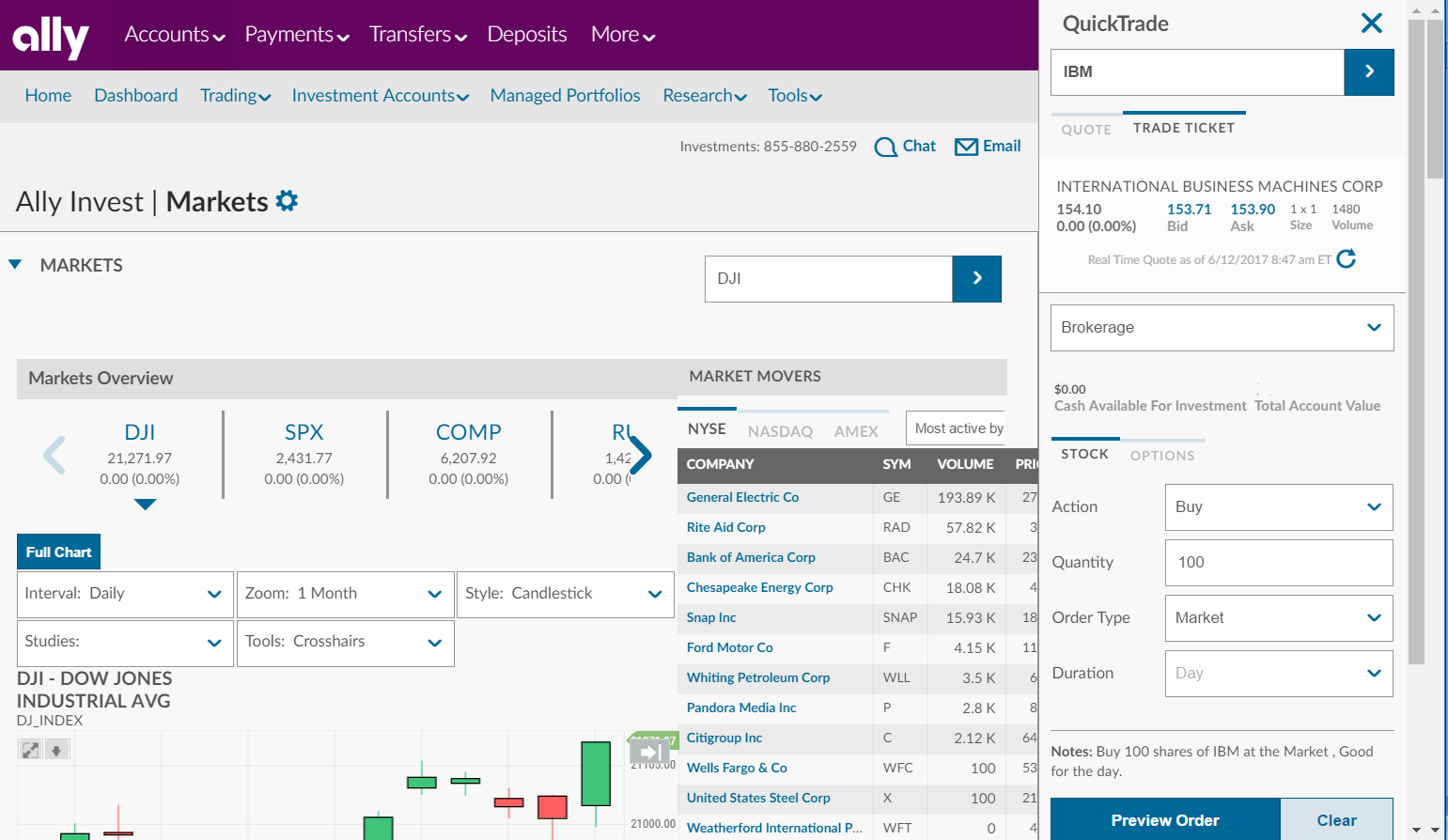

Ally Invest LIVE is the broker’s browser platform. It is able to provide real-time data on stocks, ETF’s, and options. The software’s order ticket provides market, limit, stop, trailing, and market-on-the-close orders. Unfortunately, the platform doesn’t provide Level II quotes or direct-access routing.

Charting offers many technical studies. We counted about 100 of them. Some of the available choices include Alligator, Keltner Channel, and Price Oscillator. The smallest timeframe available is one-minute intervals. Five-minute intervals can be selected as well. Display styles include bar, candle, and volume candle.

The order form on LIVE can be placed directly to the right of a chart so that an order can be placed quickly while monitoring price action. Right-click trading is not possible, although a trade button is in the upper-right portion of the platform.

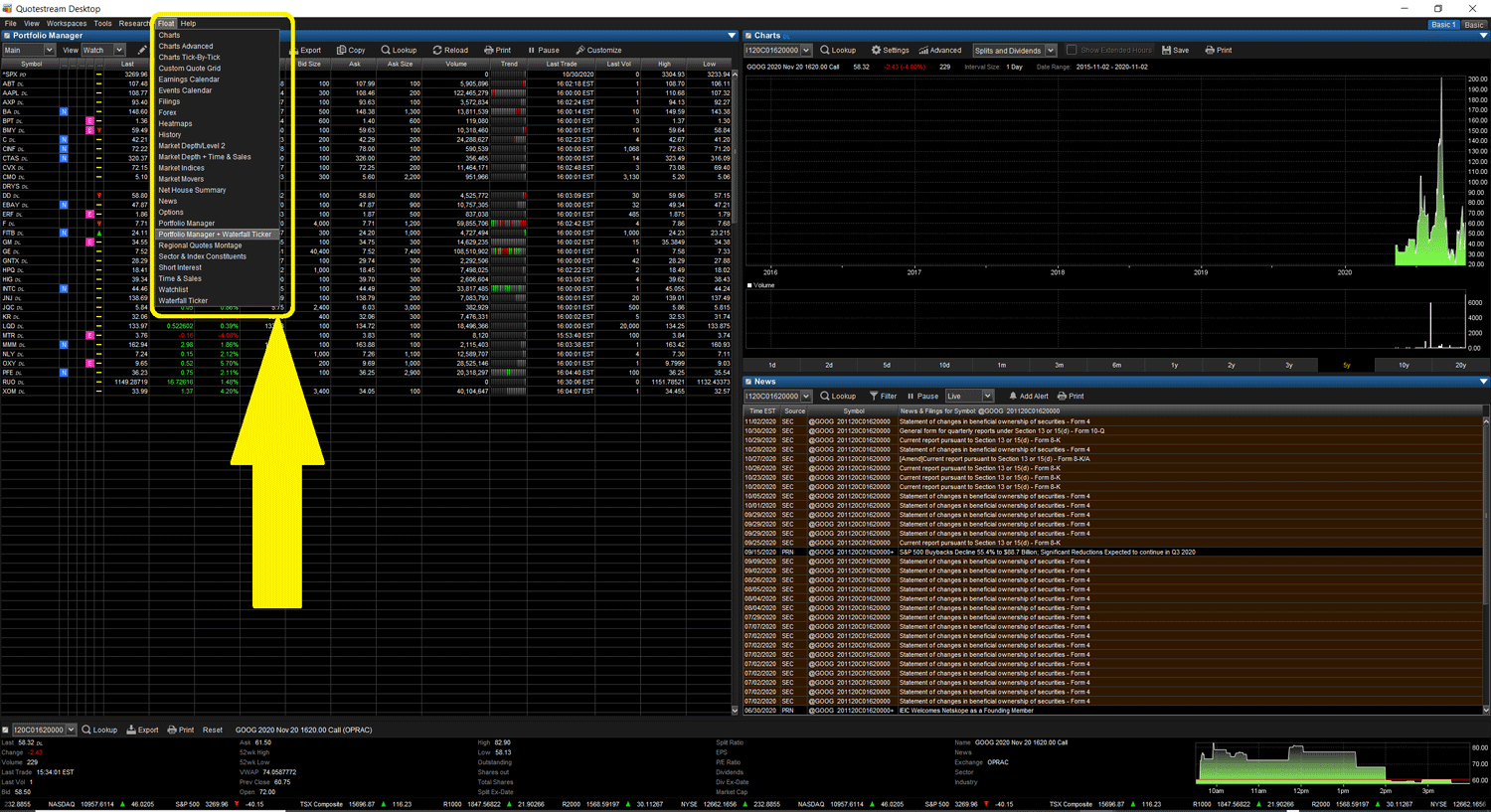

The broker’s desktop software Quotestream is available to active traders (defined as a minimum of 30 or more trades per quarter, or $100,000 in assets). The software does have Level II quotes, so obviously this is an important advantage over LIVE for day traders. Another great feature is tick-by-tick price history on a chart.

The third platform available to Ally’s day traders is the broker’s forex platform. This desktop software offers stop, limit, market, and contingent orders (such as OCO and if/then orders). Charting comes with technical indicators, and dealing boxes provide trading capability. A close button makes closing a position quick and easy. The forex arm of Ally currently offers over 50 currency pairs, and traders get 50:1 leverage.

Besides its own software, Ally also provides MetaTrader 4 to its forex customers. A forex mobile app is available, too.

Although trading is possible on Ally Invest’s website, it’s not possible to trade currencies.

Commission Schedule

Ally Invest does not charge commissions on forex trades. Instead, it is compensated by the bid-ask spread, which can vary day to day.

As for stocks and ETF’s, the trade fee is $0. Options are 50 cents.

Ally Invest does not charge any account fees. Securities accounts have no minimum deposit requirement, while currency accounts

require $50 to begin.

Better Broker For Traders

For active traders, a better alternative broker is

Charles Schwab.

It has a number of advantages over Ally Invest: virtual and futures trading,

more products, and advanced trading platforms.

Charles Schwab Website

Open Schwab Account

Ally Day Trading Judgment

Ally Invest does a decent job delivering day-trading services and software. Better packages are out there for the most demanding of

day and swing traders, however.