Transferring Brokerage Accounts Between Acorns and Ally

If you’ve heard all the hype about Acorns and want to give it a try, you can move your Ally Invest account over. And if you’re at Acorns and want to try self-directed trading at Ally Invest, we’ll show you how to do that as well. Without further ado, here we go.

Transferring an Account from Acorns to Ally Invest

Acorns does not participate in the Automated Customer Account Transfer Service (ACATS). For this reason, it is not possible to perform an ACATS transfer into or out of the broker. It is possible, however, to perform a non-ACATS transfer, and that’s what we’re going to show you.

Before we get started, you do need to open an Ally Invest account if you haven’t done so already. You’ll be able to choose either an automated or self-directed account. You can open either account type for an incoming transfer.

Remember that Acorns offers trading only in a small group of ETFs. These assets can be moved into either account type, robo or self-directed. If you move them into a self-directed account, you will be responsible for managing them. If you transfer them into Ally Invest’s robo service, they will probably be sold off and replaced with the ETFs that Ally Invest uses.

Once you have your Ally Invest account open, it’s time to start the transfer. Because it will be a non-ACATS transfer, it’s going to be cumbersome. First, you need to reach out to Ally Invest and request a transfer of your Acorns account. You can reach Ally Invest at 855-880-2559.

Ally Invest will generate some paperwork for you, and on this paperwork you will need to secure a medallion signature guarantee. Once you have completed this step, you need to send the finished paperwork to Acorns using the following address:

Acorns Securities

ATTN: Account Transfers

5300 California Ave, Bldg 1

Irvine, CA 92617

You could also email digital copies of the paperwork to help@acornssecurities.com.

Once Acorns has the required paperwork with no errors, it will send the account over to Ally Invest.

Because this journey is rather burdensome, it may be easier to simply liquidate your holdings at Acorns, transfer the cash to a linked bank account, and from there move the cash into your Ally Invest account. Keep in mind that selling securities will result in tax consequences, so consult a tax advisor before choosing this option.

Ally Alternatives

Transferring an Account from Ally Invest to Acorns

Going in the other direction will require the alternative just mentioned for the sole fact that Acorns

will only accept an incoming transfer of cash. Securities of any kind cannot be moved into an Acorns

account.

First, you need to open an Acorns account.

The next step then is to turn your Ally Invest account into cash. This will require selling everything you want to move and waiting for the trades to settle. This will take a business day or two, depending on the asset sold. Be aware that the vast majority of assets sold cannot be repurchased at Acorns (the broker only has about 12 ETFs available).

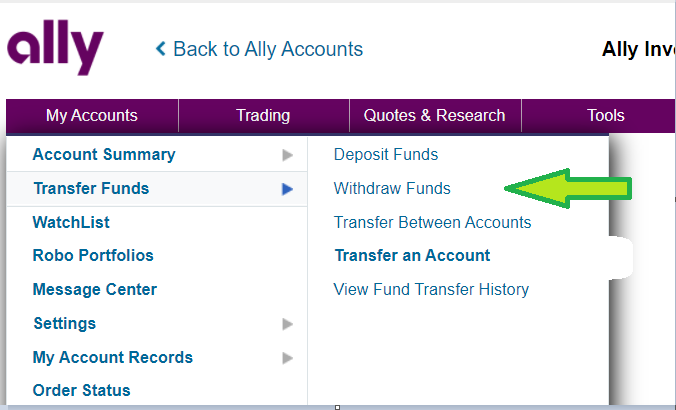

To withdraw cash from Ally Invest, hover over the My Accounts tab in the top menu. Next, select Transfer Funds and then Withdraw Funds. Here, you’ll be able to move cash into an external checking or savings account. If you haven’t linked one yet or want to add another one, you’ll be able to do so on the transfer page.

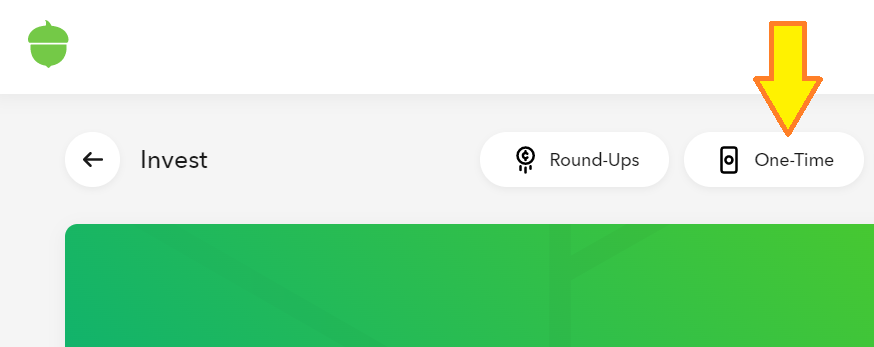

Once the funds arrive in your deposit account, you can pull the funds into your Acorns account. To do this, click on the tile that says Invest for your future. On the next page, click on the button in the top right that says One-time. This will let you make a single deposit from a linked bank account. If you haven’t linked your account yet, you’ll be able to connect it on the transfer page.

Once the cash arrives in your Acorns account, the broker’s digital advisor will automatically invest the money in the available ETFs.

Open Acorns Account

Open Acorns Account

The Cost of Transferring

For an outgoing transfer, Acorns has a very pricey $50 transfer fee that is applied per position. This means that if you move 4 funds to another broker, the cost of the transfer would be $200. The good news is that Ally Invest does reimburse other firms’ transfer fees if the transfer is valued at $2,500 or more. There is a $75 maximum rebate.

Transferring from Ally Invest to Acorns should cost nothing because there’s no actual transfer of securities. Most financial institutions charge nothing for ACH transfers of cash, so you probably won’t see any fees in this direction, although you may want to check your bank’s fee schedule just to be on the safe side.

How Long Does a Transfer Take?

The transfer of money from Ally Invest to Acorns could take a couple of weeks. First, the trades have to settle inside of Acorns. This will take one business day. Then, the funds have to move through the ACH network—another couple of business days. The bank has to release the funds for withdrawal—another few business days. Then, the money has to move through the ACH network again, finally arriving at Acorns. Expect a couple of weeks total.

To move an account in the other direction, more paperwork and bureaucracy are required, so plan on a lengthier timeframe, possibly up to 4 weeks.

|