Overview of Futures at TradeStation

If you’re looking for a brokerage firm that offers trading in futures contracts, TradeStation is definitely worth considering. With advanced software, a wide selection of tradable instruments, and a tempting promotion, this broker may have everything you need. Read on for the details.

Web Browser

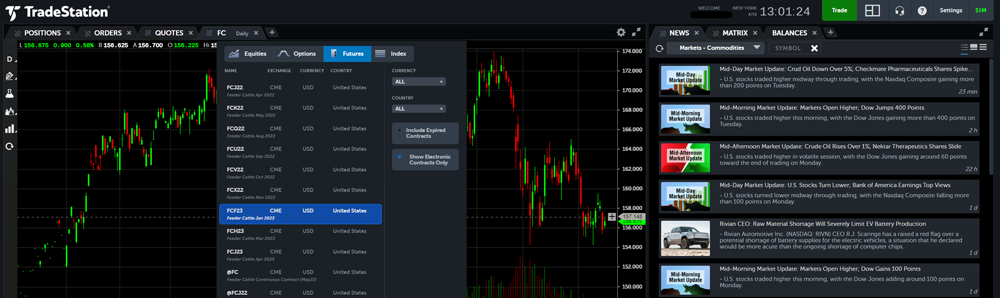

For futures trading, TradeStation offers a simple but effective browser-based application. The platform can also be used to trade options, stocks, and ETFs.

The launch location is at the top of TradeStation’s website. Just click on the Log In button at the very top of the site. This will generate a pop-up window with selections for multiple platforms. The Web Trading platform is the one that can be used to trade futures contracts. It is available in both live and simulator modes. This second option is a great resource to practice the platform without risking real money.

In the pop-up window there is another platform, FuturesPlus. This is used to trade options on futures.

The Web Trading platform has two themes: light and dark. There is a gear icon in the upper-right corner that can be used to switch between the two. Other settings, like order entry numbers, confirmation pop-ups, etc., can be manipulated here, too.

Charting and order entry for futures contracts work pretty much the same way as for equities. First, you want to enter a ticker symbol in the symbol field. This is in the upper-left corner on the order ticket. On a graph, it will be on the tab at the top of the chart. A ticker symbol for a futures contract can also be added to the platform’s watchlist (look for the Quotes tab), which is a great way to see the current bid-ask spread on a contract and how many have traded that market day.

To place a trade on the browser platform, pull up the order ticket by clicking on the green Trade button. It’s in the top-right corner of the screen. The order form will drop down from the top of the site.

The symbol field is in the far-left corner of the ticket. Just enter the contract’s ticker symbol, and TradeStation’s software will produce a drop-down list of contracts on that particular asset. For example, for wheat (ticker symbol W), we found 12 contracts with various expiration dates. Clicking on an entry automatically populates the order ticket with that particular contract.

TradeStation’s drop-down list of contracts also has choices for currency, country, and expired contracts. Make sure this window has the Futures tab at the top highlighted and not the Options or Equities tab.

With the desired contract correctly entered into the symbol field, it’s time to complete the rest of the order ticket. There are two tabs here: Standard and OCO/OSO. Despite the first tab’s name, it does have some advanced features.

A standard order has 6 trade types, including trailing and limit. There are 5 duration choices. The second tab provides a lot of advanced order types. These include bracket orders and order cancels other.

One last widget of potential usefulness for futures traders is the News window. TradeStation delivers news articles from Benzinga. They have thumbnails, which add a little bliss to them.

Although there is a symbol field in the News window, a futures contract unfortunately won’t work here. Instead, we were able to find futures news by clicking in the drop-down menu for categories and selecting Futures underneath Markets.

Simulated Trading

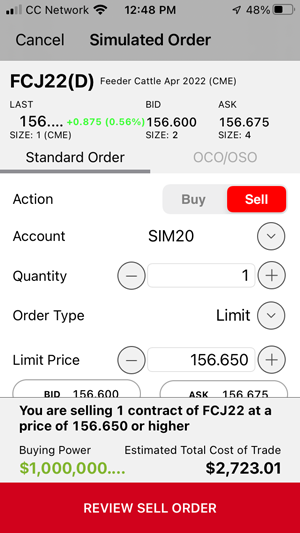

Simulated mode is of course an excellent way to practice trading futures contracts on the web platform. The software’s demo mode begins with $1,000,000 of fake currency for futures trading. This amount is kept separate from funds available for simulated equity trading. Balances are shown underneath the Balances tab, and positions are shown under the Positions tab.

TradeStation’s platform displays SIM in green in the top-right corner and next to the demo account number while in simulated mode.

Open Tradestation Account

Mobile App

TradeStation’s mobile app can also be used to submit orders for futures contracts. The watchlist from the web platform makes an appearance here, and so do alerts.

Tapping on an entry in the watchlist brings up the profile page for the contract. A vertical chart can be expanded slightly to fill more of the screen. And it’s possible to rotate a graph horizontally. However, in horizontal mode, a graph does not fill the entire screen, and we found it easier to use a chart in vertical mode.

Charting tools are available on mobile graphs. Examples include technical studies, drawing tools, and plot styles.

Tapping on a graph brings up a small window with open, high, low, and close numbers. Inside this window is a green Trade button. Tapping on this button will pull up the app’s trade ticket with the contract populated. At the bottom of the ticket, there are toggle switches for stop loss and take profit orders.

A contract’s profile also has a trading matrix on the app. This is basically a price ladder with bid and ask sizes as they come in.

FuturesPlus

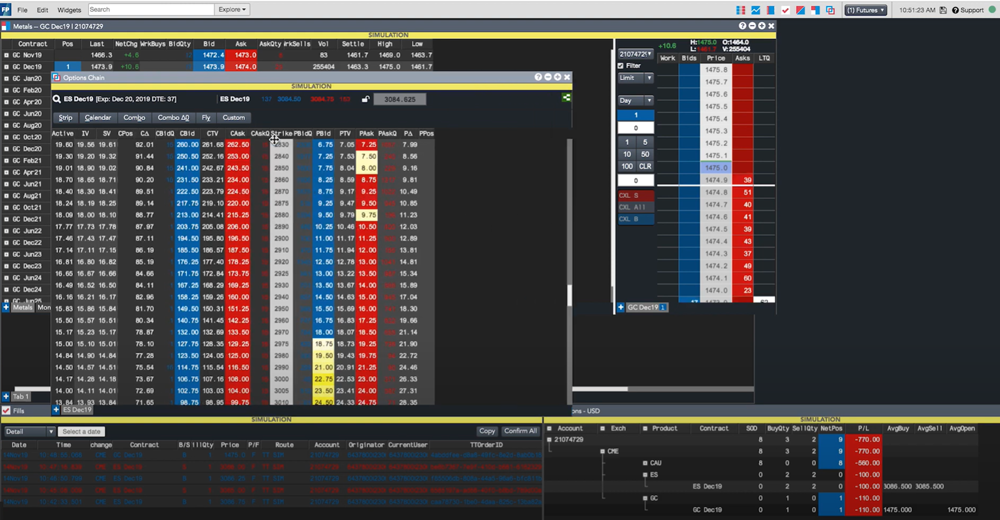

FuturesPlus is TradeStation’s software for trading options on futures. It is a desktop platform that offers charting, order entry, and vital trade data. An account must have this program enabled before it can be accessed.

Each window in the workspace has its own function, like charting, orders, positions, option chains, trade ticket, etc. These windows can be moved around and minimized.

At the top of the platform is a search bar. Typing in a ticker symbol for a futures product generates a drop-down list of contracts with a variety of expiration dates. The search bar can also search by keyword if you don’t know the ticker symbol (silver or SI, for example, will produce the same list of contracts).

The order ticket on FuturesPlus has drop-down lists for accounts (if you have more than one with TradeStation), order type, and duration. Buttons are also displayed for number of contracts to make order entry quick and simple.

Like the web browser and mobile app, FuturesPlus has a practice mode, which we found very useful for this software.

Phone Orders

Besides the software platforms already mentioned, futures orders can also be submitted over the phone at TradeStation. The broker’s futures desk can be reached at 800-837-8951.

Futures Symbols at TradeStation

On TradeStation’s software platforms, a futures contract is represented by a root symbol followed by a month code, followed by a year code. For example, for the wheat contract that expires in June of 2024, the correct string of characters is WM24, where W represents wheat and M is for June. The month codes unfortunately don’t logically correspond to the names of the months, so you have to memorize them.

An alias extension can be added to a contract on TradeStation’s software, although this is optional. The two choices are:

.D = Electronic day only

.P = Pit only

The .D symbol will display contracts that trade 24 hours a day electronically. For example, the symbol ESK24.D is for the E-Mini S&P 500 May 2024 contract that trades electronically. If no alias extension is used, the contract displayed on a software platform will be the .D contract.

Continuous contracts have an ampersand in front of them, as in @SP for the continuous contract on the S&P 500 index.

Tradable Contracts

TradeStation offers hundreds of futures and futures options products. These range from commodities to indexes to currencies to cryptos. E-mini contracts and Micro E-mini contracts are both available. The Micro contracts are just one tenth the size of the regular E-mini contracts.

Here are some examples of tradable contracts at TradeStation:

- E-MINI NASDAQ 100

- NIKKEI ($ BASED)

- CME MICRO BITCOIN

- MINI-DAX

- LONDON COCOA

- MEXICAN PESO

- 2-YR T-NOTE

- PLATINUM (NYMEX)

- BRENT CRUDE OIL (ICE)

- MINI SOYBEANS

- FEEDER CATTLE

TradeStation Futures Margin Requirements

Margin requirements vary based on the contract being traded. Generally speaking, the micro contracts will have the lowest requirements. Here are some examples of margin requirements at TradeStation:

| Contract | Intraday Initial | Intraday Maintenance | Overnight Margin | Maintenance Margin | Intraday Rate |

|---|

| E-MINI S&P 500 | $6,600 | $6,000 | $13,200 | $12,000 | 50% |

| MICRO ES | $660 | $600 | $1,320 | $1,200 | 50% |

| ICE Bitcoin | $11,000 | $10,000 | $11,000 | $10,000 | NONE |

| EURO-OAT | € 3,250 | € 3,250 | € 3,250 | € 3,250 | NONE |

| LONG GILT | £ 2,240 | £ 2,200 | £ 2,240 | £ 2,200 | NONE |

| 10-YR T-NOTE | $935 | $850 | $1,870 | $1,700 | 50% |

A margin call issued at TradeStation must be settled the same day.

Open Tradestation Account

Real-Time Data

TradeStation offers real-time data on futures contracts and options on futures. Even better, the brokerage house charges nothing for these quotes. But it does charge for some activities.

TradeStation Futures Fees and Commissions

Futures and options on futures have no base charge at TradeStation, although there are per-contract fees.

For futures contracts, TradeStation charges $1.50 per contract, per side. Options on futures have the same price tag. Micro futures receive a $1 discount.

Exchange and regulatory fees are passed onto the customer at TradeStation, and for futures, these can be significant. For example, accounts that aren’t members of the Chicago Board of Trade must pay an exchange fee of $0.30 per contract, per side for the Micro E-mini Dow contract and $2.05 for the wheat contract.

Orders placed over the phone with a live agent have a $50 surcharge.

There is no deposit minimum to open a futures account at TradeStation, although the broker does have a rather disappointing $50 inactivity fee. It can be avoided by maintaining $2,000 in account equity or placing 5 trades every 12 months.

Other fees that futures accounts are subject to include:

- Delivery ($150 per contract)

- Delivery liquidation ($75)

- Returned ACH ($25)

- Exercise/assignment/expiration ($1.50 per contract)

Futures IRA

TradeStation doesn’t stop with taxable accounts. The brokerage firm has an IRA designed for futures traders. Mindland Trust serves as the custodian for these retirement accounts, and this company does charge an annual custodial fee. TradeStation’s customer service reports that it ranges from $250 to $350 per year, which isn’t cheap by any stretch of the imagination. There are fees for other activities as well, such as account transfers and closeouts.

In order for funds to go into the futures IRA, they first must pass through Midland Trust. This system creates more bureaucracy and time to completion. The advantage of the system is that Midland offers a variety of account types, including SEP and SIMPLE plans.

Futures Education and Research

TradeStation realizes that a lot of its clients will be new to the world of futures trading. As such, it has published a few materials that new traders will benefit from. During our research, we found the following online resources:

- An e-book titled Adding Futures Options to Your Trading

- How to Trade Soybean Futures

- Micro Ethereum Futures

- Eurex Micro Futures

Contract profiles at TradeStation don’t have much information on them. Trade data is the usual information.

Open Tradestation Account

TradeStation Futures Trading Summary

TradeStation is one of the few securities brokers out there to also offer trading in futures and options on futures. Its software for trading is very good, and its pricing on taxable accounts is decent. The one area we would like to see more emphasis is on education, but these resources are available elsewhere.

|