Investing in Vanguard and Fidelity Mutual Funds/ETFs

Our readers are sometimes asking us the following questions:

- Are Vanguard (Fidelity) mutual funds and ETFs offered on Fidelity (Vanguard)?

- Can I buy and sell Vanguard (Fidelity) funds (index, bond, stock, and target retirement funds) and ETFs through Fidelity (Vanguard)?

- What is the cost to invest in Vanguard (Fidelity) mutual funds and ETFs on Fidelity (Vanguard) account?

In this article, we will provide answers to all these questions.

Funds on Fidelity/Vanguard

Fidelity does offer most Vanguard mutual funds and ETFs. Vanguard also offers most Fidelity mutual funds and ETFs.

Commissions, however, apply: $49.95 on Vanguard mutual funds at Fidelity. At Vanguard, $20 is charged on Fidelity mutual funds. ETFs have $0 commission at both brokers. To invest with $0 commission in Fidelity and Vanguard mutual funds, we recommend

brokerage firm Firstrade.

Open Firstrade Account

Open Firstrade Account

Vanguard Competitors

Vanguard attracts customers for its large selection of mutual funds and ETFs. But in other areas, some of the

Vanguard's competitors, including Fidelity, Ally Invest, and Charles Schwab, might be a better choice. Let's

take a detailed look at how Vanguard performs against its major rivals.

Cost

Charles Schwab, Fidelity and Ally Invest charge straightforward $0 for stock and ETF trades.

Mutual fund transactions are $49.99 at Fidelity, $49.99 at Charles Schwab, $20 at Vanguard and $0 at Ally Invest.

None of these brokers (except Vanguard) have account maintenance or inactivity fees. Vanguard's annual maintenance fee could be avoided by signing for electronic statements.

Ally Invest wins the first category.

Trading Tech

The Vanguard website is not intuitive and is somewhat difficult to navigate. A search field in the upper-right of the browsing window does help to locate different topics and

functions. The Ally Invest website, by comparison, was recently updated and has better drop-down menus. Charting in Ally Invest is also more sophisticated. Vanguard does not

offer an advanced trading platform, whereas Ally Invest does.

The Fidelity and Charles Schwab websites are easy to navigate. Drop-down menus and intuitive icons make finding information easier on these sites, compared to Vanguard.

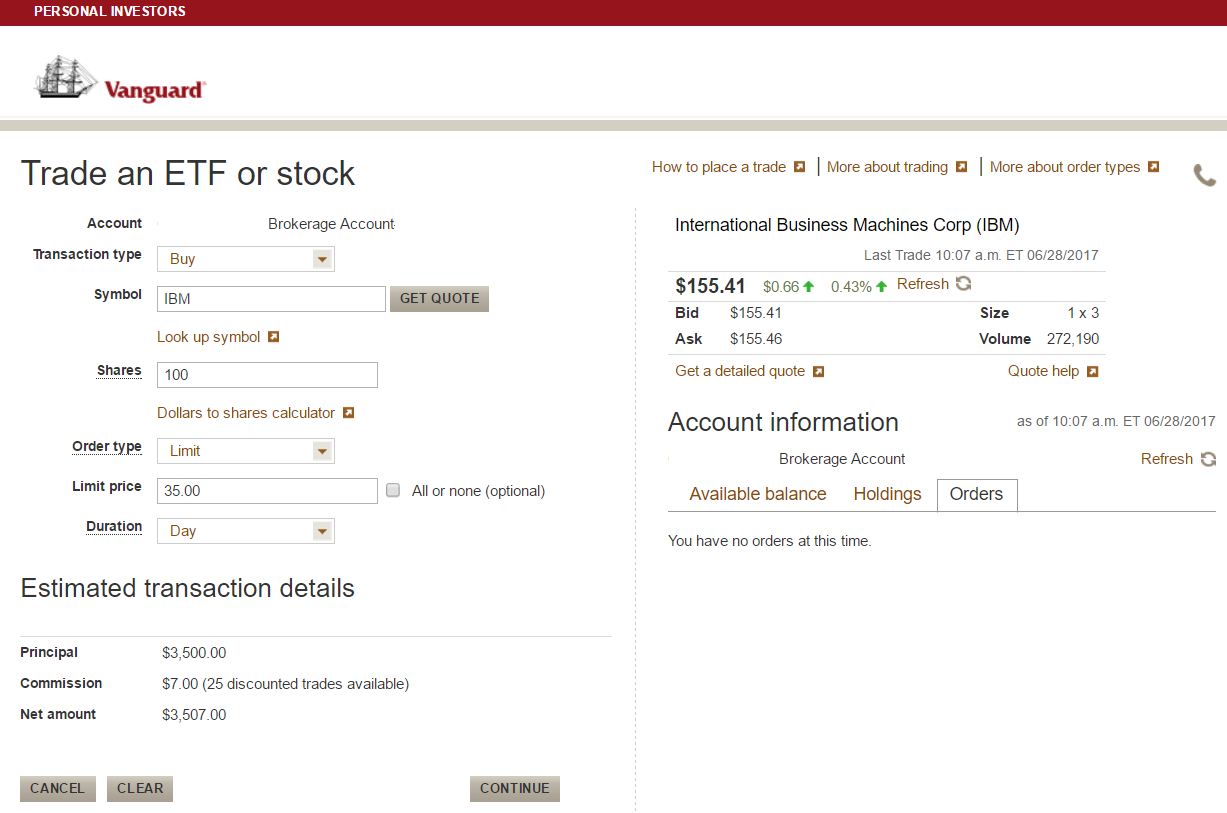

Fidelity has a simple trading ticket on the left-hand side of the browser, while Charles Schwab offers a more advanced trading bar at the bottom called SnapTicket.

It can produce a small chart, and place trades for stocks, options, and ETFs. Fidelity offers desktop software for active traders, whereas Charles Schwab customers can use

two trading systems with no requirements. One of Charles Schwab's platforms has paper trading capability as well.

Charles Schwab wins this category.

Mobile Trading

Vanguard has a mobile app that can be used on Apple, Android, and Kindle Fire. Conveniently, account documents are available in pdf format. Unfortunately, the app doesn't have live streaming of business news.

Fidelity's app can be used on Windows phone, Android, iPad, iPhone, Apple Watch, Kindle Fire HD, and Amazon Fire phone. There is live streaming of Bloomberg news in HD along with a video library. There is more market news on the Fidelity app compared to Vanguard's.

CNBC streams live at no cost on the Charles Schwab app. Traders can buy and sell securities on Android, Windows 10, iPad, iPhone, and Apple Watch. Advanced charting is available, along with mobile check deposit and funds transfer.

Ally Invest customers can use the regular Ally mobile app, which now has investment functions. It can be used to place trades for equities and options.

Market news is available. A charting feature can show price histories of stocks along with technical studies and comparisons.

Charles Schwab wins again.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

Mutual and Exchange-traded Funds

Charles Schwab clients have access to nearly 13,000 mutual funds. Of these, almost 4,200 have neither load nor

transaction fee. Ally Invest offers over 12,000 mutual funds.

There are over 11,500 mutual funds available for sale at Fidelity. Roughly 1,800 of these products have no load and no transaction fee. The Vanguard website hosts more than

16,000 mutual funds, many of which are no-load, no-transaction-fee funds.

On the ETF side, all four brokers provide exchange traded funds commission-free.

Overall, the victory goes to Charles Schwab.

Customer Service

Customer service is available over the phone at Fidelity and Charles Schwab around the clock. Fidelity has an on-line chat service, although Charles Schwab does not. Ally Invest

representatives can be reached 7am-10pm ET, 7 days a week. Vanguard only offers support from 8 am to 10 pm, Monday through Friday. Vanguard and Ally Invest do not have a network of branch locations.

Fidelity operates 180 offices, while Charles Schwab has over 600.

The victory here goes to Charles Schwab for having the best overall customer service offering.

Cash Management

All four brokers offer cash management services, although there are significant differences among them. Fidelity, for example, offerings a separate Cash Management Account that comes with checks and a debit card at no cost. Charles Schwab, by contrast, offers free checks and a debit card, but they are attached to one brokerage account. Fidelity quintuples the FDIC insurance limit of $250,000 to $1,250,000 by spreading cash deposits among multiple banks. Charles Schwab, by comparison, doubles the insurance to $500,000. Neither brokerage firm has any requirements to apply for cash management features.

Ally Invest customers can add checks and a debit card to a securities account. There is a $20 annual fee for checks, and a $35 charge for the debit card. ATM

fee rebates are not available, and the broker charges $1 for each cash machine transaction.

Vanguard's cash management account has the most limiting features. Traders must have at least $500,000 in brokerage assets to apply for cash management features. A debit card and checks are available, but there are fees for accounts smaller than $1,000,000.

Charles Schwab wins here.

Vanguard vs Competitors: Outcome

Charles Schwab succeeded in five categories, Fidelity and Vanguard failed to score. Ally Invest won the most

important Cost category, making it the best priced broker among Vanguard's top competitors.

Beginner Investors: Charles Schwab, Fidelity and Ally Invest.

IRA accounts: all four brokers.

Stocks/ETFs Traders: Ally Invest and Charles Schwab.

Options Traders: Ally Invest and Charles Schwab.

Long Term, Inactive Investors: all four brokers.

Mutual Funds Investors: all four brokers.

Small accounts: Ally Invest and Charles Schwab.

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

|