|

TIAA Review: Is It Safe, Legit, or a Scam? TIAA Complaints in 2024

|

Is TIAA Safe?

If you are wondering if TIAA is a safe financial services company, the quick answer is yes. The Teacher’s Insurance Annuity Association (TIAA) opened its doors in 1918 and has been a trusted provider of various financial services ever since.

To learn more about why TIAA is considered safe, please keep reading.

If you are a teacher, academic professional, government employee, medical professional, or involved with a non-profit organization, you’ve likely heard about the popular financial services company. Popularity doesn’t always equal trustworthiness, however. It is good to do your homework to ensure your money and interests are well cared for.

There are several places we can look to see if TIAA is a safe place to save and invest your money. Customer experience reporting and the company’s adherence to regulatory standards offer the clearest examples.

Another way to see how much you can trust a broker is by looking at how the company deals with customer complaints and concerns.

Is TIAA Legitimate?

TIAA is registered with the Financial Industry Regulatory Authority (FINRA) as a broker and an investment adviser firm. The company is also registered with the Securities and Exchange Commission (SEC). In the U.S., financial services companies must be FINRA and SEC members. Otherwise, they cannot operate.

FINRA and SEC both impose rules and regulations that must be followed. The rules that govern financial institutions are put in place to safeguard investors and brokers. When working with a broker that adheres to those rules, you can be sure that security measures are in place to keep your personal information and accounts safe.

Regulatory bodies also ensure that investment opportunities are safe and that brokers cannot take advantage of their customers.

Is TIAA FDIC Insured?

Each financial service that TIAA offers comes with some form of insurance. Banking services, including cash management features and cash sweep, are covered by FDIC. SIPC protects TIAA’s brokerage services.

TIAA is well known for its retirement and banking products. Anyone holding a money market account, a checking account, a savings account, a trust, or a WorldCurrency CD, gets the benefit of FDIC coverage.

FDIC covers up to $250,000 for each account an investor has open. If you have one checking account, a quarter million of your funds are covered. Your protection goes up to half a million if you have a checking and money market account. The more banking services you use, the more coverage you receive.

Is TIAA SIPC Insured?

SIPC insurance is used for accounts designated for investing. Brokerage accounts, annuities, and similar accounts that cannot be covered by FDIC. SIPC kicks in if any broker-related issues impact customer accounts.

Each brokerage account is entitled to $500,000 worth of coverage. SIPC is designed to cover securities, but half of the allowable amount can also be used for cash balances.

Customer Protection Policy

In addition to following industry regulations and ensuring customer accounts are insured, TIAA also provides users with a guarantee.

TIAA’s customer protection guarantee states that it will reimburse customer accounts for any loss incurred from fraudulent activity. TIAA will ensure its customers do not suffer any financial loss if an account gets broken into.

In addition to reimbursements for compromised accounts, TIAA also monitors customer credit health and helps with identity theft issues.

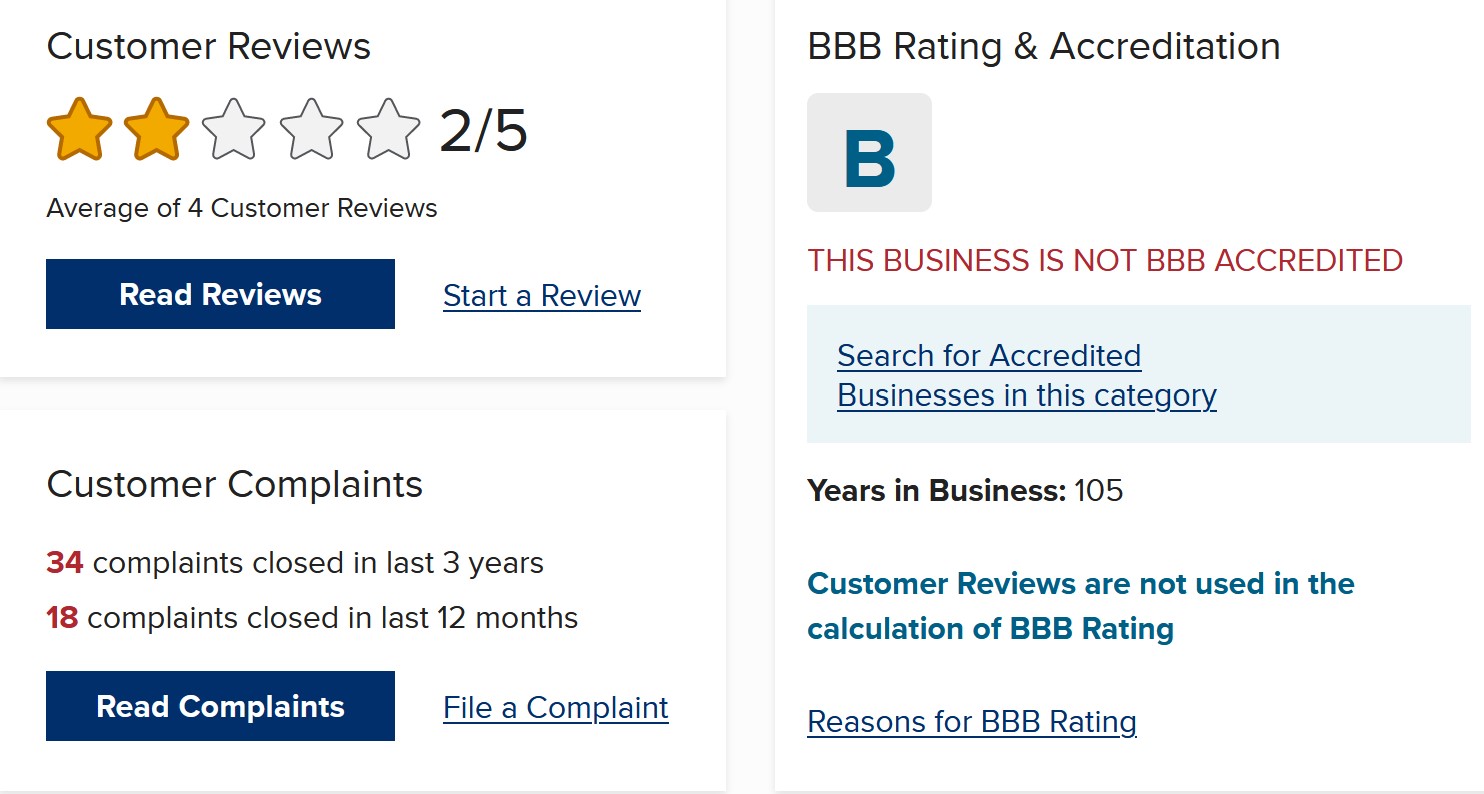

TIAA BBB Rating

The Better Business Bureau (BBB) provides many clues for investors looking for evidence of a broker’s trustworthiness. The rating, the customer reviews, and the complaints all help you develop an understanding of how brokers conduct their business.

TIAA’s BBB rating is quite positive. Although the BBB does not accredit the broker, TIAA maintains an

B rating. The company does not receive many complaints, but it has failed to respond to one BBB

complaint over the past year. BBB ratings are partly based on complaint responses, so the B rating makes sense.

The fact that the latest review went unanswered does not seem alarming or indicative of untrustworthy behavior from the financial company. All other responses show that the broker handles most complaints on its website.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

TIAA Customer Reviews

Regarding reviews, we don’t get any help from the Better Business Bureau as there are none. Another popular source of reviews shows that the company can be a bit confusing for those using retirement products. Customers also report that reps can be slow to respond or unknowledgeable regarding advisor services.

Although reviews could undoubtedly be better, none of the reviews suggest that the broker scams customers.

Best Brokers

TIAA Customer Complaints

TIAA has been around for over 100 years and has put together many account options and services. TIAA is also a Fortune 100 company. It is not surprising that the financial services provider has collected over 5 million customers.

The low number of complaints shows that the company is doing many things right.

The few complaints you see on BBB’s website all seem to share a common link. Either people have trouble accessing the information they need or not being able to navigate the rules and regulations dictated by the contractual agreements.

See TIAA BBB page here »

Is TIAA Trustworthy in Review

To sum up, TIAA can be trusted and is definitely not a scam. The company is registered with the most rigorous regulatory organizations in the industry, and customer funds are secured with FDIC and SIPC. Add to that TIAA’s customer protection policy, and you have a broker that takes all the necessary steps to keep its customers safe.

For a company as large as TIAA, it is normal that some customers can have and report negative experiences. Investors often misunderstand the fine print and are quick to complain when things don’t go their way. However, TIAA seems to handle complaints in a professional manner, and there is no indication that customers are being scammed.

|