Ally Invest IRA Review

In addition to taxable brokerage accounts, Ally Invest has a list of tax-deferred accounts, one of which is the Individual Retirement Account. This article will examine the broker’s IRA service.

Ally IRA Types

Ally Invest offers Roth and Traditional IRAs. There are no other IRA types available, such as Minor IRAs or small business accounts. It is possible to roll over a previous employer’s retirement plan. Possible targets include 403(b) and 401(k) accounts.

Investment Programs For Ally IRA

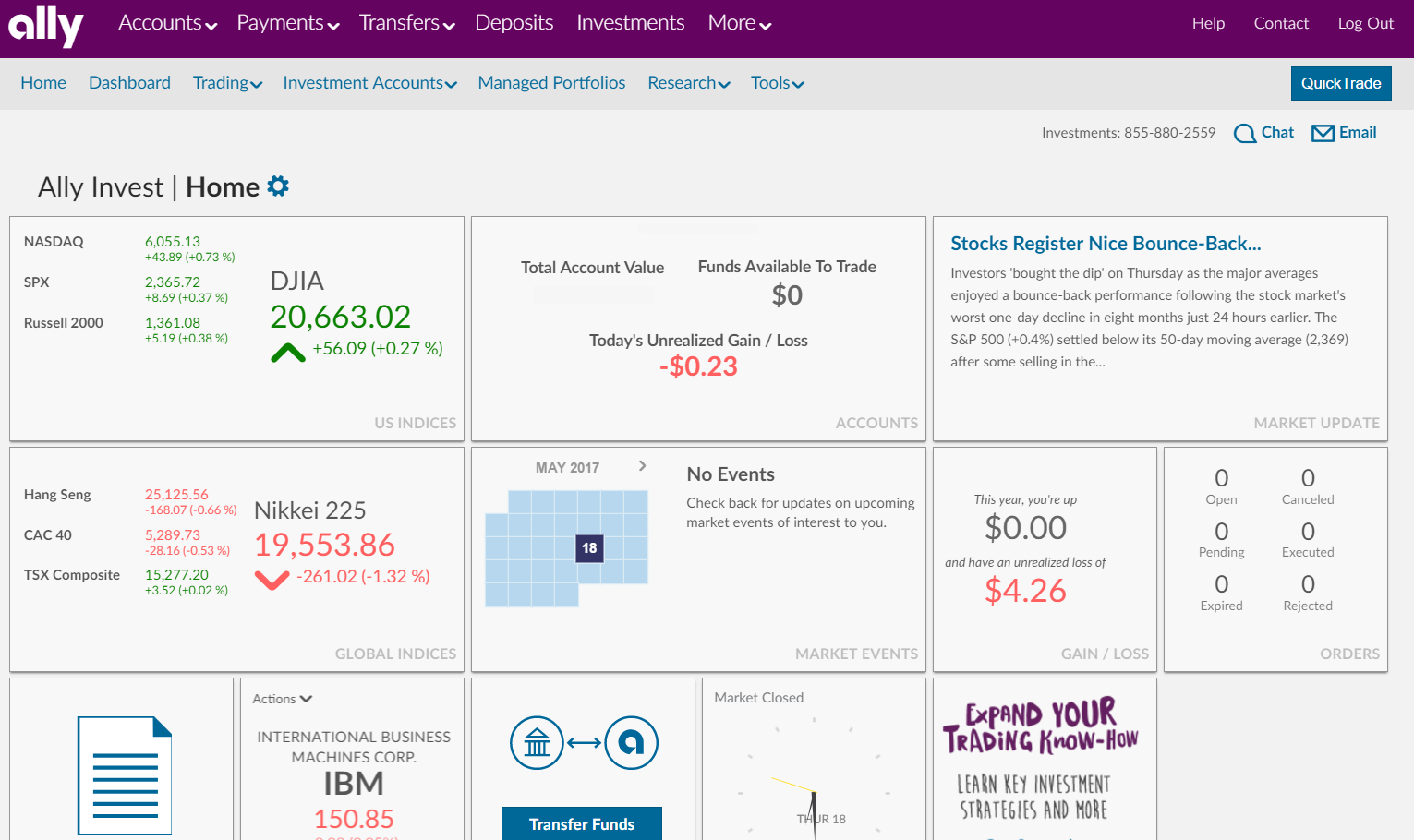

An IRA with Ally Invest can be opened in either self-managed or advisory mode. The latter is available in either robo or Wealth Management format.

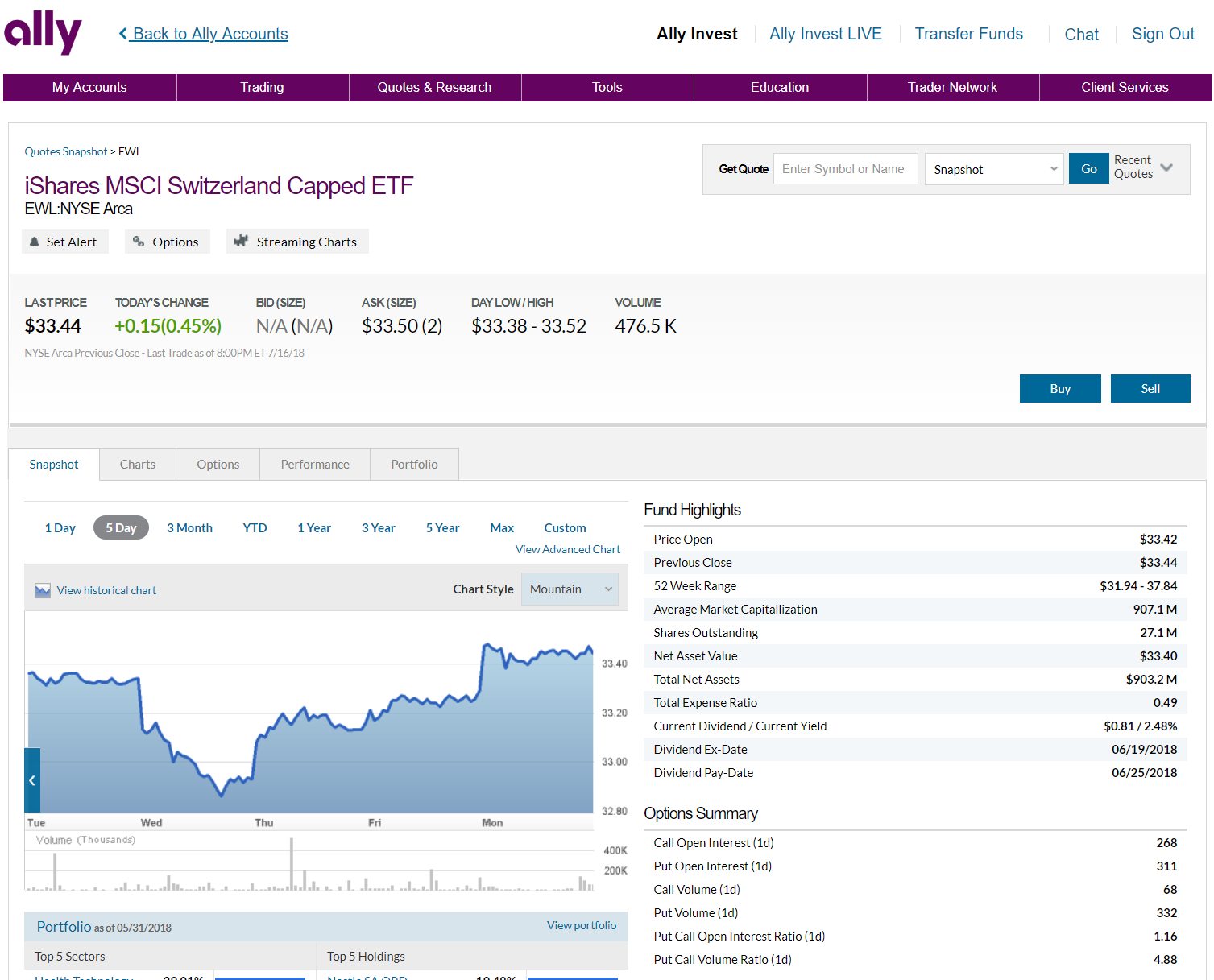

A self-directed IRA will have the largest selection of tradable assets. These include stocks, options, mutual funds, bonds, ETFs, and closed-end funds. Although Ally Invest does offer forex trading, an IRA is not eligible.

A robo IRA will automatically be invested in a selection of ETFs with low expense ratios. The Wealth Management service is a traditional program that delivers both account management and investment guidance through a human financial planner.

Opening an IRA at Ally

It’s easy to open an IRA with Ally Invest on the company’s website. Just look for the blue “Get Started” button. As you go through the required steps online, make sure you specify IRA and the mode you want (robo, self-directed, or Wealth Management).

A robo IRA requires a few questions to a short questionnaire in order to set up the automated program. A results page will show the specific funds the account will have with their target percentages. A self-directed account requires less time because there’s no questionnaire.

In order to open an IRA under the Wealth Management program, a phone call with an advisor is required. This phone call is scheduled on the website.

Ally IRA Fees and Expenses

There are no fees to open an IRA and no fees to maintain it, either. Ally Invest does have an IRA closeout fee. It is $25.

A retirement account at Ally Invest is subject to the same pricing schedule as other account types. This means self-directed accounts pay no commissions on most online trades of stocks and ETFs. Penny stocks are subject to a commission ($4.95 plus 1¢ per share).

Robo accounts pay 0.30% or 0.00%, depending on the cash position chosen. And the Wealth Management services starts at 0.85% and goes down for large balances.

Self-Directed Investments

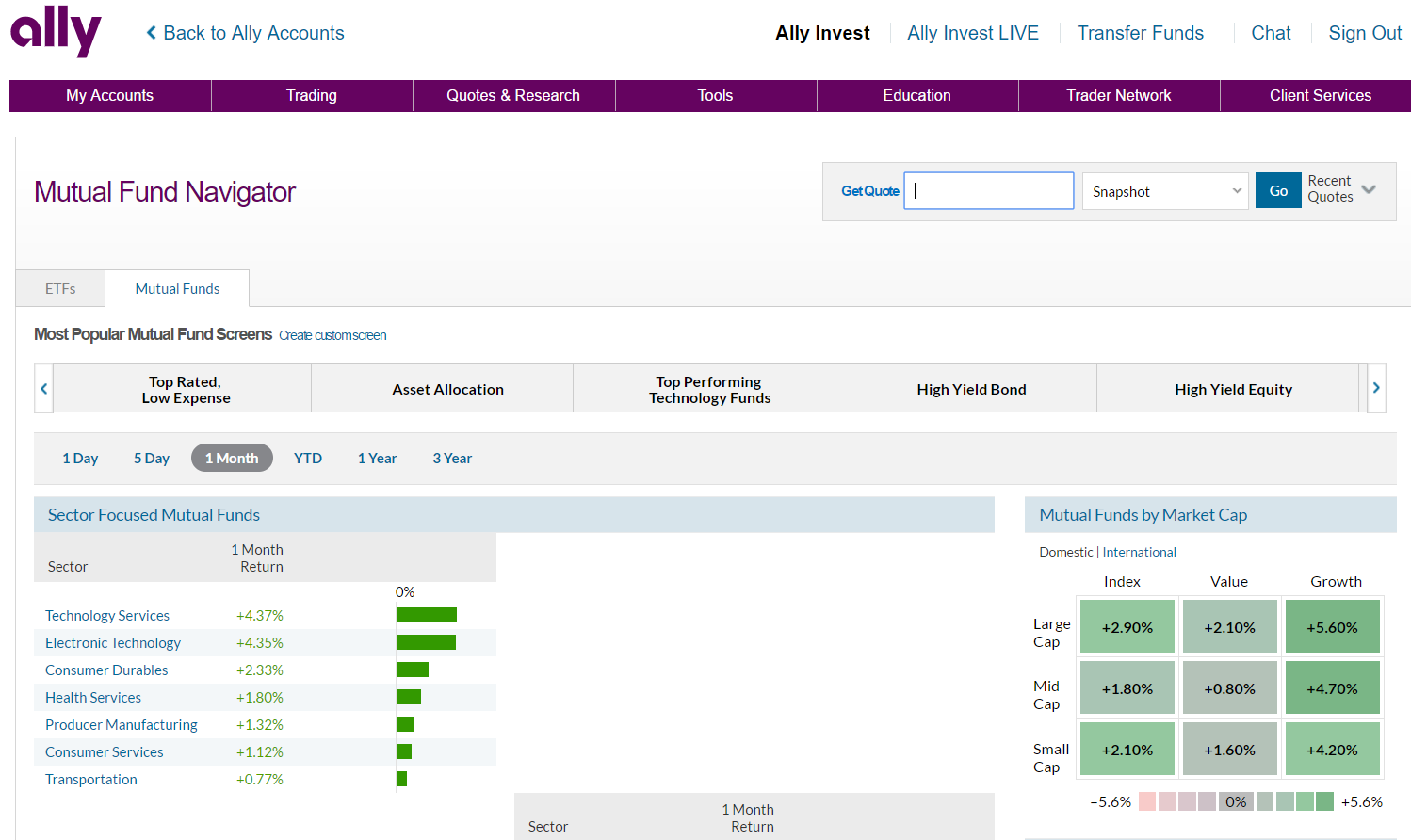

The investment advisor, either digital or human, will select the assets for IRAs at Ally Invest. Self-directed customers don’t have this luxury. However, Ally Invest does offer various assets that IRA accounts will want to take a look at.

These include target-date mutual funds that are designed for retirement planning. We found 1,095 of these funds (look for “Mixed-Asset Target” and “Retirement Income” check boxes under the Fund Classification section on the mutual fund screener).

Ally Invest charges no transaction fee on mutual fund trades.

Ally IRA Education

Ally Invest, through its affiliation with Ally Financial, offers a small selection of educational materials in the form of articles and videos (look for the Education tab in the top menu on the website).

Many of these focus on banking and personal finance, although some are devoted to investing. The investing topics don’t always focus on retirement issues, although some of them will apply to IRA holders. Examples we found include:

- How to Invest in Bonds 101

- Generating Retirement Income with Options

- How to Build a CD Ladder

- Questions to ask when choosing a financial advisor

Best Ally Alternatives

Ally Bank IRAs

Ally Bank offers Individual Retirement Accounts that are FDIC-insured deposits. These deposits can be in the form of CDs or savings accounts. One notable advantage is that the SEP IRA is available on the banking side (along with Roth and Traditional accounts). An IRA with Ally Bank is easily linked to a brokerage account with Ally Invest. A single login accesses accounts from both sides.

Ally IRA Review Judgment

Ally Invest has a decent IRA service. Its greatest strength seems to be in up-front pricing across three investment platforms (robo, self-directed, and Wealth Management). Nevertheless, the notable weaknesses—the IRA termination fee and lack of IRA calculators and other tools—tend to detract from the service. There are more thorough IRA programs out there with fewer fees and more resources.

Updated on 1/30/2024.

|