|

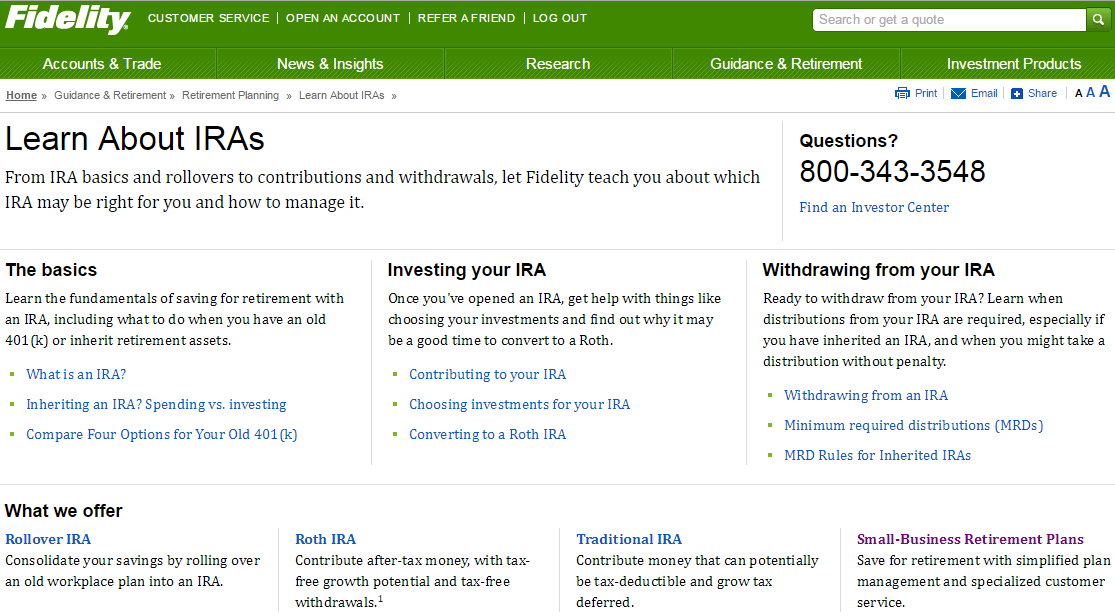

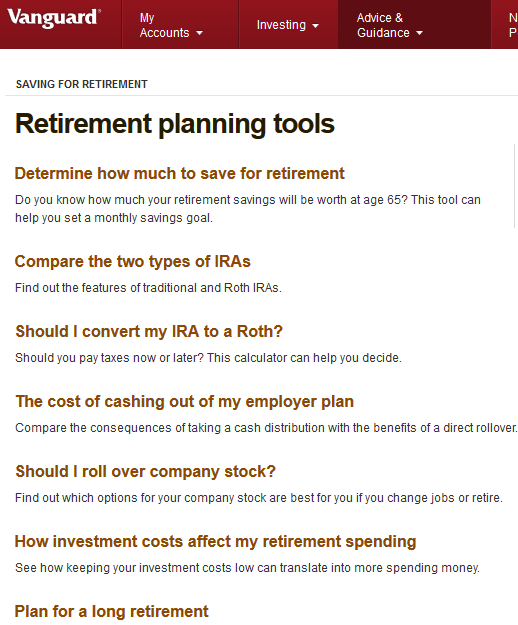

Fidelity IRA vs Vanguard IRA in 2024

Fidelity Investments vs Vanguard for IRA accounts, Roth IRA, Rollover, SEP, SIMPLE.

Compare broker retirement account fees, commissions, and offerings.

|

Overview of Vanguard vs Fidelity For IRA

Investors who want good value in brokerage services often turn to Fidelity or Vanguard. These large firms are known to provide reliable investment assistance at reasonable cost. Let's

take a close look at the fees and commissions charged by each firm and try to determine which broker is more expensive to trade with.

IRA Fees

Both brokers offer Individual Retirement Accounts. An IRA can be opened at either broker with $0.

A Fidelity IRA has no set-up fee, no annual fee, and no maintenance fee. A Vanguard IRA does have a $20 annual fee. Furthermore, as with a regular brokerage account, Vanguard imposes a $20 charge if a Vanguard mutual fund has a balance less than $10,000. The good news is that both of these fees can be waived by signing up for electronic delivery of account documents. Vanguard also imposes a $25 charge every year for each SIMPLE IRA that has a Vanguard fund in it. The charge is applied for each Vanguard fund. The fee does not apply to accounts with more than $50,000 invested in Vanguard funds.

Stock and ETF Fees

Fidelity charges a flat $0 to trade stocks and ETFs. Options at Fidelity are an extra $0.65 per contract.

Vanguard is also at $0 to trade stocks and ETFs. Derivative traders will pay $1 per contract to buy and sell options.

Mutual Fund Fees

There are 127 Vanguard mutual funds. These are free to buy and sell when trading with Vanguard. Expense ratios range from 0.05% up to 0.93%. The majority are less than 0.30%. The broker has more than 16,000 mutual funds in total. Many of these have no transaction fee. Those that do cost $35 to trade in accounts under $50,000. Larger accounts pay less than $35.

The broker does have five mutual funds that come with purchase fees, and sometimes redemption fees as well. These charges vary from 0.25% to 1.00%. Nevertheless, all of them have corresponding exchange-traded funds that don't carry the fees.

Although Vanguard's funds are known as having the lowest expense ratios in the industry, Fidelity's funds also have some pretty low expense ratios. The following is a comparison between some mutual and exchange-traded funds offered by the two companies, showing the expense ratios of similar investments.

Fidelity Spartan® 500 Index Fund (FUSEX) 0.10% ($2,500 minimum investment)

Vanguard 500 Index Fund (VFINX) 0.16% ($3,000 minimum investment)

Fidelity MSCI Energy ETF (FENY) 0.12%

Vanguard Energy ETF (VDE) 0.10%

Fidelity Health Care ETF (FHLC) 0.12%

Vanguard Health Care ETF (VHT) 0.09%

Fidelity GMNA Fund (FGMNX) 0.45% ($2,500 minimum investment)

Vanguard GNMA Fund (VFIIX) 0.21% ($3,000 minimum investment)

Fidelity Europe Fund (FIEUX) 1.03% ($2,500 minimum investment)

Vanguard European Stock Index Fund, Admiral Shares (VEUSX) 0.12% ($10,000 minimum investment)

Despite the perception over Vanguard's expense ratios, Fidelity is very competitive. However, Fidelity does offer fewer funds than Vanguard, with just under 12,000 mutual funds in total. Exactly 3,580 funds are NTF products. Half of these also come with no load. Mutual funds with a transaction fee at Fidelity will set traders back $49.95 on the buy side.

In addition to expense ratios, other fees are incurred when trading mutual funds and ETFs. Vanguard charges a $50 fee if a non-Vanguard fund is sold in less than 2 months after purchase. Fidelity charges 0.75% if a Fidelity fund is sold in less than a month after purchase. A $49.95 fee is also applied for non-Fidelity NTF funds if they are sold in under 2 months.

Vanguard assesses a $20 annual fee for every Vanguard fund that has a balance of $10,000 or less. However, this fee can be avoided by purchasing at least $50,000 of Vanguard products, or signing up for electronic delivery of account documents.

Vanguard IRA vs Fidelity IRA Summary

Both Fidelity and Vanguard have competitive pricing. Fidelity is better for small accounts, while Vanguard will benefit larger investors, especially those who

can invest at least $50,000 in Vanguard mutual funds and ETFs.

Both companies also offer a wide list of brokerage investment accounts: both IRA and non-IRA. Some brokerage firms offer

incentives for opening an account - see

Broker Promotions.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor