|

Is USAA Safe, Legitimate, and Insured? Is USAA a Scam?

USAA BBB Complaints

|

Is USAA a Safe and Legitimate Firm?

The short answer to this question is yes, USAA is a completely legitimate firm, offering safe and secure bank, insurance, investment, and

brokerage services. But before diving into the specifics, it might be helpful first to take a look at what USAA is and is not.

USAA is a financial services company, started in the 1920s, and offers insurance, banking, investments, retirement, and financial planning. USAA is a Fortune 500 company, however it is not a corporation, it is a reciprocal inter-insurance exchange. While different than a corporation, it is still a legitimate legal entity that is subject to oversight and regulation.

The company has been operating for 93 years, has 26,000 employees worldwide, and has $24 billion in revenue and $130 billion in total assets.

Is USAA a Scam?

It’s important to understand that USAA is really a group of financial operating companies and includes the following:

- Property and casualty Insurance

- Life insurance and annuities

- Investment company (including brokerage services)

- Investment services

- Banking

- Shopping (car rental, jewelry, travel, etc)

The investment and brokerage services that USAA offers today did not exist when USAA opened its doors in 1922; it wasn’t until the 1970s that investment services were added to the mix. And perhaps not as well known as some of its competitors to the general public, USAA investment options are very comprehensive, offering a range of products for just about every stage of life. The range of products and services offered can be seen in the figure below is taken from the investment services section of the main USAA website:

USAA Investments has close to $65 billion in mutual fund assets under management. Needless to say, it would be quite a feat to be able to pull off this broad an array of services at this level of operation and be a scam or somehow running its investment business illegally without catching the attention of regulators.

Even so, it’s certainly worth confirming the legitimacy of the company before forking over hard earned cash. But besides pure regulation itself, however, there is one intangible aspect of the company to consider when determining the legitimacy of USAA and that is the core tenets upon which the company is founded and where it’s leadership comes from.

USAA Competitors

Is USAA SIPC/FDIC Insured and FINRA Regulated?

The answer to this question is yes, yes and yes, but it depends on which company within USAA you are talking about.

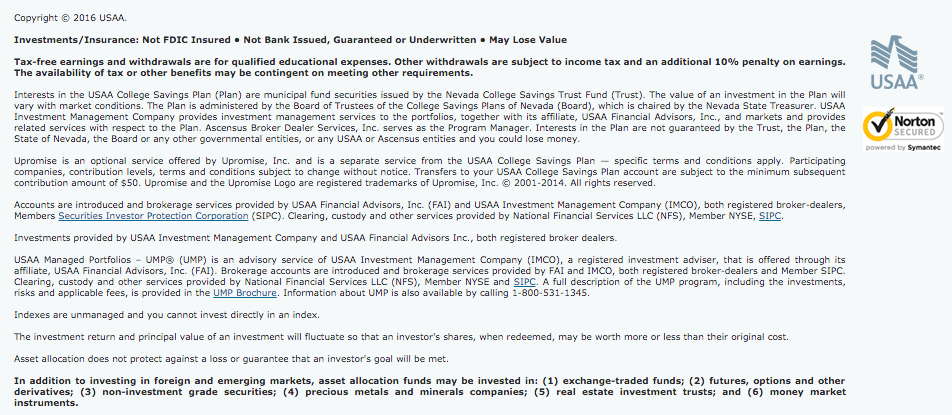

The USAA investments company is covered under SIPC, but it is not FDIC insured. The banking arm of USAA is FDIC insured. This is addressed again directly on USAA’s

website as shown in the fine print image below:

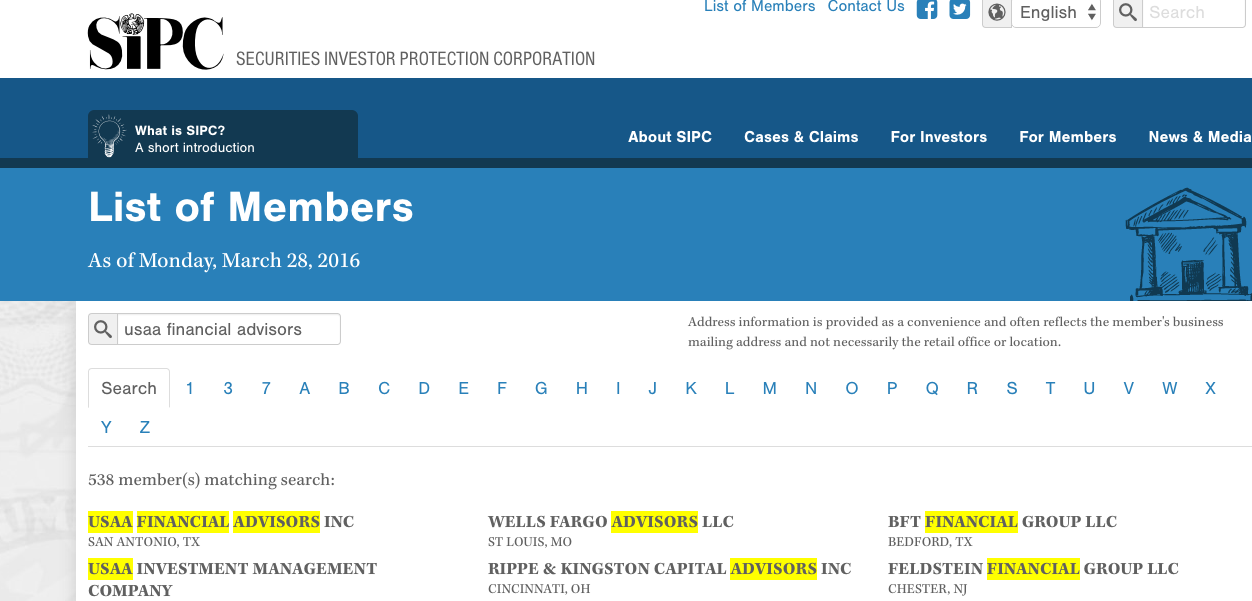

Paragraph 5 in the fine print above indicates USAA investments company is managed and run both by the USAA Financial Advisor (FAI), and the USAA Investment Management

Company (IMCO). With a quick search, both of these can be found directly on the SIPC website.

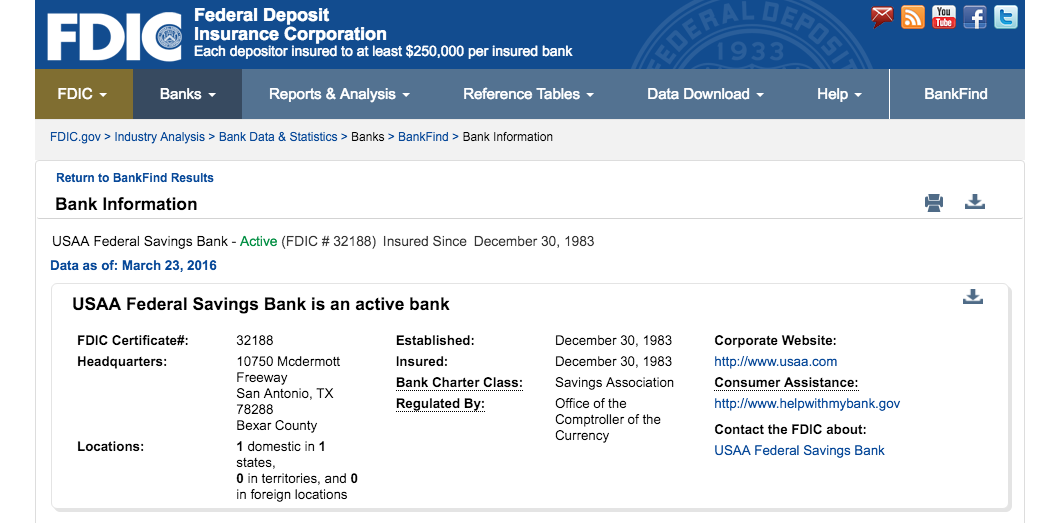

Likewise in the fine print (not shown here) it reads that USAA Federal Savings Bank is a

member of the FDIC. This also can be found directly on the FDIC website.

And finally, USAA investments and brokerage services is FINRA regulated. Straight from the FINRA website here is a

breakdown of their details:

USAA FAI: CRD# 129035 / SEC# 8-66197, 0 disclosures listed

USAA IMCO: CRD# 5475 / SEC# 8-41241, 5 disclosures listed

USAA Complaints

USAA BBB (Better Business Bureau) rating is A+. This BBB listing has 1164 closed USAA complaints in the last 3 years, 844 of which were closed in the last 12 months.

Is USAA Safe Final Word

USAA investment services is a legitimate company and represents a solid option for investors. With over 90 years in business and billions of assets

under management, investors can rest assured that the company operates as a principled financial services business, has appropriate oversight and regulation in

place, and strong leadership and values at its core.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

|