USAA Investments Has Been Sold

Free Charles Schwab Account

Open Schwab Account

USAA ROTH IRA Overview

USAA is marketed heavily toward members of the military and their families, even making some of their product offerings exclusive to those customers. However, they

open their investment and life insurance business to members of the general public. Included in their suite of investment products is a Roth IRA offering.

Opening USAA ROTH IRA Account

With few physical locations, USAA encourages customers to conduct most of their business online. This may be an issue for those who prefer a brick and mortar option

since there are only 17 locations spread across just 11 states. Their company website is well designed and easily navigable, with just three clicks required to get

from the home screen to where you can start the process of opening an IRA.

USAA allows anyone to open a Roth IRA with as little as a $50 investment with a $50 or more automatic monthly contribution, depending on the fund. USAA funds are

open to investors, as are a selected number of Non-USAA Mutual funds. You may also fund your IRAs with a USAA Certificate of Deposit (CD) after a minimum of $250

deposit. Interestingly, USAA offers two annuity options as well inside their IRA products: a Flexible Retirement Annuity accessible with a $5,000 initial

investment, and a Guarantee Savings Annuity, limited to those who have $20,000 available to get started.

USAA allows initial funding through any bank or investment account and does not require a USAA bank account to proceed. They also accept mailed checks. Rollover

options include the option to transfer your existing 401(k), TSP, or other employer-sponsored account into your new USAA retirement account.

There are no fees associated with opening an account. There are no incentives for opening an account either.

Investment Options

With a USAA Roth IRA, the following investment options are available: stocks, bonds, exchange-traded funds (ETFs), mutual funds and certificates of deposit (CDs).

However, new accounts will be initially limited to investments solely in USAA managed funds.

There are 43 different USAA managed funds available to IRA holders. Among the offerings are target retirement year, index, sector, growth, and income funds. The average expense ratio for this collection of funds is high at 1.04%. Three mutual funds have recently received Lipper Awards. The average Morningstar Rating of the collection is 2.97, with a single 5-star rated fund and five 1-star rated funds.

By default, investors only have access to USAA managed mutual funds. USAA will extend your ability to purchase other funds, but this is done on an account-by-account basis and requires a phone call to their financial advisor team to set up.

User Interface

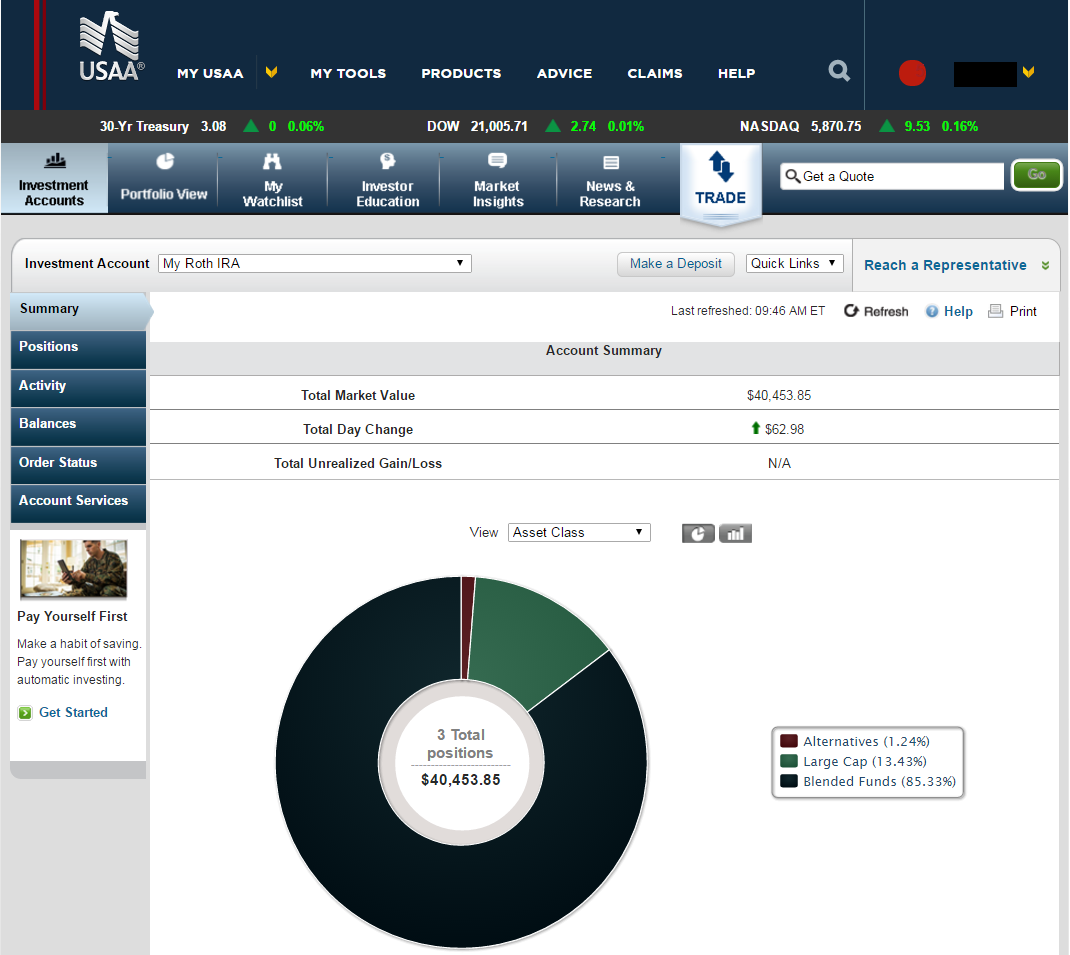

After logging into your USAA account, you will arrive at the account summary screen. From here, a high-level overview of your account appears, similar to what you would expect on any account page. The main navigation bar runs across the top of the screen and includes links to take you to all of the account services offered by USAA.

Investment Accounts. This is the primary page for your IRA, and includes the landing site that comes up after you log in. You may navigate within this page to view your account summary, positions, activity, balances, order status, and account services. Account services does a good job of consolidating links to most any action you would need to perform, including recurring transfer management, automatic investment plans, and tools for transferring funds.

Portfolio View. This screen is somewhat redundant to the Summary page under the Investment Account section. It displays a pie chart of your investments with extra information. If you do happen to have additional investment accounts with USAA (a brokerage account, for instance), then this screen is more helpful as it will show you those accounts as well.

My Watchlist. This screen gives you the ability to create a watchlist of stocks. This functionality is similar to features on publicly accessible sites such as Google Finance or Yahoo Finance and adds nothing new or novel to the concept.

Investor Education. This screen serves as a repository for articles about investment. Topics include retirement, education savings, investing principles, taxes, and personal finance. Some example headlines are “Five Year-End Portfolio Mistakes to Avoid” and “Four Strategies for a Low-Return Environment.” Most of the content comes from Morningstar, with the occasional USAA piece added from time to time. There are 149 articles in this knowledge base.

Market Insights. This page features links to commentary on the market from USAA and Morningstar. There are also links to news segments that feature USAA fund managers. This section of the IRA site presents a more real-time analysis of the market. The articles are terribly formatted and do not display correctly in the Chrome desktop browser. At this time of this review, the Morningstar content was not available to view.

News & Research. This page is very similar in style and content to the landing pages for Google Finance or Yahoo Finance. It includes links to headlines in the media (Marketwatch.com features prominently), as well as overall market information at a glance. Oddly enough, there is also a feature on this page to create another watchlist.

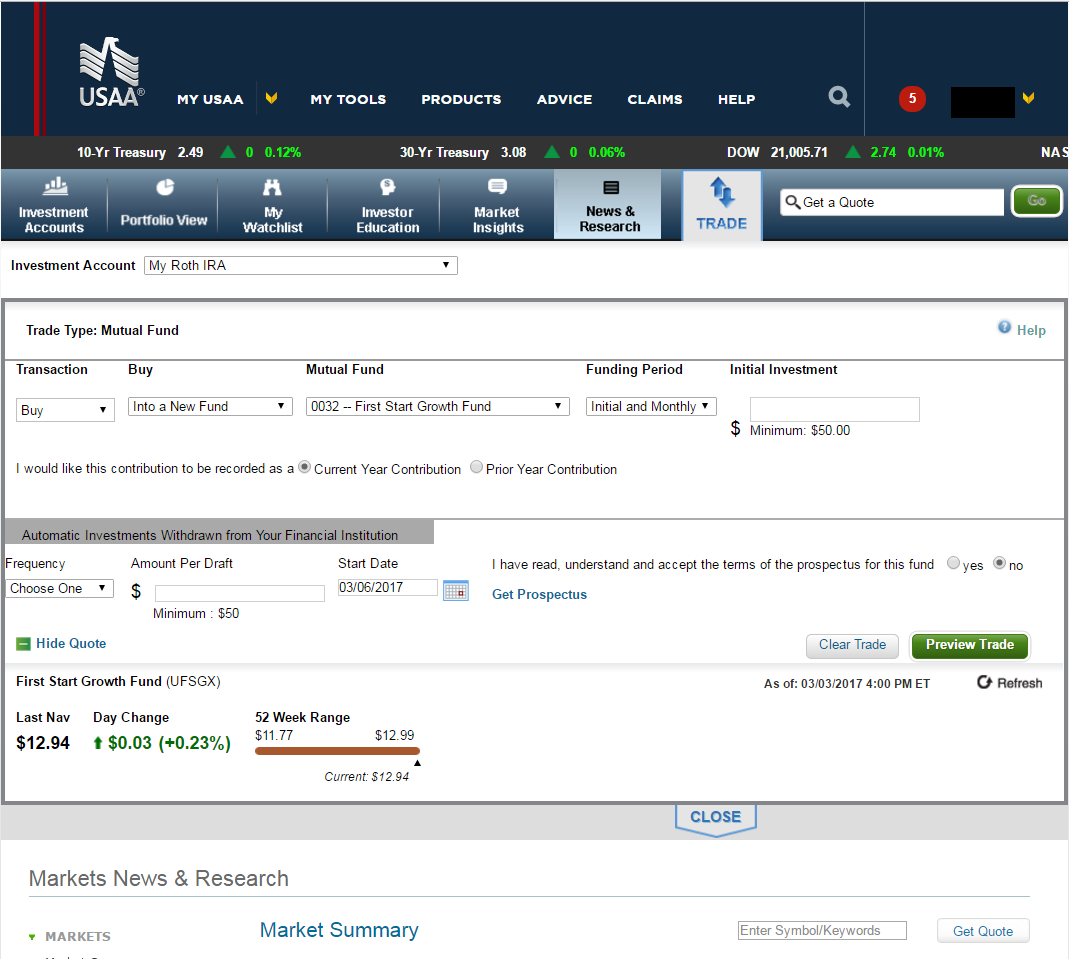

Trade. This button expands the trading window where you may place trades within your account. The process is very simple and relatively straight forward, and USAA makes it easy to set up an automatic investment schedule during your initial trade. Initial investment minimum amounts are clearly marked, and you can select whether or not you want to the funds to count for the previous year during the eligibility window. Managing recurring transfers or setting up a new one for an existing investment is performed on a different screen, which can lead to confusion.

Mobile App

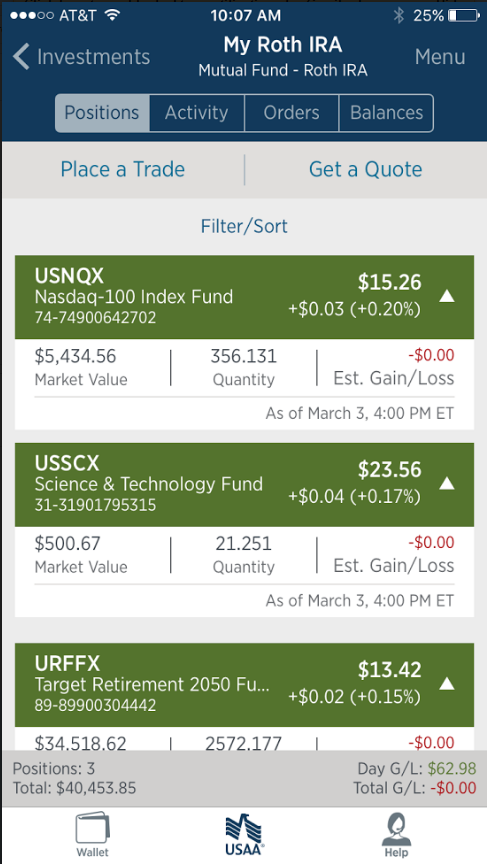

USAA offers a mobile app with a robust set of features designed to capture every offering from the company within a single application. The app includes support

for IRAs, but the functionality is extremely limited. Users of the app are only able to access an account summary and view their activity, balances, and pending

orders. There is no ability to place a trade from within the app, manage automatic investment plans, or transfer funds out of the IRA. You may, however, transfer

funds into your IRA through the app.

Pros

- integration with other USAA products is thorough

- trade window makes it easy to set up automatic investments

- excellent customer support

Cons

- few physical locations

- initially limited to USAA funds

- USAA funds are expensive and underperform their peers

- website includes several redundant and minimally useful features

- website is poorly designed compared to other product pages

- minimal functionality within the mobile app

Recommendation

This product is only a good fit for someone who is an existing USAA customer and wants to keep all their accounts in one place, and who also is a passive investor

content to leave their money in USAA managed funds. Anyone else would be strongly encouraged to shop elsewhere for their Roth IRA.

USAA ROTH IRA Review Summary

Those seeking a Roth IRA offering will find very little unique or positive in the offering from USAA. There is simply no reason for a new customer to USAA to begin

their relationship with this product. Existing USAA customers may find it convenient to house all of their accounts at one company, as the website and the app are

well integrated, and the customer service is exceptional. There is also a benefit from increased transfer speed of funds between accounts. However, due to the

expensive, poorly managed selection of mutual funds that you are initially limited to, even existing USAA customer would be advised to shop elsewhere for their

Roth IRA.

Free Charles Schwab Account

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

|