JP Morgan Chase IRA Review

J.P. Morgan Investing clients who are trading inside of taxable accounts may want to consider switching to tax-advantaged accounts. The brokerage firm offers Individual Retirement Accounts (IRAs) with the same financial resources that taxable accounts receive.

There are just two IRA versions available at J.P. Morgan Investing. These accounts, of course, are

the traditional and Roth accounts. There are no other IRA accounts available, either for individuals or small businesses. It’s possible to have one of each under a single tax ID number. They can be accessed with a single login.

IRA Modes at J.P. Morgan Investing

An IRA with J.P. Morgan Investing can be set up as either a self-directed account or an advisory account. There is no robo-advisor or human-advisory service, although an affiliated company, J.P. Morgan Advisors, does offer old-school services with human financial planners. This program offers other IRA types, such as the SIMPLE IRA.

Chase IRA Minimums and Fees

In line with industry norms today, J.P. Morgan Investing

charges no commissions on trades inside any type of account, taxable or tax-advantaged. There is no minimum deposit required. There are no on-going fees imposed on accounts.

The annual fee for the automated service is to be expected. But here’s where J.P. Morgan Investing departs from most of its competitors: a $75 IRA closeout fee. While many firms have eliminated this charge, J.P. Morgan Investing still imposes it.

JP Morgan Chase IRA Promotion

Get $0 stock commissions at J.P. Morgan.

Open Chase Account

Tradable Assets

Inside of a J.P. Morgan Automated Investing account, only exchange-traded funds are available. And only a small selection is used by the company’s software program.

J.P. Morgan Self-Directed Investing customers get a larger list of securities. These include the entire lineup of ETFs that trades on the major U.S. exchanges plus stocks, bonds, mutual funds, closed-end funds, and options.

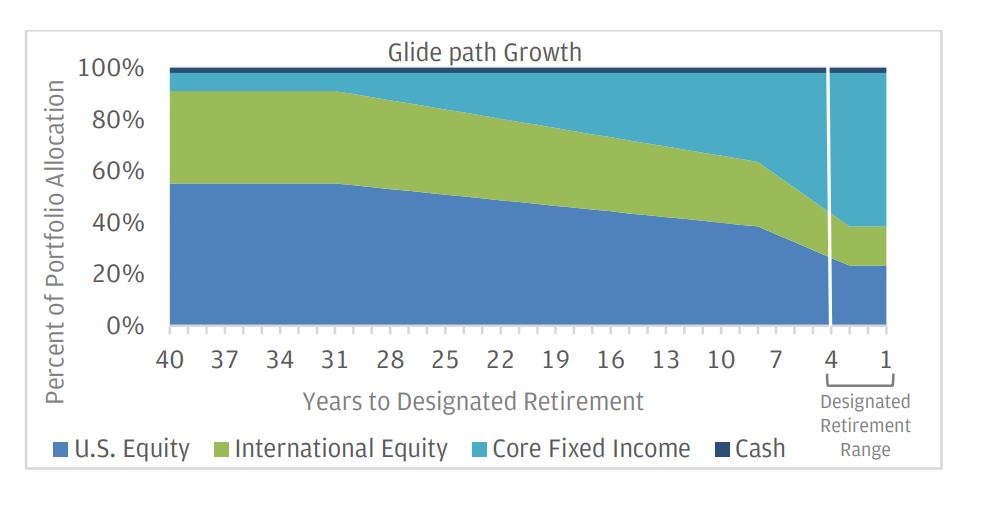

Although the list of available mutual funds for self-directed accounts isn’t very large (only about

3,000 funds), every single fund is a no-load, no-transaction-fee product. Moreover, the list contains exactly 189 lifecycle mutual funds. These are funds that have a built-in glide slope, which is a sort of autopilot tool for retirement planning.

J.P. Morgan Investing’s website has a link to these funds. To find it, click on the Investments tab in the top of the site and select “Find investments” in the drop-down menu. On the next page, click on the link to search for mutual funds. On the screening page, scroll down to the tile for “Target Date.”

One of the lifecycle funds on the list is the American Century One Choice 2040 Fund. Trading with ticker symbol ARDVX, the fund has 3 stars out of 5 for its overall performance from Morningstar. It has a net expense ratio of 0.84%. The minimum initial purchase amount is $2,500. The fund pays a dividend once per year in December. The yield was 4.6% last year.

Opening an IRA at J.P. Morgan Investing

An IRA can be opened on either the J.P. Morgan Investing website or mobile app. Both platforms are the

same ones that Chase Bank customers use.

On the application page,

click on the "CLICK TO OPEN ACCOUNT".

On the next page, you can choose an IRA.

Currently, J.P. Morgan Investing is running

a special on new IRA applications. An account opened with at least $25,000 qualifies for a $125 cash bonus. The IRA does need to be funded within 45 days of opening, and the balance must be maintained for at least 90 days. This special expires on January 19, 2024.

Rollover Service

An IRA with J.P. Morgan Investing can accept a rollover from a 401k or other Qualified Retirement Plan from a previous employer. For extensive details on this process, click on the Pay & transfer tab in the top menu on the website and then select “transfer securities.”

On the next page, you’ll see a tile with brief details on moving an employer-sponsored retirement plan into the IRA with J.P. Morgan Investing. Click on the "learn more" button to pull up a dedicated page on this topic.

On the next page, along with various details about migrating from the employer’s plan, there is a blue Get Started button. Click on this, and the website will walk you through a series of questions to begin the process of moving the 401k or other plan into the IRA.

J.P. Morgan Investing’s website will help provide information on how to make the process as easy as possible. The starting point, though, is actually with the employer. You’ll need to contact the plan administrator and request the Qualified Retirement Plan be moved into the IRA with J.P. Morgan Investing.

IRA Transfer

In addition to employer plans, an IRA with another brokerage firm can be moved into an IRA with J.P. Morgan Investing. This one is a little easier because there’s less red tape involved.

To perform an IRA-to-IRA transfer, the first step is to open an IRA with J.P. Morgan Investing. Once this is open, log into the website and go back to the Pay & transfer tab. Select “transfer securities.” This time, you’ll want to select the button to perform a transfer “from an external financial institution.”

The next page will present a list of potential outgoing brokerage firms. Examples include Robinhood, Fidelity, and E*Trade. If you don’t see yours, there is a search bar at the top. Follow the instructions and your old IRA will be moved into your IRA with J.P. Morgan Investing in less than 2 weeks.

Chase IRA Contributions and Withdrawals

To make contributions or withdrawals to or from an IRA with J.P. Morgan Investing, head back to the Pay & transfer tab in the top menu and select the link to transfer money. For contributions and withdrawals, the link to transfer securities won’t work.

On the page to transfer money, an external bank account can be linked, and ACH transfers can be submitted. There is a transfer date field, which means it’s possible to schedule a transfer for the future. Repeat transfers can also be established.

Chase Retirement Advice

As already mentioned, self-directed customers have access to a pretty lengthy list of lifecycle mutual funds.

There are some requirements to add a glide path to an IRA. First, the account must have at least 10 years of life before the target date, which is the date retirement is expected to commence. Second, the risk profile on the account must be set to moderate, growth, or aggressive.

Once J.P. Morgan Automated Investing’s glide path reaches the target date, the software will stay at the final year’s allocation strategy.

Portfolio Builder

IRA customers who decide to pass on both the automated management option and lifecycle mutual funds have one more tool at their disposal: Portfolio Builder. This is a digital widget on the broker’s website that will create a custom portfolio of ETFs based on a variety of parameters. This time, the account holder is responsible for adjusting asset allocations over time. This job is fairly easy to do thanks to user-friendly tools on the website.

Although Portfolio Builder is free to use, an account balance of at least $2,500 is required. The tool can be found underneath the Investments tab on the website.

Retirement Education

The J.P. Morgan Investing website hosts a decent, albeit not extensive, amount of resources to help self-directed clients make better financial decisions. These materials will be found in the Research section underneath the Investments tab. Examples of articles we found include:

- Starbucks' Fiscal 2024 Outlook Offers Limited Visibility, Analysts Say

- China Holds $6 Billion Worth Of Crypto, Could 'Kill' Crypto Markets If It Wishes

- Self-Storage Is Big Business

Obviously, these articles are not particular to retirement planning. For materials actually focused on retirement, you have to go to the JPMorgan Asset Management site (located at am.jpmorgan.com) and look under the Insights tab. Here, we found lots of retirement tools and resources, some of which require a separate login on the JPMorgan Asset Management site.

Many issues are covered in these resources. Examples include:

- Roth IRA conversion

- Median annual nursing home cost

- Types of annuities

- Spending during retirement

- Charitable IRA rollover

- Power of attorney

- Asset transfer

Other Financial Services

J.P. Morgan Investing does not offer annuities, long-term care insurance, or other services that retirement planners may be interested in.

Best IRA Accounts

Chase Investment IRA Review Assessment

For its IRA services, J.P. Morgan Investing succeeds in many areas. It is especially great option for

Chase bank customers who can have most financial acounts under one login. <

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

|