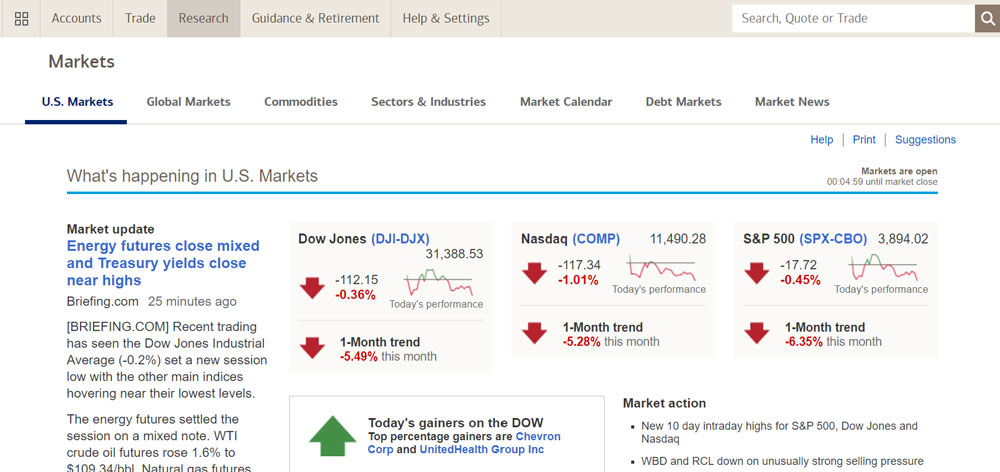

| Investments | Commissions |

|---|

| Stocks and ETFs | $0 |

| Stocks and ETFs broker assisted | $29.95 |

| Options | $0.65 per contract |

| Mutual funds | $19.95 |

| Merrill Edge self-directed mutual funds | 0.75% gross proceeds, $50 minimum, $250 maximum |

| Bonds | On a net yield basis |

| Investments | stocks, mutual funds, options, ETFs, bonds, CDs |

| Merrill Edge minimum deposit to open account | $0 |

- Traditional IRA

- ROTH IRA

- Rollover IRA

- SIMPLE IRA

- SEP IRA

- 401(k)

Merrill Edge IRA Fees

- IRA setup fee: $0

- Annual IRA fee: $0

- IRA termination fee: $49.95

Merrill Edge IRA Overview

Merrill Edge is Merrill Lynch’s online investment platform and a part of Bank of America’s holdings. Merrill Edge combines the power and research capabilities one would expect from one of the most well-known financial institutions in the United States with a tech forward solution targets the modern investor who wishes to build and manage their own portfolio. Users can engage with the platform via both web and mobile app and not see a major drop in performance between the two.

Merrill offers a full suite of the traditional investment opportunities to users, including stocks & ETFs, options, mutual funds, and fixed income. Because it is predominantly a self-driven service, Merrill provides the information and ability to execute investments, but the time horizons and strategies deployed for investments are up to the individual users. Long-term focused everyday investors may use the traditional trading platform, while more active traders can leverage Merrill Market Pro for real-time analysis and enhanced trading capabilities. In addition to setting up traditional investment accounts, Merrill Edge enables investors to set up retirement accounts, including IRAs, Roth IRAs, and 401(k)s.

Lastly, Merrill’s platform has been integrated with all of Bank of America’s traditional banking services in addition to providing investors with most investment and brokerage services that one would expect from a large bank. Customer support can be done in the traditional online methods (chat, email), phone, or in-person at Bank of America or Merrill Investment brick-and-mortar locations.

Merrill Edge IRA Key Features

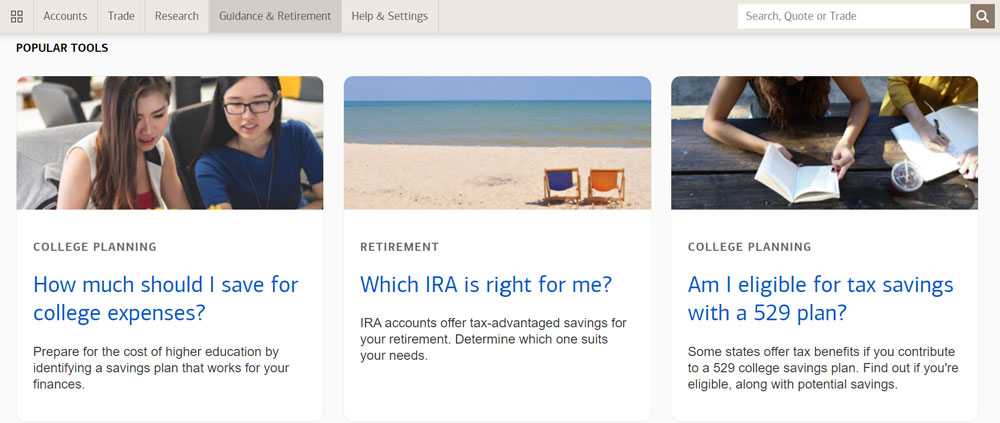

Full Suite of Services: Merrill Edge provides users with the capabilities to execute $0 fee trades across myriad securities, but it also offers a wide variety of additional services to its customers under its “Guidance and Retirement” section. Users can tap into Merrill Edge for resources, both self-guided and with Merrill advisement professionals, on retirement planning, prioritization and goal setting, and tools and calculators for critical life events such as college planning. In the event that a user wishes to have more management oversight, Merrill offers both managed investment portfolios and the ability to work a Merrill advisor.

Bank of America Integration: As mentioned above, Merrill is owned by Bank of America. While not a pre-requisite for using the platform, Bank of America customers who also use Merrill Edge will enjoy many benefits that come with the two platforms being under the same umbrella. Users can see account information from both services in each application, transfer money between their accounts in real-time, and Merrill users can leverage all Bank of America locations for its additional services. In addition, Merrill users who bank with BofA can enjoy special promotions and perks through the BofA Preferred Rewards platform.

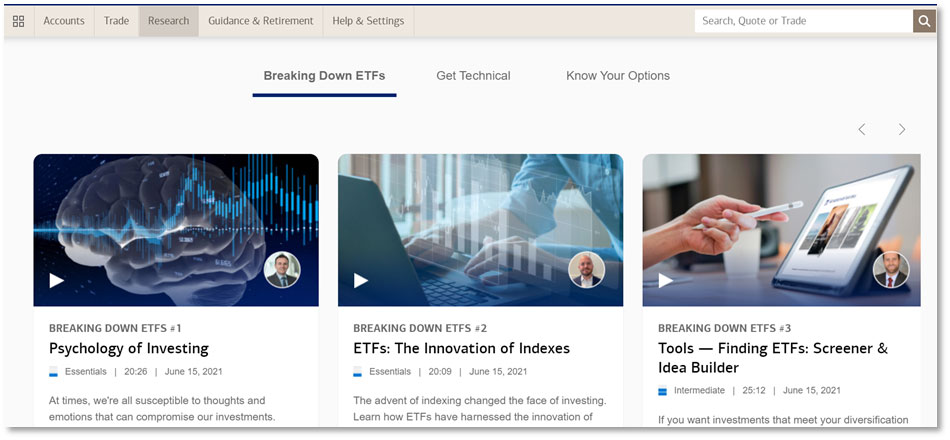

Research and How-To’s: Merrill Edge prides itself on providing a robust suite of research tools as well as investor guides and education services. Using Merrill Edge means users have access to information and analysis from Merrill, Bank of America, Morningstar, and a number of other highly regarded research firms and news publications. If one is looking to sharpen their skills, Merrill has webinars, education guides, and unique investing tools and calculators, as well as an “Idea Builder” platform, to empower users to become more well-rounded investors.

Merrill Edge IRA Fee Structure

Like many brokerage platforms, Merrill has switched to a no-cost trading model for do-it-yourself trading. This means that in practice, everyday Edge users can execute trades on traditional securities (stocks and ETFs) for free. Note that fees can begin to be accrued when users engage in more complex trades – i.e., options contracts, fixed income trading, and trading on margin.

Lastly, there are no annual account fees, inactivity fees, or fees for traditional brokerage administrative services such as receiving wires or generating statements and confirmations, but there are fees for closing accounts ($49.95) and broker-assisted trades ($29.95 per trade).

Merrill Edge IRA Pros

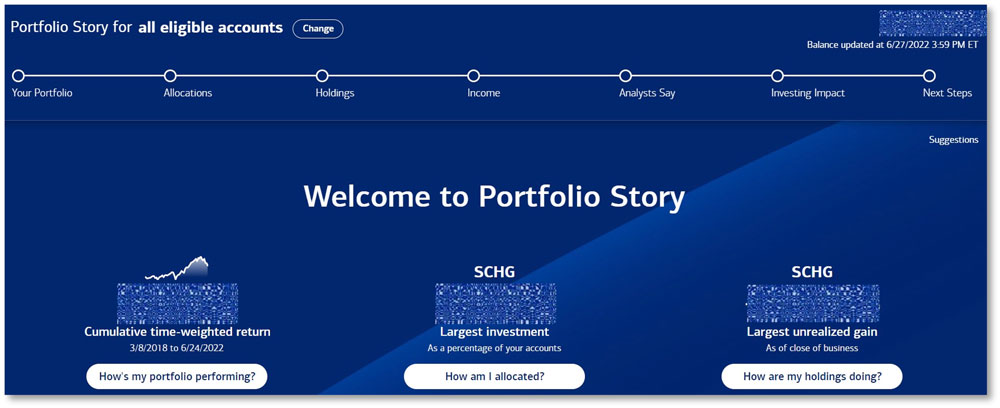

Clean User Interface and Experience: When it comes to a complex, heady topic like investments and financial accounts, users do not want to deal with the additional burden of using a hard-to-understand platform. Merrill Edge assuages these concerns by providing a clean user interface with a simplified, intuitive design that day one users can pick up and understand. One shining star worth calling out is the “Portfolio Story,” which takes users on a visual guided tour of their accounts by highlighting the portfolio performance via time-weighted returns and individual stock breakdowns, allocation analysis by investment type and sector, and future earning potential based upon analyst expectations.

Caters to Every Level of Investment Sophistication: It is to be expected that a platform backed by one of the largest banks in the country has a robust suite of services that can satisfy most trading needs. Where Merrill stands out is that it empowers the user to choose the level of involvement the platform has in the user’s day-to-day activities. Fully self-sufficient users can leverage the research and trade building tools to execute trades and manage their portfolios at little to no cost. Users with no experience who are seeking guidance can tap into Merrill and Bank of America’s advisor network and/or leverage the managed portfolio or “robo-investment” solutions to help them on their investing journey. For the large swath of individuals in the middle, Merrill can meet the users where they wish to be met by providing education guides, how-to’s, and idea generators that enable users to “stair step” their way up to becoming more sophisticated investors.

Incredible Value for Bank of America Users: As noted above in the Key Features section, Merrill Edge and Bank of America are integrated within both platforms. This convenience provides users with the benefits of tapping into a tightly integrated experience as well as a robust suite of offerings and rewards. For example, users with at least $20,000 in combined banking and investment accounts are eligible for additional perks through the Bank of America Preferred Rewards program, which includes boosts on savings account interest rates and BofA credit card rewards, discounts on mortgage, auto loans, and Merrill Guided Investing, and no-fee transactions at BofA ATMs. Lastly, users can leverage the extensive Bank of America/Merrill network for in-person meetings and customer support, which some may prefer.

Merrill Edge IRA Cons

Limited Options on New Investment Vehicles: While providing users with a robust set of traditional securities to invest in and a seamless, integrated experience across most of its platform, Merrill Edge does not allow for trading in new age investments like cryptocurrency or fractional shares trading. This may be partially due to the unknown regulatory challenges some of these new investment vehicles may encounter, but it is an area that much of the general population engages in now and may want from their brokerage. For the time being, Merrill users will need to seek out these investment opportunities on other platforms.

Best IRA Accounts

Merrill Edge IRA Review Recap

Merrill Edge is the brokerage platform of one of the biggest, most widely used banks in the United States, and it acts like it. While it does not offer some of the “new frontier” investment opportunities, the robust suite of investment services, research, and tools enables users of all levels to put their money to work in traditional securities and even grow their capabilities as sophisticated investors at little to no cost.

These features, combined with a solid design and intuitive user experience, make it an excellent choice for users who are interested in investing in traditional securities. Specifically for Bank of America users, the seamless integration with the larger Bank of America network and the additional incentives for using both platforms make it essentially a “no brainer.”

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

|