M1 Finance IRA Promotion For 2024

M1 Finance IRA (ROTH and Traditional) promotions, cash bonuses, special offers for

opening a new taxable brokerage or retirement account.

|

M1 Finance IRA Promotion

Open M1 Finance Account

M1 Finance IRA Promo #1 – Deposit Bonus

M1 Finance is giving its customers two different bonuses to take advantage of. You will get a cash bonus of up to $250 for depositing funds in a new account, or up to $500 for transferring a brokerage account to M1 Finance.

The first bonus that we will talk about is the deposit bonus. Simply by funding a new brokerage account, you can unlock a cash payout of up to $250.

Here is everything you need to know to access the M1 bonus.

M1 IRA Deposit Bonus Details

When you open a new brokerage account at M1 Finance, you’ll need to make a deposit of at least $5,000 to trigger the bonus. To get the full payout, you will need to make an ACH deposit of at least $50,000 within the first two weeks of the account.

The size of the bonus is dependent on the deposit amount. M1 Finance uses a tiered bonus schedule to decide how much cash to award to new account holders.

Here is the tier schedule.

Eligible Accounts

To get the deposit bonus, you need to open an M1 Invest account. Non-taxable account options like the retirements account option are not eligible for this bonus.

M1 IRA Promo Terms and Conditions

M1 Finance will deposit your bonus directly into your investment account.

New invest account deposits must be made with the ACH deposit method.

To take advantage of the M1 Invest deposit bonus, you cannot be a current or returning customer. The bonus is intended for investors new to M1 Finance.

M1 Finance IRA Promotion

Open M1 Finance Account

M1 Bonus #2 – ACAT Transfer Bonus

The other promotional offer currently on the table is the account transfer bonus. To access this payout, all that is required is transferring a brokerage account to M1 Finance using the automated account transfer service.

Here’s how it works.

M1 Transfer Bonus Details

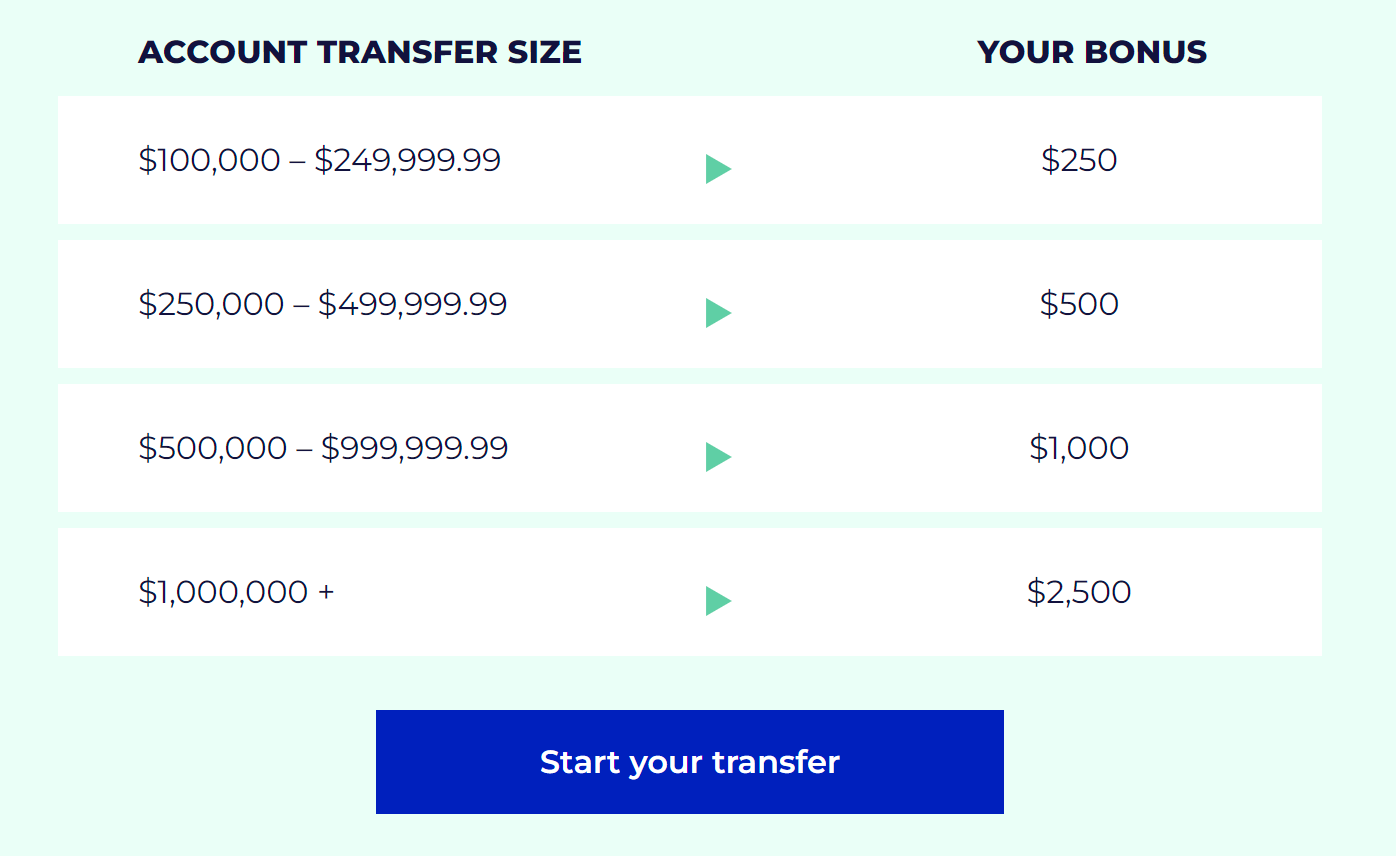

M1 Finance is giving out up to $10,000 for account transfers. The account transfer bonus makes a much larger cash payout available, but it takes a larger financial commitment to trigger it as well.

That may be easier than many think, however, because you do not need ‘new money’ to fund your account. All that is required is to transfer your brokerage account over to M1, and you’ll receive a healthy bonus in the process.

By using the M1 Finance ACAT transfer tool, you can complete the application to transfer a partial or full investment account in a matter of minutes.

ACAT transfers usually complete within 7 days of the initial application, though the process can take a bit longer if there are any complications or requests to transfer assets that are either unsettled or unsupported.

As with the new account deposit bonus, the ACAT bonus is also given out based on a tiered schedule. The minimum amount required for this bonus is $100,000. To receive the full bonus amount, you will need to transfer a brokerage account with at least $1,000,000 in cash and assets.

Here is the ACAT transfer bonus payout schedule.

M1 IRA Promo #2 Terms and Conditions

ACAT Promotion is valid until December, 31, 2024.

This bonus is only available to new customers.

Only ACAT transfers can make up the minimum funding amount. It is not possible to use the ACAT method in addition to other funding methods.

The account transfers must be completed within the first 60 days of opening the new account.

Only the M1 Invest account is available for this bonus. Retirement accounts are not eligible.

Cryptocurrencies cannot be transferred using the ACAT system. If you have digital assets in the account that you are transferring from, you will need to either liquidate them and transfer the proceeds once they have settled or do a partial ACAT.

The account transfer bonus is paid 150 days after the new account is opened.

Reasons to Choose M1 Finance

If you are on the fence about either opening a brand-new brokerage account or transferring an existing one to M1 Finance, here are some reasons that investors enjoy their experience with the broker.

First, M1 Finance presents its take on an ‘all-in-one’ solution for investors. There is a brokerage account available, retirement account, cash management (like a checking account), and a chance to borrow money from M1 using your own assets as collateral.

M1 also offers some portfolio automation (with M1 Plus) that helps investors stay on track with their big-picture goals and strategies.

In addition, you can trade fractional shares of all available U.S. exchange-listed stocks, ETFs, and ADRs.

Commissions and fees are free and margin rates are lower than many of the other popular brokers available, including names like Vanguard, Schwab, and Fidelity.

M1 Finance IRA Bonus

Open M1 Finance Account

|