|

Wellstrade/Wells Fargo vs Robinhood in 2024

Robinhood versus Wellstrade Wells Fargo which is better? Compare IRA/Roth accounts, online trading fees, stock broker rates.

|

Introduction

Robinhood and WellsTrade are two brokerage firms with very different offerings and emphases. They attract different types of traders and their commission schedules

vary widely in some areas. Let’s take a detailed look at these two companies and see if one is better—Robinhood or Wells Fargo.

Pricing

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Robinhood

|

$0

|

na

|

$0

|

$0

|

$0

|

|

Wellstrade

|

$0

|

$35

|

$0.65 per contract

|

$0

|

$0

|

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

Robinhood

|

|

|

|

|

|

|

|

Wellstrade

|

|

|

|

|

|

|

Promotions

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

WellsTrade:

Open a Wells Fargo investment account.

Research and Education Tools

WellsTrade clients have access to market news and commentary on the broker’s website. Articles written by Wells Fargo investment advisors can be downloaded in pdf format free of charge. Prices are shown for a variety of indexes and commodities. Effective screeners can search for securities offered by the firm. Morningstar stock reports are available at no cost.

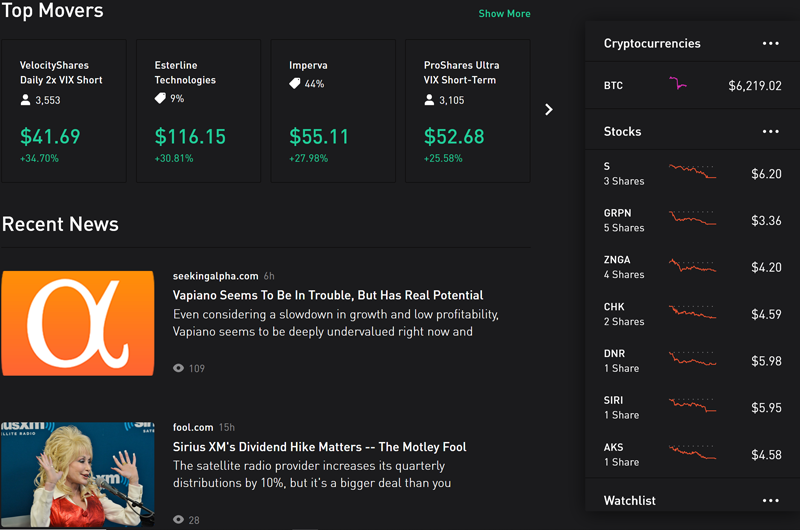

Traders at Robinhood have fewer materials. There are several FAQ’s on Robinhood’s website. But most of these cover issues regarding opening and maintaining a brokerage account. There are very few resources on the website devoted to security research or education. Limited stock research is available on the Robinhood mobile app.

WellsTrade wins the first category.

Trading Tech

The Robinhood website isn’t designed for trading. There is information about trading with the

broker, but there is no trade bar. The website is used primarily for account applications and

marketing. There is also no desktop platform.

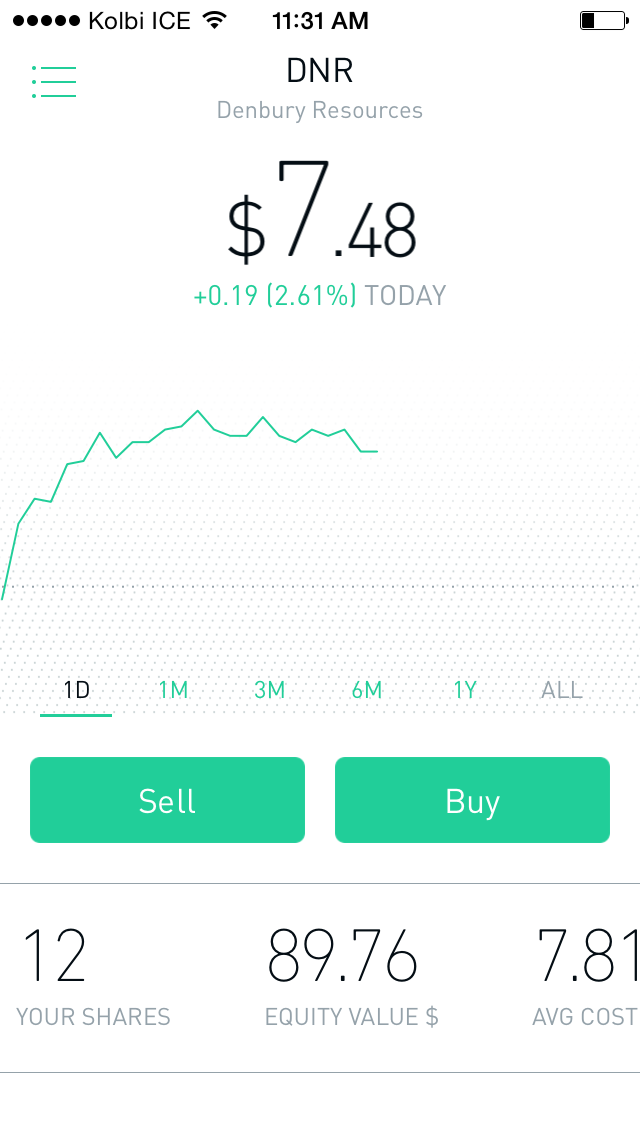

Trading and security research take place on the broker’s mobile app. Charts are available here, but they are very rudimentary. There are no technical studies or drawing tools. Line format is the only chart style available. Security research is provided, but the amount of information is very limited. There is also a Robinhood app for Apple Watch.

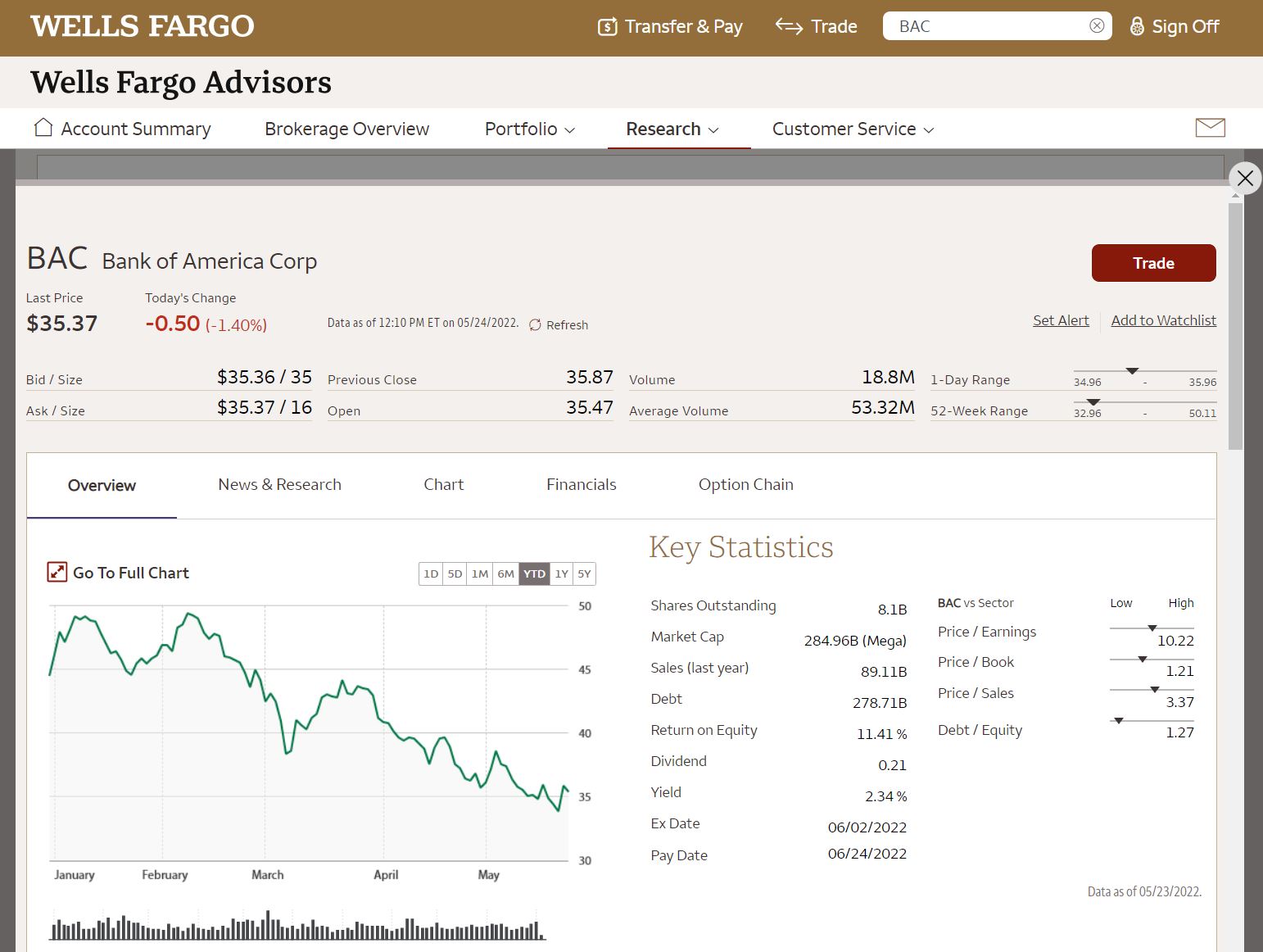

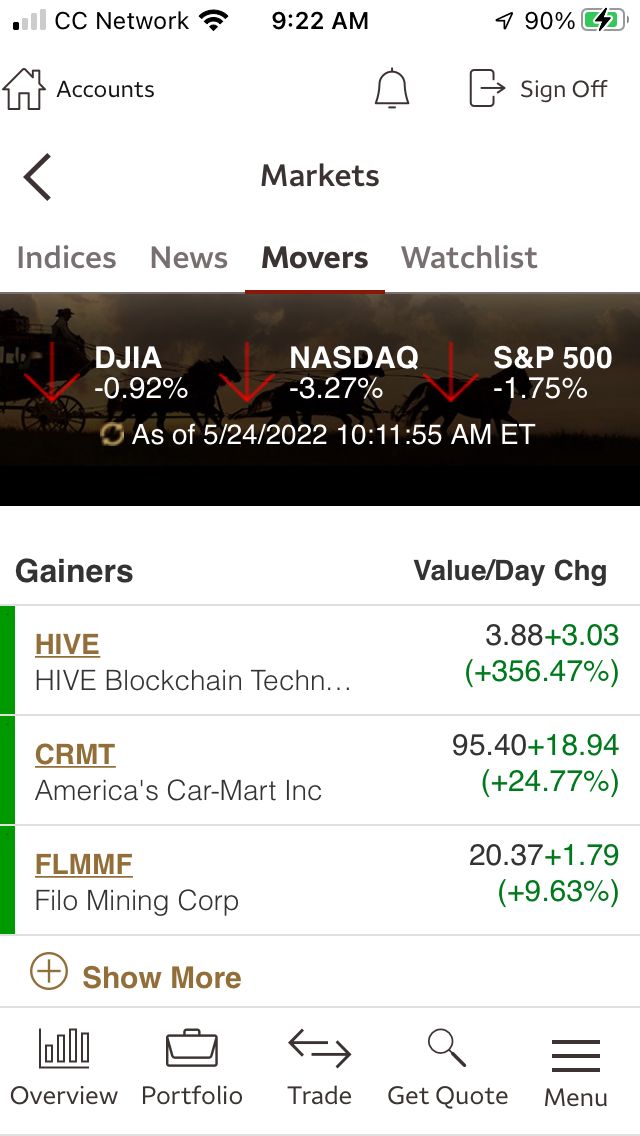

WellsTrade’s site is designed for security research, charting, and order placement. The broker does not provide a trade bar or desktop platform. Charting on the website has technical studies and comparisons. There are some drawing tools, although a chart cannot be displayed full screen.

Although WellsTrade doesn’t have a platform for Apple Watch, it does provide a mobile app for Android and Apple phones and tablets. There are options chains (which the Robinhood app doesn’t have) along with charting and market news that is relevant to a particular stock. Orders can be submitted for mutual funds on the broker’s app as well.

WellsTrade is clearly the better choice here.

The Cost of Trading

Robinhood has challenged the entire brokerage industry by offering free stock and ETF trades. That’s right, the company charges $0 for every stock and

ETF transaction, and it doesn’t impose any limits on the number of trades customers can place.

The broker makes money on customers' uninvested cash and by charging its clients for other services, such as margin rates, trade confirmations

($2 each) and printed statements ($5 each). Regulatory and exchange fees for sales are also passed onto the trader, although these surcharges are very

small.

Robinhood does not impose any monthly or annual fees. There are also no surcharges for low balances or inactivity. The broker does not require any deposit amount to open a brokerage account.

Trading at WellsTrade stocks and ETFs costs $0 per transaction.

Option contracts

are $0.65 each. Bonds (which Robinhood does not offer) are priced on a markdown/markup basis. One

exception is fixed-income from the U.S. Treasury, where the broker charges $50 for each order.

Like Robinhood, WellsTrade does not have a minimum opening deposit requirement. The broker does impose a $30 annual fee per household, but it can be eliminated by signing up for e-delivery of account documents. Tax statements are exempt.

Robinhood wins its first category.

Mutual Funds and ETF’s

Besides the securities already mentioned that Robinhood doesn’t offer, mutual funds are another product investors won’t find at the broker. They are not available at any price.

WellsTrade does offer mutual funds, and its screener returns nearly 10,000 of them. Over 2,500 come with no transaction fee and no load. Some of the mutual funds are Wells Fargo funds. There is a $35 transaction for non-NTF funds. There is no short-term redemption fee at WellsTrade.

Exchange-traded funds are available at both brokers and are free to trade.

The lack of any mutual funds at any price is a major flaw with Robinhood. This category must go to WellsTrade.

Cash Management

Wells Fargo, the parent company of WellsTrade, is a very large financial institution. Even so, banking features at WellsTrade are not spectacular. A brokerage account doesn’t not have any cash management features by default. Customers who wish to add checkwriting privileges and a debit card will have to pay $100 per year.

Robinhood pays 0.50% annual percentage yield (APY) on your cash. It also offers paycheck cashing,

paying bills, and checking. Robinhood's Mastercard debit card is accepted in 75,000+ ATMs fee-free.

Robinhood is victorious here.

Managed Accounts and Financial Advice

Investors who need in-person financial advice or otherwise want to hire someone to manage their assets can find assistance at one of Wells Fargo Advisors’ many locations throughout the U.S. Of course, there is an additional fee for this support. But it’s better than Robinhood, who offers nothing in this area.

WellsTrade wins once again.

Customer Support

A WellsTrade representative is available over the phone 24/7. The broker’s website has a messaging feature, but there is no on-line chat.

Robinhood offers customer service only during the weekday during trading hours. The broker’s phone number isn’t toll free, and the Robinhood mobile app has a messaging feature.

WellsTrade seems like the better option here.

Promotions

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

WellsTrade:

Open a Wells Fargo investment account.

Wells Fargo vs Robinhood Summary

Five categories were won by WellsTrade, and Robinhood succeeded just twice. WellsTrade

is the victor. Free equity trades are available at Robinhood,

but there isn’t much else.

|

Open Account

|

Open Account

|