|

Moomoo (FUTU) Assets Under Management (AUM) in 2024

Moomoo total assets under management (custody). FUTU AUM and number of customers (user accounts).

|

Futu (including Moomoo) Assets Under Management (AUM)

| Futu client assets |

HK$369.6 billion |

| Number of customers |

18 million |

| Total number of paying customers |

1,444,955 |

| Total revenues |

HK$1,945.6 million |

| Net income |

HK$754.6 million |

Moomoo is a mid-size brokerage company by assets.

However, it is extremely small when comparing total assets under management to

Charles Schwab, who has

$7.13 trillion in AUM and over 32.9 million customers.

Free Charles Schwab Account

Open Schwab Account

Moomoo Overview

If you are looking for an online broker with a great promotions, Moomoo is a broker that you may want to consider.

The promotional offers at Moomoo are especially good for anyone interested in free stocks, as there are multiple opportunities to get a trading portfolio started even before buying a first stock. Free stocks are offered for new account creation, funding a new account, and inviting friends and family to the broker.

Keep reading to learn more about the promotional offers as well as why you might wish to devote your time and money to Moomoo.

Notable Features

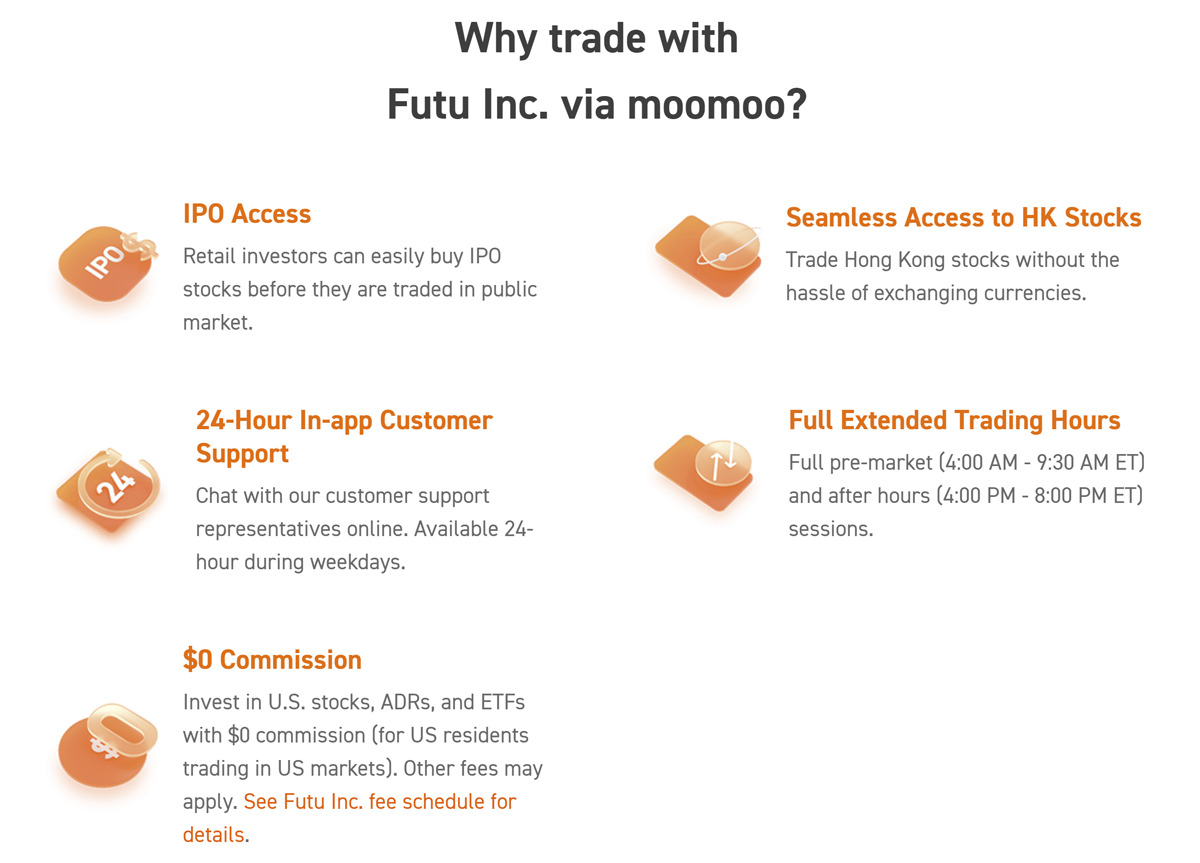

Before thinking about the promotions that a stockbroker offers, it is a good idea to decide if you are interested in the broker in the first place. Fortunately, there are many attractive features at Moomoo, so it is an easy choice.

Here are some of the things that help Moomoo stand out from the crowd.

Market Insights

One of the ways that Moomoo makes life a little simpler for investors is to provide a wealth of market data, news, trends, and more.

Market-specific data, such as Level II market data, company financials, analyst ratings, and more. It should be noted that Level II data comes at no additional cost to traders which is always a nice thing to see.

Additionally, the provided news feeds are streamed to investors 24/7, keeping traders up to date as global economic conditions and scenarios unfold. There is also a clever social aspect to the data provided, allowing investors to see which tickers are trending and what public opinion is suggesting.

Charting and Platform

Another feature that makes the broker an attractive option is the app-focused nature of the broker.

In today’s increasingly mobile-crazy world, it is good for brokerage firms to respond to that reality.

Moomoo clearly understands this. The broker offers advanced charting and order placement on mobile that is simple to use and always easily accessible.

Fee Schedule

Following the example of the most popular brokers in the United States, Moomoo offers commission-free trading in stocks, ADRs, and ETFs.

Market Access

Traders at Moomoo have access to a range of tradable assets. Whether it’s a full listing of Hong Kong listed stocks, IPOs, ADRs, ETFs, or US stocks, the list of options is certainly extensive. Moomoo also keeps its doors open for the entire extended trading session, unlike a few of the other mobile-first brokers in the industry.

|