|

Merrill Edge vs Citi Self Invest (2024)

|

Merrill Edge vs. Citi Introduction

The bull and the traveler’s which group holds more value for their investors. Most wall street

firms are now reengineering the way clients trade in the 21st century. So, for the 2nd and 3rd

largest banks in the U.S. it would only be fitting they offer competitive trading platforms to

bolster revenues for the firm. Let us look at a comparison of the two brokerages on how they fair

to one another.

Cost

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Merrill Edge

|

$0

|

$19.99

|

$0.65 per contract

|

$0

|

$0

|

|

Citibank

|

$0

|

$0

|

na

|

$0

|

$0

|

|

Firstrade

|

$0

|

$0

|

$0

|

$0

|

$0

|

Services

Promotions

Firstrade: Get up to $250 ACAT rebate and $0 commission trades.

Merrill Edge: no promotion right now.

Citi: no promotion right now.

Merrill Edge

Merrill Edge is a spin-off subsidiary from the iconic Merrill Lynch name. The brand was created

for the common investor and clients with a net worth under 250 thousand. The Merrill setup is one

of the best on the market for every investor from beginner to expert. They offer various accounts

to choose from CMA, Roth IRA, Traditional IRA, college planning, self-directed, guided investing,

and many more options.

What makes Merrill Edge one of the most attractive platforms to use is their initial sign-up bonus,

commission fees, integrated research and analysis, access to financial advisors with assets

20 thousand or more, and integration with the bank of America clients.

Typically, if the client has assets of 20 thousand or more, they qualify for Bank of America's

preferred rewards program which gives them more perks using Merrill Edge. On top of that, the

client gets 0-dollar commission & trade fees.

Also, the details and information that goes into their market and insight research tabs are priceless.

The client is getting the same information as a Merrill Lynch client who pays a high premium for being

a client.

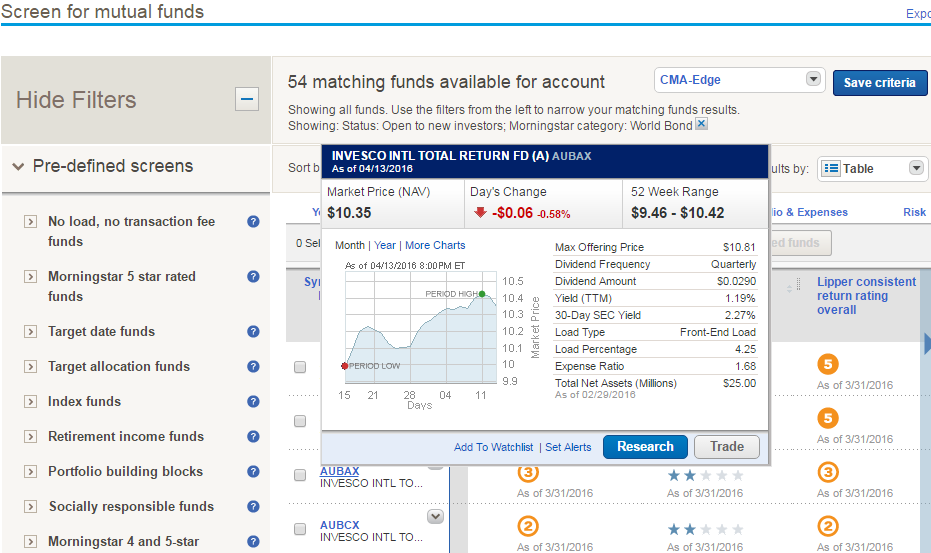

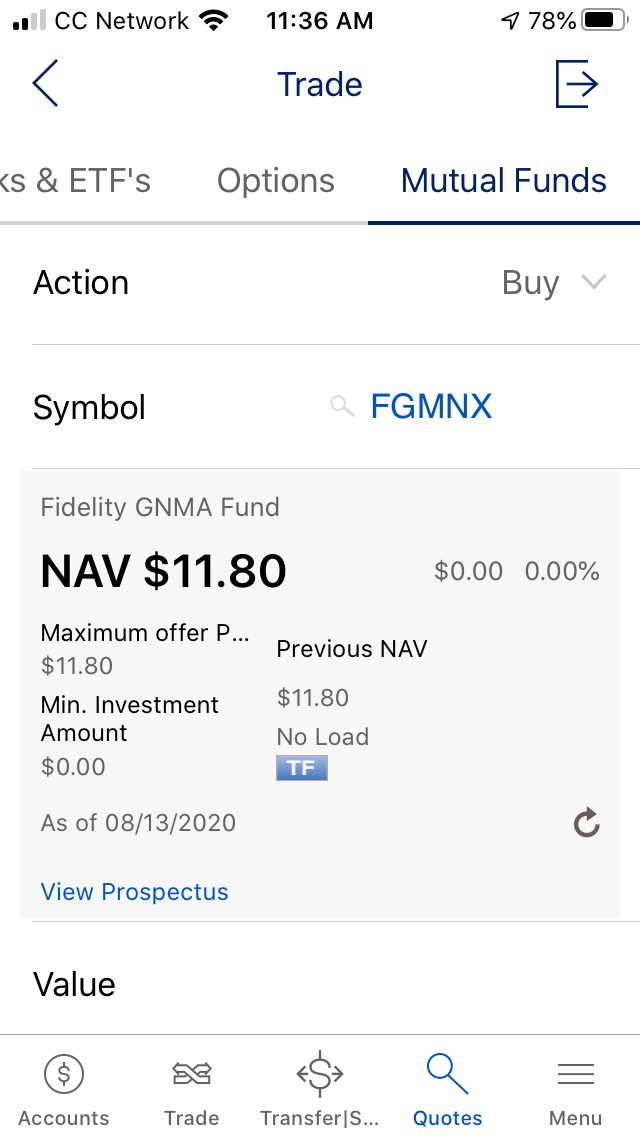

Merrill Edge Trading Tools

The one thing that sets Bank of America / Merrill Lynch apart from any Wall Street firm is the amount

of money spent on technology. The Merrill Edge platform is quite simple and user friendly. The user

can trade on a mobile app or desktop interface.

There are a few differences between the two though. For example, in order to reinvest dividends, one

must use the desktop version, Trading options are very condensed on the app versus the desktop, and

charts are easier to read on the desktop version.

Merrill Edge Verdict

Merrill Edge is a good trading platform for anyone looking to invest. The integrated system for Bank

of America clients, 0-dollar trade fees, and the ability to work with an advisor would make this a

great choice for anyone to use. Also, the user-friendliness of the app and desktop interface makes it

easy for the user to navigate and trade.

Citi Brokerage

Citi Brokerage is another choice for the investor to choose as their preferred trading platform.

Citi offers similar options as many other brokerages do for their clients. The typical IRA’s,

college planning, cash account, etc.

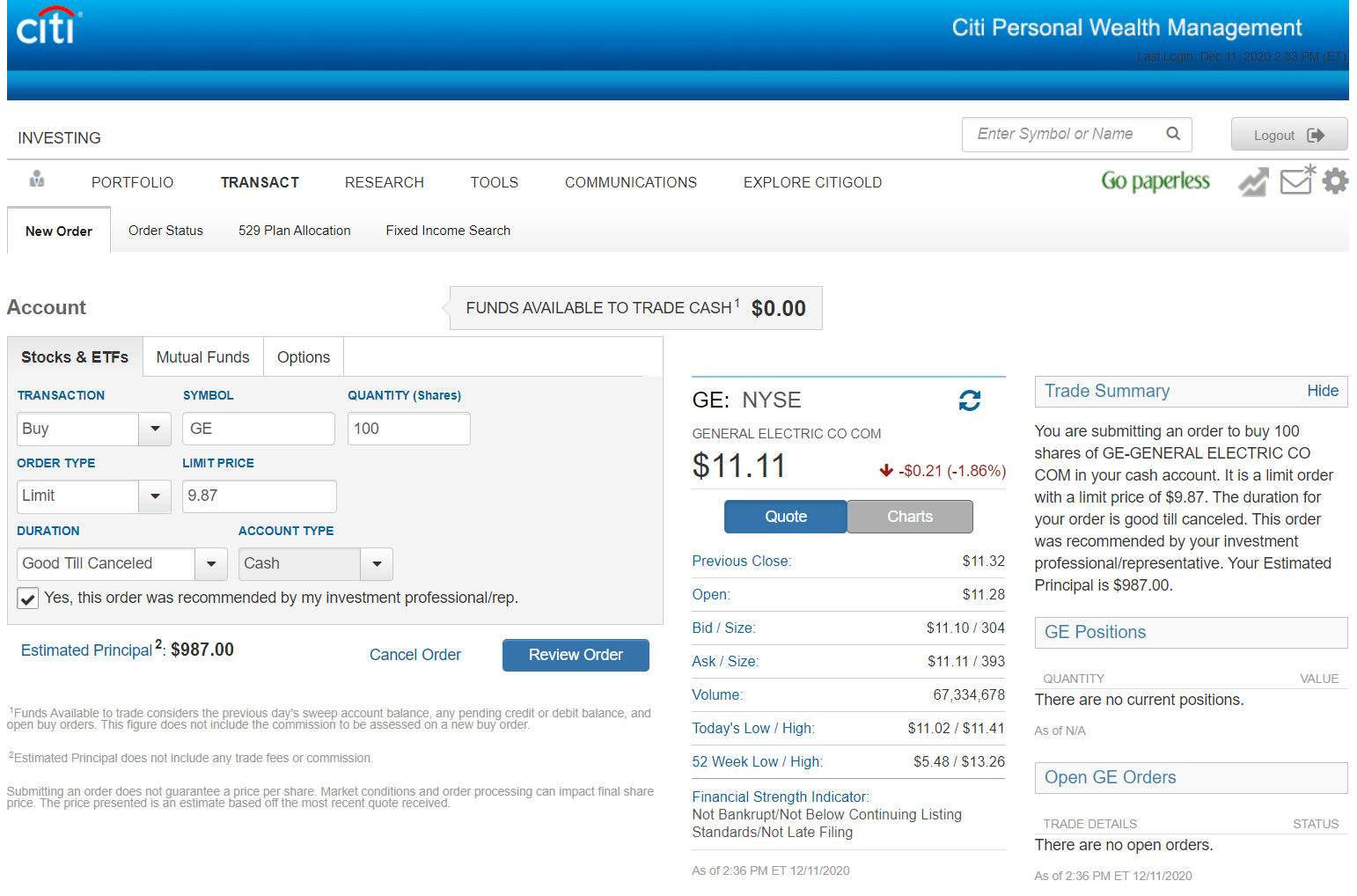

Citi Brokerage Trading Tools

The Citi platform is not one of the best and could use a lot of updates or even a complete

overhaul. The platform lags so many other brokers with respect to user-friendliness, options on

the mobile app, constant technical difficulties, and time lags.

Citi Cost

Citi unlike many other brokers charges a trade fee of $4.95 per trade. This is one of the major

disadvantages of trading with Citi due to the sheer fact there are so many other brokerages not

charging fees.

Problems

Also, Citi does not have a good database of the research market and analysis for the client to use

when making investing decisions. Also, most features must be implemented via the desktop or

calling directly to the wealth management department.

Another major problem is time delays when trading. The system is 15 minutes behind the current

stock price and goes into a queue, that can take several minutes to execute.

Citi brokerage also requires more capital than most firms to get into the door. Most investors

need at least 50 thousand plus in order to get an account.

Also, in order to use strategies like margin, call, and put options. The client must also call the

brokerage department in order to get things like dividend reinvestment options, the mutual fund

sells, and margin trading.

All of these make Citi brokerage, not a preferred choice to invest with unless the client has a

deep banking relationship with Citibank.

Citi vs Merrill Edge Verdict

Comparing the two Merrill Edge by far edges out Citi brokerage as the best choice to invest with.

The commission fee trading versus paying, much more integrated trading platform via mobile app &

desktop, and better market research and analysis. Both do offer great perks for existing client

relationships for advisor services.

Overall, Merrill Edge is much better for the beginner investor all the way to the most advanced.

Investors looking for the lowest commissions

should take a look at Firstrade.

Promotions

Firstrade: Get up to $250 ACAT rebate and $0 commission trades.

Merrill Edge: no promotion right now.

Citi: no promotion right now.

|

Open Account

|

Open Account

|