|

TD Ameritrade Recurring Investment in 2024

Can I use automatic recurring investment plan (AIP) on TD Ameritrade? Does TD Ameritrade have dollar cost

averaging program (DCA)?

|

TD Ameritrade Closed Its Doors

Charles Schwab Website

Open Schwab Account

Can You Set Up an Automatic Investment at TD Ameritrade?

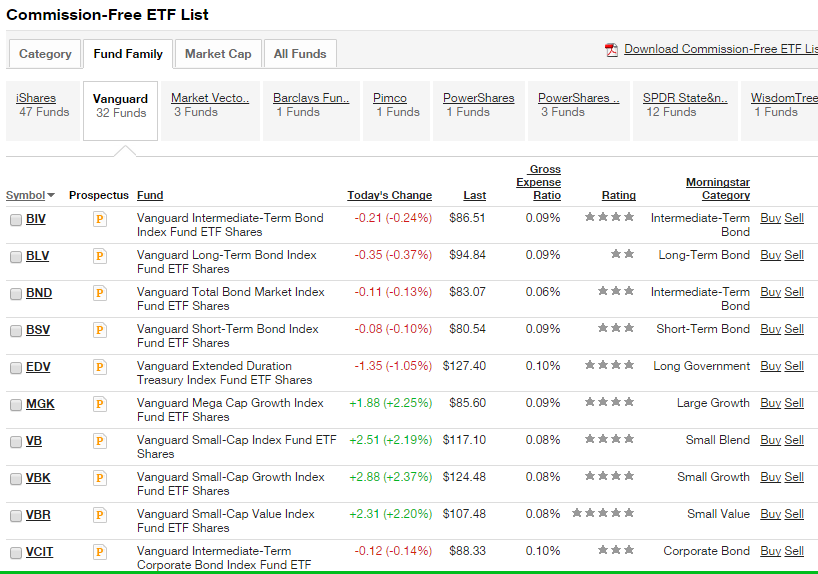

Investors at TD Ameritrade can take advantage of a convenient automatic investing plan (AIP), which is free of

charge. TD Ameritrade allows any type of mutual fund to be registered for automatic purchases.

Both load and

no-load funds, and both transaction-fee and no-transaction-fee funds can be enrolled. Over 13,000 mutual funds

are available on the TD Ameritrade of which 4,200 are commission-free.

Unfortunately, stocks and ETF’s are not eligible for automatic purchases.

Open TD Ameritrade Account

TD Ameritrade Dollar-Cost Averaging

The broker’s automatic investment plan is a form of dollar-cost averaging. With this method of money management, you make fixed-dollar purchases at regular intervals. Because the dollar amount is fixed, and not the number of shares as would stock or ETF purchases, you receive more shares when the NAV is low. This is the primary advantage of dollar-cost averaging. The other advantage is the ability to purchase fractional shares, which isn’t possible with ETF’s and stocks.

As an example, you could buy $50 every week of VBINX, which is the Vanguard Balanced Index fund.

TD Ameritrade Automatic Investment Fee

There is a transaction fee of $49.99 on the initial purchase. Before you can make automatic

investments, you first have to buy the fund. The transaction fee is only applied to the first

purchase. Automatic investments cost nothing extra.

TD Ameritrade Automatic Investing in ETFs and Stocks

TD Ameritrade's automatic investment service is not available on ETFs and stocks.

Funding the Recurring Purchases

If you’re going to sign up for automatic purchases of mutual funds, you’ll of course need to fund these

transactions. The TD Ameritrade website has a very convenient funds transfer tool that that can establish

recurring deposits into a brokerage account. The company allows recurring transactions to be weekly, every

other week, monthly, quarterly, semi-annual, or annual. More unique choices are available, such as third

Friday of the month.

Setting up TD Ameritrade Automatic Investment Plan

To establish an AIP, you’ll first need to call TD Ameritrade's customer service. The broker will send you a paper

form that you’ll need to fill out and submit. The minimum purchase amount is $50. The recurring

investment can be weekly, semi-monthly, monthly, quarterly, semi-annually, or even annually.

Multiple accounts can use this free service, and there is no limit to the number of mutual funds

that can be enrolled. If in the future you decide that you want to change or cancel your AIP,

you can simply call TD Ameritrade and request a change.

Does TD Ameritrade Offer Automatic Investing on Stocks?

There is no automatic investing offered for stocks, other than dividend reinvestment plan.

Comparison

Not all brokers allow load funds and transaction-fee funds to be used in an automatic investment plan. For example, E*Trade restricts its

AIP to no-load, no-transaction-fee funds, which obviously reduces the number of funds eligible for automatic purchases.

On the other hand, E*Trade has much more extensive information on its site about its AIP. TD Ameritrade provides no information, so its

customers will have to hunt for information if they want to use this service.

|