Merrill Edge IRA Fees

- IRA set-up fee: $0

- Annual IRA fee: $0

- IRA termination fee: $75

- Inactivity fee: $0

Merrill Edge IRA Trading Commissions

- Stocks and ETFs: $0

- Stocks and ETFs broker assisted: $29.95

- Options: $0.65 per contract

- Mutual funds: $19.95

- Merrill Edge self-directed mutual funds: 0.75% gross proceeds, $50 minimum, $250 maximum

- Bonds: on a net yield basis

- Investment products: stocks, mutual funds, options, ETFs, bonds, CDs

- Merrill Edge minimum deposit to open account: $0

Individual Retirement Accounts at Bank of America and Merrill Edge Overview

Bank of America and its subsidiary Merrill Edge both offer IRAs. A retirement account at Merrill can be used to trade stocks, bonds, mutual funds, and other securities; while a CD or savings account can be used in an IRA at the banking division of the company. Let's take a closer look at the retirement options available at these two affiliated financial institutions and see how they compare to each other.

IRAs at Bank of America

One of the advantages of opening an Individual Retirement Account at a bank is that the assets will be FDIC insured. This assumes that the bank is a member of FDIC, which virtually all banks in the US are. Deposits at Bank of America are protected up to $250,000 per customer, although there are strategies for increasing this amount. Balances from both a regular deposit account and an IRA will add towards the total insurance limit.

Besides FDIC protection, there are other advantages of having an IRA at a bank, rather than a broker. IRA assets at a bank are deposited in savings accounts, certificates of deposit, money market accounts, or other fixed-income investments. Unlike securities, the value of these products doesn't fluctuate.

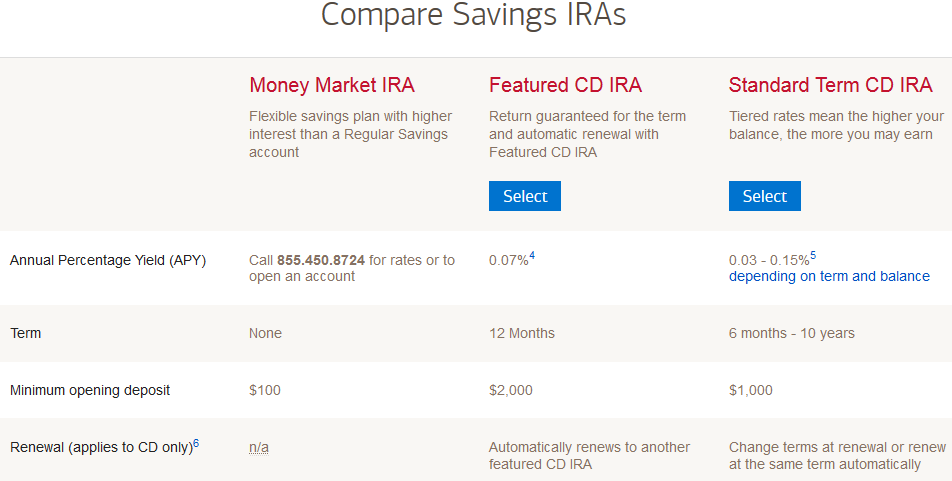

Bank of America in particular offers CD's and money market deposit accounts, both of which can be used inside an IRA. Currently, the money market account pays just 0.03%. The yield on an IRA CD varies from 0.03% to 0.15%, depending on how long the term is, what the balance is, and what type of CD is opened. The bank offers a standard term CD, a featured CD, a risk free CD, and a variable rate CD. The featured CD currently pays 0.07%, has a 1-year term, and requires at least $2,000 to open. A standard term CD of 4 years or longer will earn 0.15%. A minimum deposit of $1,000 is required.

As the name suggests, a variable rate CD has an interest rate that fluctuates with time. Currently, the APY is 0.03%, another low rate. Only $100 is required to open the CD, and deposits can be made at any time. The penalty free CD offers access to the CD's value at any time with no penalty. The product currently pays 0.04% per annum, with a $2,000 minimum deposit.

All the rates quoted above are rather low, compared to what could be achieved in a brokerage account. Nevertheless, the safety of a bank product continues to attract retirement savers. Bank of America's rates are lower than some of its rivals. For example, a savings account IRA at Ally Bank earns 1.00%, more than six times Bank of America's highest rate. Choosing a 60-month CD at Ally instead of the savings option increases the APY to 1.7%. This rate only requires a $5,000 deposit. A 2-year IRA CD at Synchrony Bank earns 1.45% annually and requires a $2,000 deposit. The bank's money market account has a $250 minimum but still pays 0.85%.

An Individual Retirement Account at a bank can be opened in either Roth or Traditional format. The Roth is designed for savers who will be in a higher tax bracket during retirement. The Traditional is intended for the opposite situation. Bank of America also offers a Rollover IRA. Customers who have an old employer plan, such as a 403(b) or 401(k), can move it to the bank. Citibank also has a Rollover retirement account.

Bank of America has a useful retirement help desk. If you have any questions about the company's retirement products or need assistance opening or transferring an account, give them a call at 1-855-450-8724.

Building an IRA at Merrill Edge

As we have seen, bank IRA rates are not very high. Obviously, some investors are going to seek higher returns, and they typically find them at a brokerage house. One of the disadvantages of making the switch is that brokers are not FDIC insured. Nevertheless, most of them do have SIPC protection. The SIPC was established by Congress and is funded by the organization's member brokerage firms. A securities account is insured up to $500,000, which includes a maximum of $250,000 in cash deposits.

Merrill Edge is a member of the SIPC. Besides offering double the insurance that a bank account provides, Merrill also offers trading in assets that have a much higher return potential. These securities include stocks, ETFs, and mutual funds. The broker also offers bonds, including short-term, mid-term, and long-term products.

Several IRA types are available with Merrill Edge. Besides Roth and Traditional, the broker has SEP and SIMPLE accounts for small businesses and self-employed persons. A Rollover IRA can also be opened.

A Merrill Edge IRA does not have any on-going fees. There are no maintenance, inactivity, or annual fees. There is also no charge to establish an IRA. There is, however, a $49.95 charge to close a retirement account.

An IRA at Merrill Edge comes with the same commission schedule as a non-retirement account. Stock and ETF transactions placed on-line are $0. Trades on the broker's automated phone system are the same price. Using a live representative to execute a trade costs $29.95. By default, all accounts are set up to receive statements electronically. Paper statements are available, although they cost $5 each.

There are many tools and educational materials for retirement savers on the Merrill Edge website. For example, there are videos and webinars on several important IRA topics. These include strategies on how not to outlive a nest egg, and creating a retirement account for young people.

IRA calculators on the broker's website are helpful in a variety of areas. One analyzes the pros and cons of converting an employer's plan to an IRA. Another calculates the required minimum distributions that must be taken out of a Traditional IRA, and when those withdrawals must begin.

Besides the great retirement resources on the Merrill site, the broker also has an ample supply of mutual funds. The broker's screener returns 3,963 products, with 2,246 carrying neither load nor transaction fee. Some of these securities are target-date funds, which are designed for investors saving for retirement.

Comparison

The Merrill Edge website has much more educational material compared to Bank of America. The difference exists probably because securities are considered higher risk and more difficult to manage than fixed-income bank products. People who are interested in learning more about IRAs and retirement savings might prefer the Merrill IRA just for the amount of educational material that would be available to them.

It is possible to open an IRA at each institution. The IRS allows this, but the maximum annual contribution is still $5,500 across both accounts ($6,500 for persons 50 and older). You could have low-risk IRA invested in bank deposits and a higher-risk account invested in stocks and mutual funds. Both accounts would also be automatically linked by both companies. You would see both accounts after logging into either the Merrill Edge or Bank of America site.

Bank of America IRA Fees Review Summary

While Bank of America offers lower rates than what securities might produce, there is a safety in a bank CD that will appeal to people who are in or near retirement. Investors who can take on more risk or want more retirement education would benefit from a Merrill Edge IRA.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

|