Rivalry Outline

Firstrade and Robinhood are two ultra low cost brokerage firms that attract investors for the value

they offer. Edward Jones is the largest and best known wealth management company in the country. So just which firm is the better choice? This article is going to find out.

Cost

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Firstrade

|

$0

|

$0

|

$0

|

$0

|

$0

|

|

Robinhood

|

$0

|

na

|

$0

|

$0

|

$0

|

|

Edward Jones

|

$0

|

$0

|

$0

|

0.50% to 1.50% + $300

|

0.50% to 1.50% + $300

|

Edward Jones is without a doubt the most expensive option of the 3 in this article, being its biggest downfall in the argument. Charging fees of $3.95 for trades, 2.5% for advisory services, and more fees elsewhere, EDJ makes sure they get paid as well. When signing an agreement for advisory services at Edward Jones, the client should be well aware of the fees that come with, as they could affect long term returns.

Management Fees

First $250,000: 1.35%

Next $250,000: 1.30%

Next $500,000: 1.25%

Next $1,500,000: 1.00%

Next $2,500,000: 0.80%

Next $5,000,000: 0.60%

Next $10,000,000: 0.50%

Portfolio Strategy Fees

First $250,000: 0.09%

Next $250,000: 0.09%

Next $500,000: 0.08%

Next $1,500,000: 0.07%

Next $2,500,000: 0.06%

Next $5,000,000: 0.05%

Next $10,000,000: 0.0%

Trade Commissions

Up to $5,999.99: 2.50% (max fee: $150)

$6,000 to $9,999.99: 2.00% + $30 (max fee: $230)

$10,000 to $24,999.99: 1.50% + $80 (max fee: $455)

$25,000 to $99,999.99: 1% + $205 (max fee: $1,205)

$100,000 and above: 0.50% + $705 (no max fee)

Services

Promotions

Firstrade: Get up to $250 ACAT rebate and $0 commission trades.

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

Edward Jones: none right now.

Tech Tools

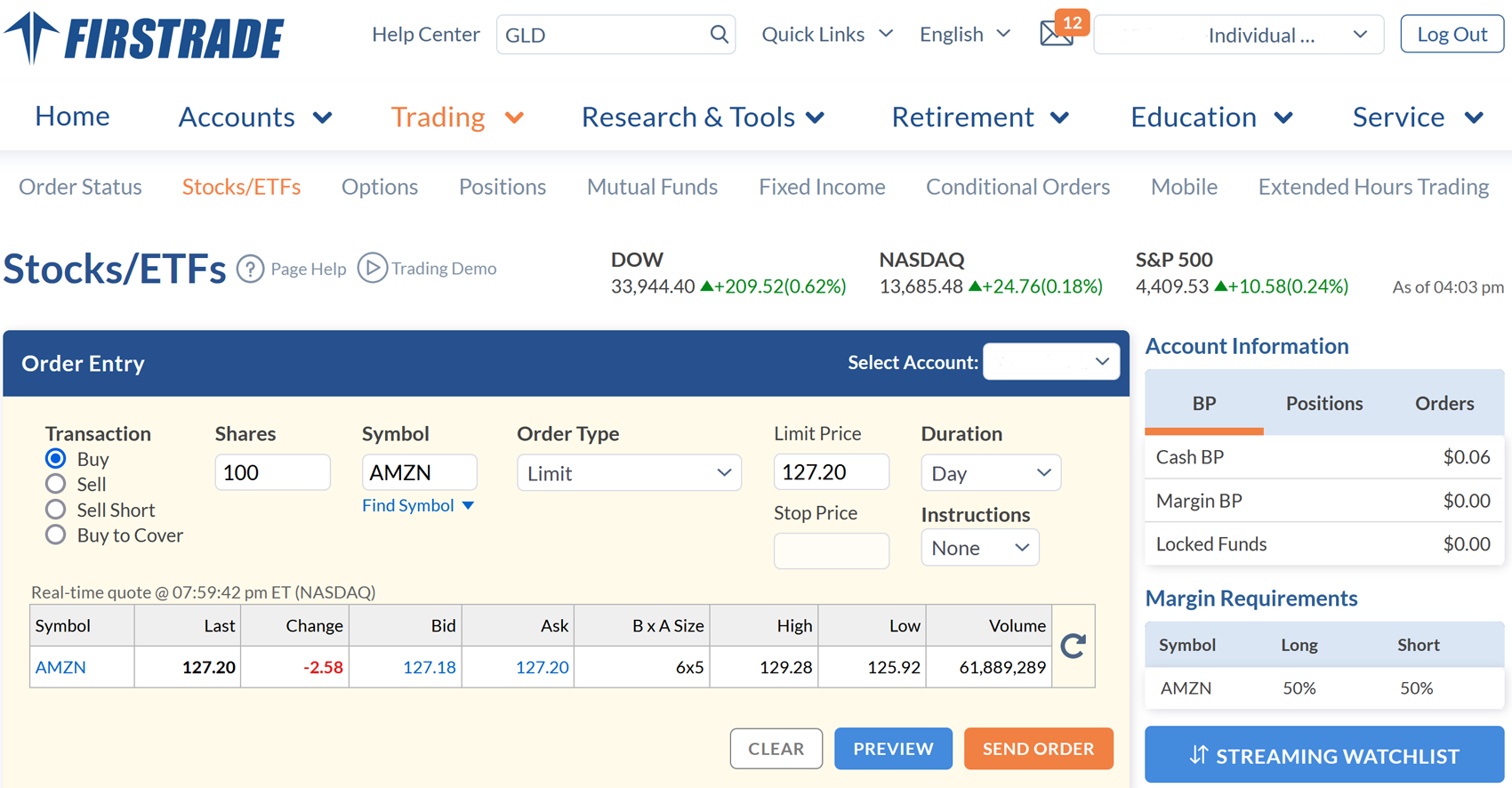

Trading and security research take place on the Firstrade's web-based platform, which carries no active trader requirement.

Advanced charting, option chains, and watchlists can all be found on it. The interface is beautifully designed, easy to

understand and use even for beginner investor.

The Robinhood website has limited information on it. Investors cannot trade from it or do any sophisticated research.

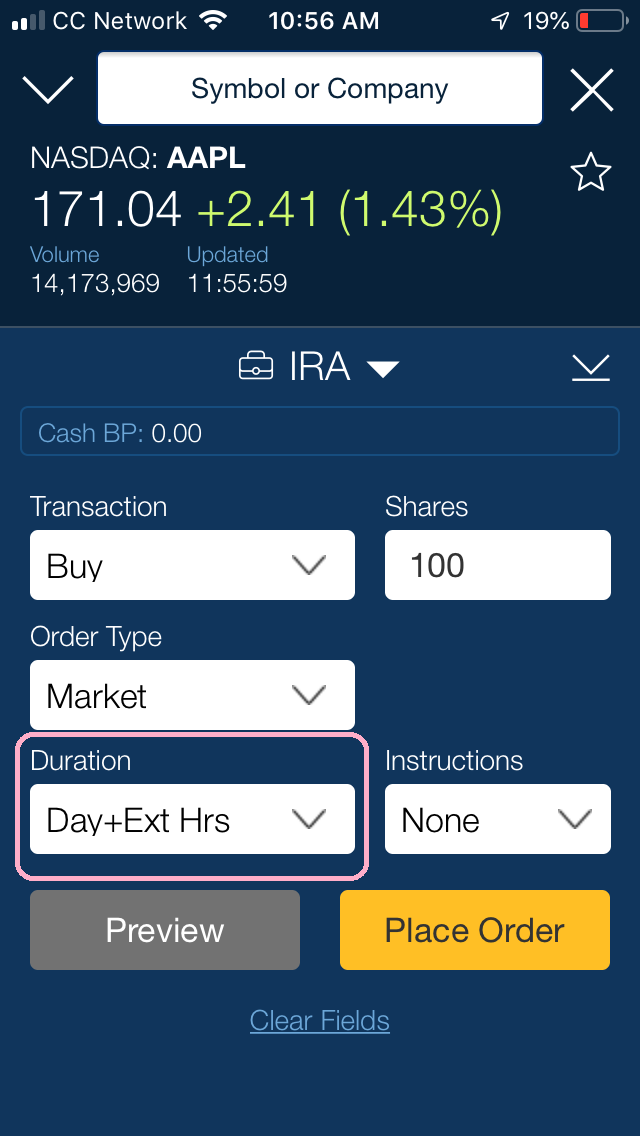

Unlike Firstrade, Robinhood does not offer a browser based trading. So how do the broker's clients place trades? They do

it on the Robinhood mobile app. The platform can be used on either an Android or Apple device. Charting is very basic,

with no drawing tools or technical studies. Line is the only option for graph style, and a chart cannot be displayed

horizontally. This is the only charting software the broker's customers are offered. Smartphone users have access to a

Robinhood app for Apple Watch.

Firstrade offers a mobile app, but not a platform for Apple Watch. Users can do limited security research and look over

the price history of a security. Charting on the Firstrade app is much more sophisticated compared to Robinhood's app.

Firstrade customers can also use a paper trading feature on the app, an unusual feature in the industry.

Edward Jones is lacking when it comes to tech tools, and If the user has an advisor there are little to no technical tools. Edward Jones provides minimal charting tools, outside of those for display. The mobile app comes with much of the same offerings of their website: a simple interface that is great for the hands-off style of an investor. This is attractive for a majority of investors, as more than 8 million of them have chosen EDJ.

Firstrade takes the first victory.

Security Education & Research

Firstrade investors have a limited amount of information on the broker's website for investment education. There are a

few articles that introduce the mechanics of investing. Morningstar reports on mutual funds are available.

Despite Firstrade's somewhat limited supply of information in this category, Robinhood actually offers even less. There

is very little material on both the broker's mobile app and website.

Edward Jones puts a huge emphasis on educating the investor. There is a library

of educational resources that are freely available on their website. With articles such as

“Daily Market Snapshots” to tax or even mental wellbeing, Edward Jones provides everything an

uneducated investor needs to make the next step in their journey.

Edward Jones wins here.

Mutual Funds and ETFs

Both firms offer trading in all exchange-traded funds. On the mutual fund side, Robinhood has zero offerings.

Firstrade’s mutual fund screener can search by a variety of criteria, including YTD return, total assets, and minimum

purchase. The screener returns 10,000 securities, and 3,412 of these have no load. All mutual funds are free to buy and sell at Firstrade.

Robinhood fails here.

Pricing

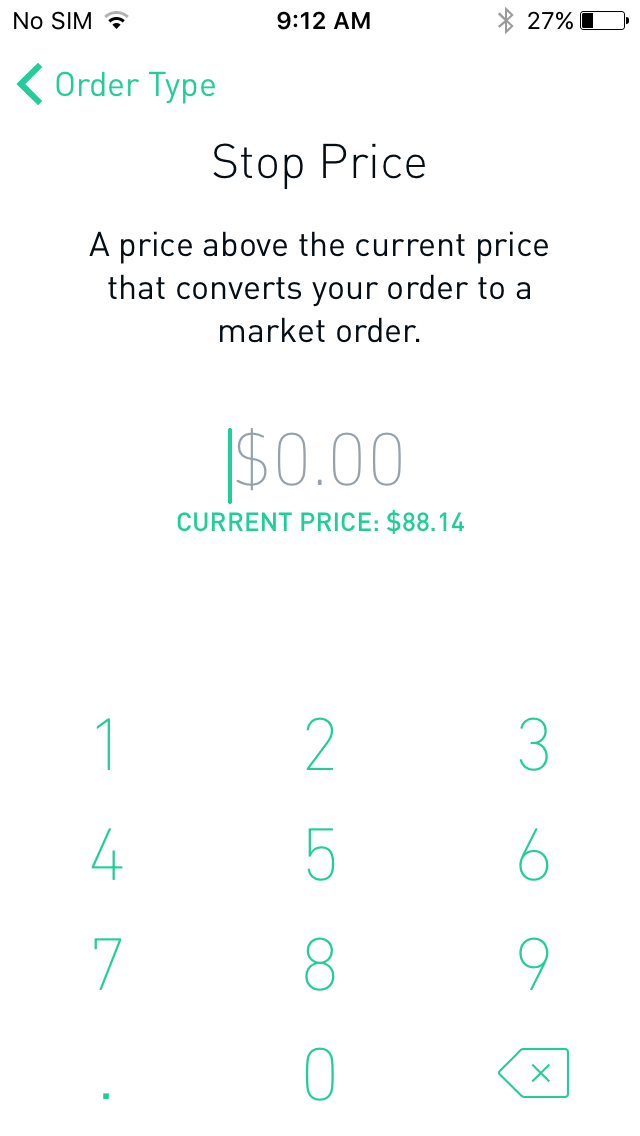

Robinhood has thrown down the gauntlet in the brokerage world, offering free trades to stock and ETF traders. Yes, that's

right, $0 commissions. The broker helps to offset this loss in commissions by charging its customers $5 for mailed

statements and $2 for hard copy trade confirmations. Exchange and regulatory charges are also passed onto the customer.

There is a $10 fee for placing a trade over the phone with the help of a representative.

Trades at Firstrade are free too. This charge is the lowest by industry standards and applies to stock, mutual funds, options, and ETF transactions.

This category is a tie between Robinhood and Firstrade.

Cash Management

Firstrade customers can open a hybrid investment-cash management account. The broker does require a fairly significant

$25,000 to do so, however. The account comes with checks and a Visa debit card, courtesy of UMB Bank. There is no charge

for these banking tools, which is a nice policy because Firstrade used to charge for them. While the Visa card can be

used worldwide, there is a 3% fee for transactions that occur outside the U.S. There is no annual fee for the account,

and securities can be traded in it.

Although these conditions seem pretty severe, Robinhood offers its clients nothing at all in this area.

Similar to Firstrade, EDJ provides hybrid cash-investment cards to users, along with bank deposits, and a number of other options for accessing the investors money.

Edward Jones provides a wide variety for the user, and is consistent in encouraging the use of an advisor. This could be a downfall, depending on the user and their preferences. The dedicated help of a local advisor should increase the success chances of an investors portfolio.

Firstrade takes another category.

Customer Service

Firstrade offers customer support during the week from 8:00 am until 6:00 pm, Eastern Standard Time. The broker’s website

has a chat function during these times. Firstrade does not offer weekend customer service, nor does it have any branch

locations, other than its headquarters in Flushing, New York. The broker does offer Chinese language support, both on its

website and over the phone.

Robinhood, by contrast, has no such phone number. In fact, the one phone number it has isn't even toll-free. An agent can

be reached only during market hours. While the firm does have a service e-mail address, we didn't receive a response to a

test inquiry for two days.

The price that comes with Edward Jones services ensure that the customer service is nothing short of excellent. There are helpful resources such as active chat bots, 1-800 help services, weekly newsletters, and in app advisor communication. This ensures a positive experience, because there are a number of insightful references for the user.

For any investor/advisor partnership, communication is key and Edward Jones makes sure this communication is available in a number of ways. If an investor is going to hold their portfolio with EDJ, it will be largely due to the tremendous customer service that is provided. Edward Jones puts an emphasis on this and it shows.

Edward Jones wins this section, as they should be given the prices that come with an account.

Promotions

Firstrade: Get up to $250 ACAT rebate and $0 commission trades.

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

Edward Jones: none right now.

Product Availability

Robinhood doesn't offer trading in bonds, or mutual funds, all of which are fairly standard in the industry. In

addition to these products, Firstrade also offers CDs. Robinhood offers IRAs with 1% free match.

Edward Jones has wide product availability, including:

- Annuities. Variable. Fixed. Immediate

- Employer Retirement Plans. Defined Contribution. DefinedBenefit

- Education Savings. 529 Plans.

- Equity Investments. Common Stocks

- Exchange-traded Funds

- Fixed-income Investments. Bonds. Corporate Debt Securities.

- Individual Retirement Accounts (IRAs) Roth IRAs. Traditional IRAs.

With this list, the investor has access to just about everything they could want. Keep in mind the encouragement of a financial advisor from Edward Jones, someone that could influence which product the investor chooses.

Firstrade vs Robinhood vs Edward Jones Results

Firstrade was victorious in four categories, Edward Jones took two, there was one tie and Robinhood

failed to take a single category. Firstrade is the winner.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

|